Final Expense Insurance_ Covering Funeral Costs

Understanding Life Insurance Policies A Comprehensive Guide

Life insurance is a cornerstone of financial planning, providing a safety net for your loved ones in the event of your passing. But navigating the world of life insurance can be daunting. With so many options available, how do you choose the right policy for your specific needs? This guide will walk you through the different types of life insurance, their benefits, and how to determine the coverage amount you need.

Term Life Insurance Explained A Beginner's Guide

Term life insurance is the simplest and often most affordable type of life insurance. It provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. If you die within the term, your beneficiaries receive a death benefit. If the term expires and you're still alive, the coverage ends. You can often renew the policy, but the premiums will likely be higher due to your age.

Benefits of Term Life Insurance:

- Affordability: Term life insurance is generally less expensive than permanent life insurance, especially when you're young and healthy.

- Simplicity: The policy is straightforward and easy to understand.

- Flexibility: You can choose the term length and coverage amount that best suits your needs.

When to Consider Term Life Insurance:

- You have young children and want to ensure they're financially protected if something happens to you.

- You have a mortgage or other significant debt that you want to cover.

- You need coverage for a specific period, such as until your children graduate from college or until you retire.

Permanent Life Insurance Policies A Long Term Solution

Permanent life insurance provides coverage for your entire life, as long as you pay the premiums. It also includes a cash value component that grows over time on a tax-deferred basis. You can borrow against the cash value or withdraw it, although doing so will reduce the death benefit.

Types of Permanent Life Insurance:

- Whole Life Insurance: Offers guaranteed premiums, a guaranteed death benefit, and a guaranteed rate of cash value growth.

- Universal Life Insurance: Provides more flexibility than whole life insurance. You can adjust the premiums and death benefit within certain limits. The cash value growth is tied to current interest rates.

- Variable Life Insurance: Allows you to invest the cash value in a variety of investment options, such as stocks and bonds. The death benefit and cash value can fluctuate depending on the performance of the investments.

- Variable Universal Life Insurance: Combines the features of universal life and variable life insurance, offering both flexibility and investment options.

Benefits of Permanent Life Insurance:

- Lifelong Coverage: Provides coverage for your entire life.

- Cash Value Growth: Offers a tax-deferred savings component.

- Flexibility: Some policies offer flexibility in terms of premiums and death benefit.

When to Consider Permanent Life Insurance:

- You want lifelong coverage.

- You want to accumulate cash value for retirement or other financial goals.

- You want to leave a legacy for your heirs.

Understanding Whole Life Insurance Coverage and Benefits

Whole life insurance is a type of permanent life insurance that provides lifelong coverage with guaranteed premiums, a guaranteed death benefit, and a guaranteed rate of cash value growth. It's a conservative and predictable option for those seeking long-term financial security.

Key Features of Whole Life Insurance:

- Guaranteed Premiums: The premiums remain level throughout the life of the policy.

- Guaranteed Death Benefit: The death benefit is guaranteed to be paid to your beneficiaries.

- Guaranteed Cash Value Growth: The cash value grows at a guaranteed rate, providing a safe and predictable savings component.

- Policy Loans: You can borrow against the cash value of the policy.

- Dividends: Some whole life policies pay dividends, which can be used to reduce premiums, increase the death benefit, or accumulate cash value.

Pros and Cons of Whole Life Insurance:

Pros:

- Guaranteed coverage and cash value growth.

- Predictable and stable.

- Can provide a source of retirement income.

Cons:

- Higher premiums than term life insurance.

- Less flexibility than other types of permanent life insurance.

- Cash value growth may be slower than other investment options.

Exploring Universal Life Insurance Flexibility and Options

Universal life insurance is a type of permanent life insurance that offers more flexibility than whole life insurance. You can adjust the premiums and death benefit within certain limits. The cash value growth is tied to current interest rates.

Key Features of Universal Life Insurance:

- Flexible Premiums: You can adjust the premiums within certain limits, depending on the policy's cash value.

- Adjustable Death Benefit: You can increase or decrease the death benefit within certain limits.

- Cash Value Growth: The cash value grows based on current interest rates, which can fluctuate over time.

- Policy Loans: You can borrow against the cash value of the policy.

Pros and Cons of Universal Life Insurance:

Pros:

- Flexibility in premiums and death benefit.

- Potential for higher cash value growth than whole life insurance.

Cons:

- Cash value growth is not guaranteed.

- Premiums may need to be increased if interest rates decline.

- More complex than whole life insurance.

Variable Life Insurance Investing for Higher Returns

Variable life insurance is a type of permanent life insurance that allows you to invest the cash value in a variety of investment options, such as stocks and bonds. The death benefit and cash value can fluctuate depending on the performance of the investments.

Key Features of Variable Life Insurance:

- Investment Options: You can choose from a variety of investment options, allowing you to tailor the policy to your risk tolerance.

- Fluctuating Death Benefit and Cash Value: The death benefit and cash value can increase or decrease depending on the performance of the investments.

- Policy Loans: You can borrow against the cash value of the policy.

Pros and Cons of Variable Life Insurance:

Pros:

- Potential for higher cash value growth than other types of permanent life insurance.

- Control over investment options.

Cons:

- Risk of losing money if the investments perform poorly.

- More complex than other types of permanent life insurance.

- Higher fees than other types of life insurance.

Variable Universal Life Insurance Combining Flexibility and Investment

Variable universal life insurance (VUL) combines the features of universal life and variable life insurance, offering both flexibility and investment options. This type of policy allows you to adjust your premiums and death benefit, and also provides the opportunity to invest your cash value in a variety of subaccounts, which are similar to mutual funds.

Key Features of Variable Universal Life Insurance:

- Flexible Premiums: Like universal life, you can adjust your premium payments within certain limits, allowing you to increase or decrease your contributions based on your financial situation.

- Adjustable Death Benefit: You can also adjust your death benefit, providing flexibility as your needs change over time.

- Investment Options: VUL policies offer a range of investment options, allowing you to allocate your cash value among different subaccounts with varying levels of risk and potential return.

- Cash Value Growth: The cash value grows based on the performance of your chosen investments. This means that your cash value can fluctuate with the market.

- Policy Loans and Withdrawals: You can typically borrow against your cash value or make withdrawals, although these actions can reduce your death benefit and cash value.

Pros and Cons of Variable Universal Life Insurance:

Pros:

- Flexibility: VUL offers a high degree of flexibility in terms of premiums, death benefit, and investment options.

- Potential for Higher Returns: The ability to invest in the market provides the potential for higher returns compared to other types of permanent life insurance.

- Tax-Deferred Growth: The cash value grows on a tax-deferred basis, meaning you don't pay taxes on the earnings until you withdraw them.

Cons:

- Risk: Investment performance is not guaranteed, and you could lose money if your investments perform poorly.

- Complexity: VUL policies are more complex than other types of life insurance, requiring a good understanding of investment principles.

- Fees: VUL policies typically have higher fees than other types of life insurance, including mortality and expense charges, administrative fees, and investment management fees.

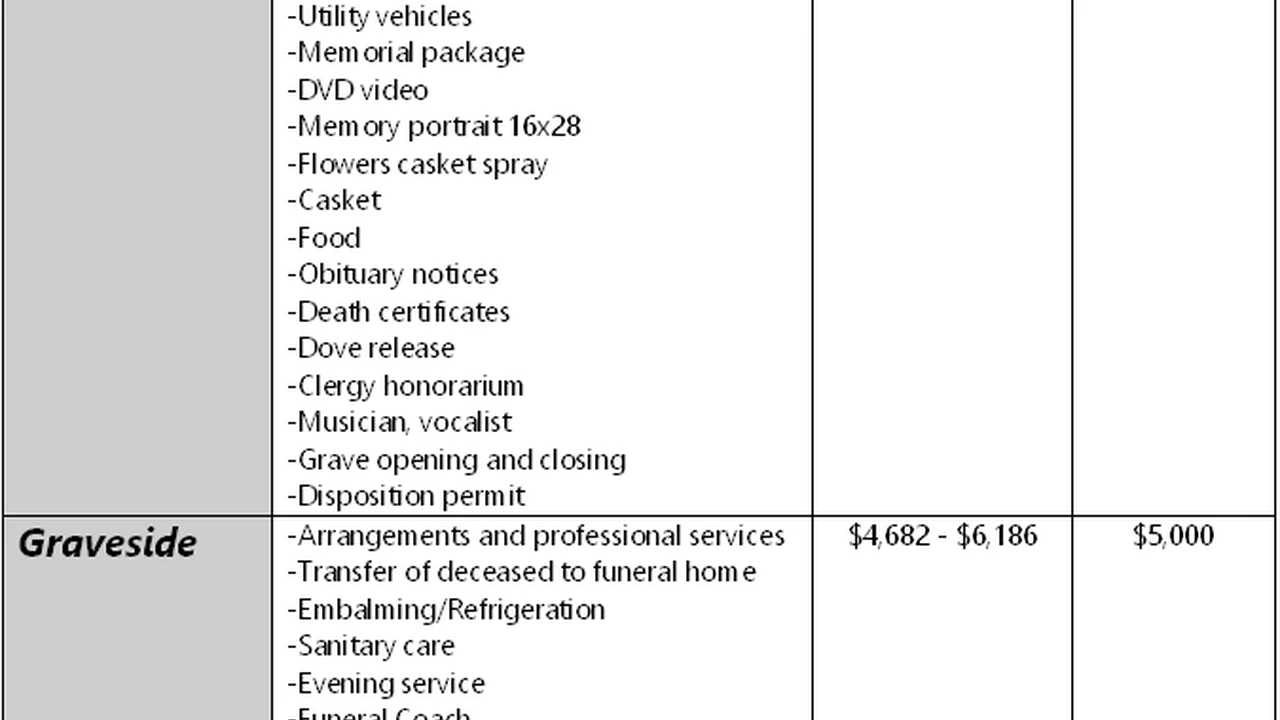

Final Expense Insurance Covering Funeral Costs In Detail

Final expense insurance, also known as burial insurance or funeral insurance, is a type of whole life insurance designed to cover the costs associated with your funeral and other end-of-life expenses. These policies typically have smaller death benefits than traditional life insurance policies, ranging from $5,000 to $25,000.

Key Features of Final Expense Insurance:

- Smaller Death Benefit: Designed to cover funeral costs and other end-of-life expenses.

- Simplified Underwriting: Often requires little to no medical exam, making it easier to qualify for coverage.

- Guaranteed Acceptance: Some policies offer guaranteed acceptance, regardless of your health.

- Level Premiums: Premiums typically remain level throughout the life of the policy.

- Cash Value: Accumulates cash value over time, similar to other whole life policies.

Who Should Consider Final Expense Insurance?

- Seniors who want to ensure their funeral costs are covered.

- Individuals with health issues who may not qualify for traditional life insurance.

- People who want a simple and affordable way to protect their loved ones from the financial burden of funeral expenses.

What Does Final Expense Insurance Cover?

Final expense insurance can be used to cover a variety of expenses, including:

- Funeral costs: including the casket, embalming, funeral home services, and burial or cremation.

- Burial plot or cremation urn.

- Headstone or memorial marker.

- Outstanding medical bills.

- Legal and administrative fees.

- Other end-of-life expenses.

Choosing the Right Life Insurance Policy A Step by Step Guide

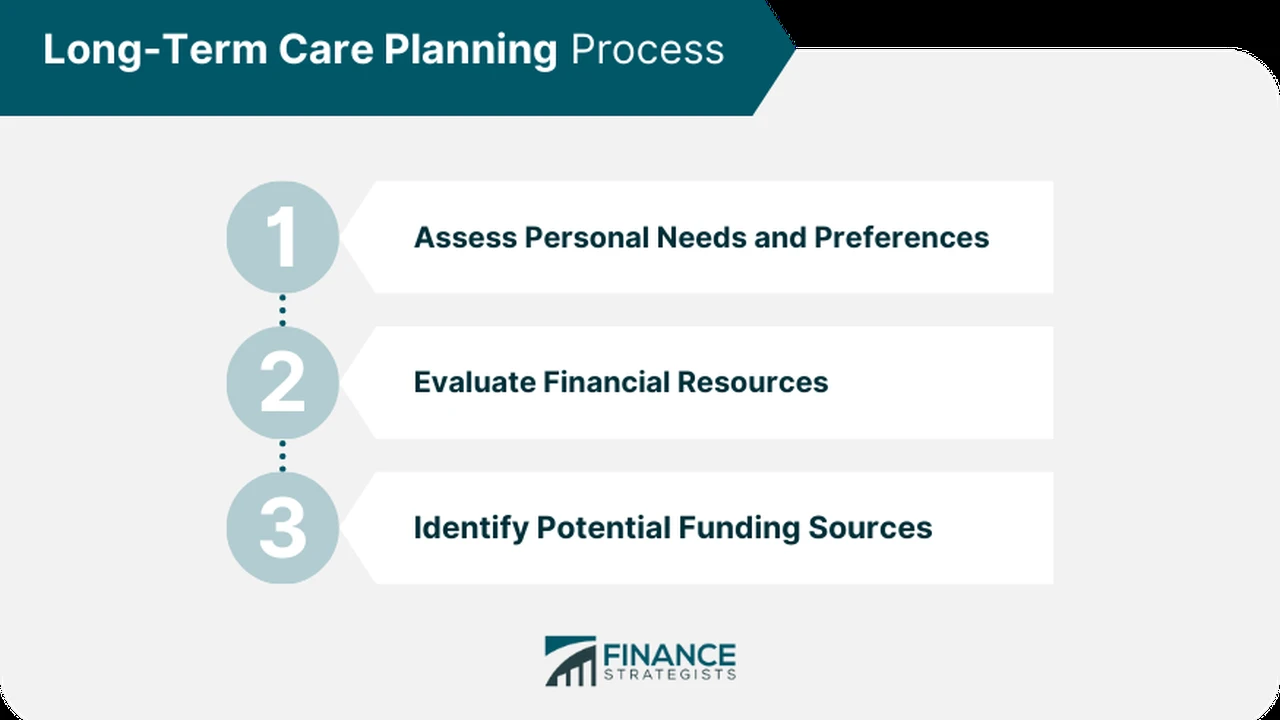

Choosing the right life insurance policy can be a complex process, but by following these steps, you can find a policy that meets your specific needs and budget.

- Determine Your Needs: Start by assessing your financial situation and determining how much coverage you need. Consider factors such as your debts, income, assets, and the needs of your dependents.

- Choose the Right Type of Policy: Decide whether you need term life insurance or permanent life insurance. Term life insurance is generally more affordable, while permanent life insurance offers lifelong coverage and cash value growth.

- Compare Quotes: Get quotes from multiple insurance companies to compare premiums and coverage options.

- Consider the Insurer's Financial Strength: Choose an insurer with a strong financial rating to ensure they can pay out claims.

- Read the Policy Carefully: Before you sign up for a policy, read the fine print carefully to understand the terms and conditions.

- Consult with a Financial Advisor: If you're unsure which policy is right for you, consult with a financial advisor who can help you assess your needs and find the best solution.

Life Insurance Needs Analysis Calculating Your Coverage Amount

Determining the appropriate amount of life insurance coverage is crucial to ensuring your loved ones are financially protected in the event of your death. A life insurance needs analysis helps you calculate the coverage amount necessary to meet your family's financial obligations and future needs.

Factors to Consider in a Life Insurance Needs Analysis:

- Outstanding Debts: Include your mortgage, car loans, credit card debt, and any other outstanding debts.

- Future Expenses: Consider future expenses such as college tuition for your children, childcare costs, and long-term care expenses for your spouse.

- Income Replacement: Determine how much income your family would need to replace if you were no longer there.

- Final Expenses: Include funeral costs, burial expenses, and legal fees.

- Existing Assets: Take into account any existing assets that your family could use to cover expenses, such as savings, investments, and other life insurance policies.

Calculating Your Coverage Amount:

There are several methods for calculating your coverage amount, including:

- The Income Replacement Method: This method estimates how much income your family would need to replace if you were no longer there. A common rule of thumb is to multiply your annual income by 7 to 10 years.

- The Debt and Expense Method: This method calculates the total amount of your debts, future expenses, and final expenses, and then subtracts your existing assets.

- The Human Life Value Method: This method estimates the present value of your future earnings.

Life Insurance Quotes Comparing Rates and Finding the Best Deals

Getting life insurance quotes from multiple companies is essential to finding the best rates and coverage options. Different insurers have different underwriting processes and pricing models, so comparing quotes can save you significant money.

Where to Get Life Insurance Quotes:

- Online Insurance Brokers: Online brokers allow you to compare quotes from multiple insurers in one place.

- Independent Insurance Agents: Independent agents work with multiple insurers and can provide personalized advice.

- Direct Insurers: Direct insurers sell policies directly to consumers, without using agents or brokers.

Factors That Affect Life Insurance Rates:

- Age: Older individuals typically pay higher premiums.

- Health: Individuals with health issues may pay higher premiums or be denied coverage.

- Gender: Women typically pay lower premiums than men.

- Lifestyle: Smokers and individuals with risky hobbies may pay higher premiums.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Policy Type: Permanent life insurance policies typically have higher premiums than term life insurance policies.

Life Insurance Companies Reviews and Ratings Top Insurers

Choosing the right life insurance company is just as important as choosing the right policy. Look for a company with a strong financial rating, a good reputation, and excellent customer service.

Top Life Insurance Companies:

Here are some of the top life insurance companies, based on financial strength ratings, customer satisfaction, and product offerings:

- New York Life: Consistently earns high ratings for financial strength and customer satisfaction.

- Northwestern Mutual: Known for its financial stability and whole life insurance policies.

- State Farm: Offers a wide range of insurance products and services, including life insurance.

- MassMutual: Provides a variety of life insurance options, including whole life, universal life, and term life.

- Prudential: A large and well-established insurance company with a strong reputation.

Factors to Consider When Choosing a Life Insurance Company:

- Financial Strength Rating: Look for a company with a high financial strength rating from agencies such as A.M. Best, Standard & Poor's, and Moody's.

- Customer Satisfaction: Check customer reviews and ratings to see what other policyholders have to say about their experience with the company.

- Product Offerings: Make sure the company offers the type of policy you need, whether it's term life, whole life, universal life, or variable life.

- Premiums and Fees: Compare premiums and fees from multiple companies to find the best deal.

- Customer Service: Choose a company with excellent customer service and a reputation for handling claims fairly and efficiently.

Life Insurance Underwriting The Application Process Explained

Life insurance underwriting is the process by which insurance companies assess the risk of insuring an individual. The underwriter reviews your application, medical history, and other information to determine whether to approve your application and at what premium rate.

Steps in the Life Insurance Underwriting Process:

- Application: You'll complete an application that includes information about your age, health, lifestyle, and financial situation.

- Medical Exam: Some policies require a medical exam, which may include a physical examination, blood test, and urine test.

- Medical Records Review: The insurer may request your medical records from your doctor.

- Motor Vehicle Report: The insurer may review your driving record.

- Prescription Drug History: The insurer may review your prescription drug history.

- Financial Information: The insurer may request financial information to verify your income and assets.

- Underwriting Decision: Based on the information gathered, the underwriter will make a decision to approve your application, decline your application, or offer you a policy at a different premium rate.

Factors That Affect Underwriting Decisions:

- Age: Older individuals are generally considered to be higher risk.

- Health: Individuals with health issues such as heart disease, diabetes, or cancer are considered to be higher risk.

- Lifestyle: Smokers and individuals with risky hobbies are considered to be higher risk.

- Family History: A family history of certain diseases may increase your risk.

- Occupation: Some occupations are considered to be higher risk than others.

Life Insurance Beneficiaries Naming and Updating Your Designations

A beneficiary is the person or entity you designate to receive the death benefit from your life insurance policy. Choosing the right beneficiaries and keeping your designations up to date is crucial to ensuring your loved ones are financially protected.

Who Can Be a Beneficiary?

- Individuals: You can name one or more individuals as beneficiaries, such as your spouse, children, parents, or other relatives.

- Trusts: You can name a trust as a beneficiary, which can provide greater control over how the death benefit is distributed.

- Charities: You can name a charity as a beneficiary, which can provide a tax-deductible donation.

- Estates: You can name your estate as a beneficiary, but this may result in probate delays and taxes.

Types of Beneficiaries:

- Primary Beneficiary: The primary beneficiary is the first person or entity to receive the death benefit.

- Contingent Beneficiary: The contingent beneficiary receives the death benefit if the primary beneficiary is deceased or unable to receive it.

Updating Your Beneficiary Designations:

It's important to review and update your beneficiary designations regularly, especially after major life events such as:

- Marriage

- Divorce

- Birth of a child

- Death of a beneficiary

- Change in financial circumstances

Life Insurance Policy Riders Enhancing Your Coverage

Life insurance policy riders are optional add-ons that can enhance your coverage and provide additional benefits. Riders can customize your policy to meet your specific needs and circumstances.

Common Life Insurance Policy Riders:

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become disabled and unable to work.

- Accidental Death Benefit Rider: Pays an additional death benefit if you die as a result of an accident.

- Child Term Rider: Provides term life insurance coverage for your children.

- Guaranteed Insurability Rider: Allows you to purchase additional life insurance coverage in the future without having to undergo a medical exam.

Life Insurance Taxes Understanding the Tax Implications

Understanding the tax implications of life insurance is crucial to making informed decisions about your coverage. Life insurance death benefits are generally tax-free to beneficiaries, but there are some exceptions.

Taxation of Life Insurance Death Benefits:

- General Rule: Life insurance death benefits are generally tax-free to beneficiaries.

- Exceptions: The death benefit may be subject to estate taxes if the policy is owned by the insured's estate or if the death benefit exceeds the estate tax exemption amount.

- Interest Income: Any interest earned on the death benefit while it's held by the insurance company is taxable.

Taxation of Life Insurance Cash Value:

- Cash Value Growth: The cash value of a permanent life insurance policy grows on a tax-deferred basis, meaning you don't pay taxes on the earnings until you withdraw them.

- Policy Loans: Policy loans are generally not taxable, as long as the policy remains in force.

- Withdrawals: Withdrawals from the cash value may be taxable if they exceed the amount you paid in premiums.

Life Insurance Claim Process Filing and Receiving Benefits

Filing a life insurance claim can be a stressful experience, especially during a time of grief. Understanding the claim process can help you navigate the process smoothly and receive the benefits you're entitled to.

Steps in the Life Insurance Claim Process:

- Notify the Insurer: Contact the insurance company as soon as possible to report the death of the insured.

- Obtain Claim Forms: The insurer will provide you with claim forms to complete.

- Gather Documentation: You'll need to provide documentation such as the death certificate, the policy document, and your identification.

- Submit Claim Forms and Documentation: Submit the completed claim forms and documentation to the insurer.

- Claim Review: The insurer will review the claim and may request additional information.

- Payment of Benefits: If the claim is approved, the insurer will pay the death benefit to the beneficiaries.

Life Insurance Common Mistakes to Avoid

Making mistakes when choosing life insurance can have serious financial consequences for your loved ones. Here are some common mistakes to avoid:

- Not getting enough coverage: Underestimating your coverage needs can leave your family financially vulnerable.

- Waiting too long to buy life insurance: Premiums increase as you get older and your health declines.

- Choosing the wrong type of policy: Selecting the wrong type of policy can result in inadequate coverage or unnecessary expenses.

- Not comparing quotes: Failing to compare quotes from multiple insurers can lead to paying too much for coverage.

- Not reviewing your policy regularly: Failing to review your policy regularly can result in outdated beneficiary designations or inadequate coverage.

- Not understanding the policy terms: Not understanding the policy terms can lead to surprises and disappointments.

Life Insurance for Seniors Options and Considerations

Life insurance can be an important financial tool for seniors, providing coverage for funeral expenses, estate taxes, and other end-of-life needs. However, life insurance for seniors can be more expensive and may have different features than policies for younger individuals.

Life Insurance Options for Seniors:

- Term Life Insurance: Term life insurance can be a more affordable option for seniors who need coverage for a specific period.

- Whole Life Insurance: Whole life insurance provides lifelong coverage and cash value growth, but it can be more expensive than term life insurance.

- Final Expense Insurance: Final expense insurance is designed to cover funeral costs and other end-of-life expenses.

Factors to Consider When Choosing Life Insurance for Seniors:

- Coverage Needs: Determine how much coverage you need to cover funeral expenses, estate taxes, and other end-of-life needs.

- Affordability: Choose a policy that fits your budget.

- Health: Your health will affect your premium rates.

- Policy Features: Consider the policy features that are important to you, such as cash value growth or accelerated death benefit riders.

Life Insurance for Young Adults Starting Early

While young adults may not think they need life insurance, it can be a valuable investment in their future financial security. Life insurance can provide coverage for student loans, mortgage debt, and future family expenses.

Benefits of Buying Life Insurance Early:

- Lower Premiums: Premiums are generally lower when you're young and healthy.

- Financial Protection: Life insurance can protect your loved ones from financial hardship in the event of your death.

- Peace of Mind: Knowing that your loved ones are protected can provide peace of mind.

Life Insurance Options for Young Adults:

- Term Life Insurance: Term life insurance is a more affordable option for young adults who need coverage for a specific period.

- Permanent Life Insurance: Permanent life insurance provides lifelong coverage and cash value growth, which can be used for future financial goals.

Life Insurance and Estate Planning Coordinating Your Finances

Life insurance is an important component of estate planning, providing funds to pay estate taxes, settle debts, and provide for your heirs. Coordinating your life insurance with your estate plan can help ensure your assets are distributed according to your wishes.

How Life Insurance Can Help with Estate Planning:

- Paying Estate Taxes: Life insurance can provide funds to pay estate taxes, which can be significant for large estates.

- Settling Debts: Life insurance can provide funds to settle debts, such as mortgages and loans.

- Providing for Heirs: Life insurance can provide financial support for your heirs, such as your spouse and children.

Tips for Coordinating Life Insurance with Your Estate Plan:

- Review Your Beneficiary Designations: Make sure your beneficiary designations are consistent with your estate plan.

- Consider a Trust: Consider naming a trust as the beneficiary of your life insurance policy to provide greater control over how the death benefit is distributed.

- Consult with an Estate Planning Attorney: Consult with an estate planning attorney to ensure your life insurance is properly integrated into your overall estate plan.

Life Insurance and Business Planning Protecting Your Company

Life insurance can also play a crucial role in business planning, protecting your company from the financial consequences of the death of a key employee or business owner. Key person insurance and buy-sell agreements are two common ways life insurance is used in business planning.

Key Person Insurance:

Key person insurance provides coverage for the death of a key employee who is essential to the success of the business. The company is the beneficiary of the policy, and the death benefit can be used to cover the costs of replacing the key employee, such as recruiting and training expenses.

Buy-Sell Agreements:

A buy-sell agreement is a contract that outlines what will happen to a business owner's share of the company in the event of their death or disability. Life insurance can be used to fund the buy-sell agreement, providing the surviving owners with the funds to purchase the deceased owner's share of the company.

Final Expense Insurance Product Recommendations and Reviews

Choosing a final expense insurance policy requires careful consideration of your needs and budget. Here are some product recommendations and reviews to help you make an informed decision.

Mutual of Omaha Final Expense Insurance:

Mutual of Omaha offers a guaranteed acceptance final expense insurance policy that is available to individuals ages 45 to 85. The policy has a death benefit ranging from $2,000 to $25,000 and requires no medical exam.

Pros:

- Guaranteed acceptance

- No medical exam

- Level premiums

Cons:

- Limited coverage amount

- Graded death benefit for the first two years (full death benefit paid for accidental death)

Colonial Penn Final Expense Insurance:

Colonial Penn offers a guaranteed acceptance final expense insurance policy that is available to individuals ages 50 to 85. The policy has a death benefit based on units of coverage purchased, and requires no medical exam.

Pros:

- Guaranteed acceptance

- No medical exam

- Easy to understand

Cons:

- Limited coverage amount

- Higher premiums compared to other options

- Graded death benefit for the first two years (full death benefit paid for accidental death)

Gerber Life Insurance Grow-Up Plan:

While technically a whole life insurance policy, the Gerber Life Grow-Up Plan can be used as a final expense policy for children. It offers a small death benefit that doubles in value at age 18.

Pros:

- Guaranteed acceptance for children

- Builds cash value

- Policy doubles in value at age 18

Cons:

- Small death benefit

- May not be suitable for covering all final expenses

Term Life Insurance Product Recommendations and Reviews

Term life insurance is a simple and affordable way to provide financial protection for your family. Here are some product recommendations and reviews to help you choose the right term life insurance policy.

SelectQuote Term Life Insurance:

SelectQuote is an online insurance broker that allows you to compare quotes from multiple insurers. They offer a wide range of term life insurance policies with varying coverage amounts and term lengths.

Pros:

- Easy to compare quotes from multiple insurers

- Wide range of policy options

- Competitive rates

Cons:

- You need to provide personal information to get quotes

- May be overwhelming to compare so many options

Ladder Life Insurance:

Ladder is an online life insurance company that offers flexible and affordable term life insurance policies. You can apply online in minutes and adjust your coverage amount as your needs change.

Pros:

- Easy online application

- Flexible coverage options

- Affordable rates

Cons:

- Limited policy options

- May not be suitable for individuals with complex insurance needs

Haven Life Insurance:

Haven Life is an online life insurance company that offers term life insurance policies underwritten by MassMutual. They offer a simple and straightforward application process and competitive rates.

Pros:

- Easy online application

- Competitive rates

- Backed by a reputable insurer

Cons:

- Limited policy options

- May not be suitable for individuals with complex insurance needs

Permanent Life Insurance Product Recommendations and Reviews

Permanent life insurance provides lifelong coverage and cash value growth, but it can be more expensive than term life insurance. Here are some product recommendations and reviews to help you choose the right permanent life insurance policy.

New York Life Whole Life Insurance:

New York Life is a well-established insurance company that offers a variety of whole life insurance policies. Their policies provide guaranteed premiums, a guaranteed death benefit, and a guaranteed rate of cash value growth.

Pros:

- Guaranteed coverage and cash value growth

- Financial strength and stability

- Dividend potential

Cons:

- Higher premiums than term life insurance

- Less flexibility than other types of permanent life insurance

Northwestern Mutual Whole Life Insurance:

Northwestern Mutual is another reputable insurance company that offers whole life insurance policies. Their policies are known for their strong financial performance and dividend payments.

Pros:

- Guaranteed coverage and cash value growth

- Financial strength and stability

- High dividend payments

Cons:

- Higher premiums than term life insurance

- Less flexibility than other types of permanent life insurance

Sample Life Insurance Policy Pricing and Details

Understanding the pricing and details of different life insurance policies is essential to making an informed decision. Here are some sample pricing scenarios to give you an idea of what you can expect to pay.

Sample Term Life Insurance Pricing:

- 30-year-old male, non-smoker, $500,000 coverage, 20-year term: Approximately $25-$35 per month.

- 40-year-old female, non-smoker, $250,000 coverage, 10-year term: Approximately $20-$30 per month.

- 50-year-old male, non-smoker, $100,000 coverage, 10-year term: Approximately $50-$70 per month.

Sample Whole Life Insurance Pricing:

- 30-year-old male, non-smoker, $100,000 coverage: Approximately $200-$300 per month.

- 40-year-old female, non-smoker, $50,000 coverage: Approximately

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)