Life Insurance and Bankruptcy_ What You Need to Know

Understanding Life Insurance Basics for Financial Security

Life insurance is a fundamental tool for financial planning, providing a safety net for your loved ones in the event of your passing. It's a contract between you and an insurance company, where you pay premiums in exchange for a death benefit – a sum of money paid to your beneficiaries upon your death. This death benefit can be used to cover a variety of expenses, including funeral costs, outstanding debts, mortgage payments, and future living expenses for your family. Choosing the right life insurance policy involves understanding different types of coverage, assessing your financial needs, and comparing policy options to find the best fit for your circumstances. This article delves into the intricacies of life insurance, particularly its interaction with bankruptcy, to help you make informed decisions about your financial future.

Bankruptcy and Its Impact on Your Assets

Bankruptcy is a legal process designed to provide individuals and businesses facing overwhelming debt with a fresh start. It involves the filing of a petition with a bankruptcy court, which then reviews your assets and liabilities to determine how your debts can be discharged or reorganized. There are several types of bankruptcy, each with its own set of rules and implications. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of your non-exempt assets to pay off creditors. Chapter 13 bankruptcy, on the other hand, allows you to create a repayment plan to pay off your debts over a period of three to five years. Understanding the different types of bankruptcy and their potential impact on your assets is crucial when considering your financial options.

Life Insurance as a Protected Asset During Bankruptcy

One of the key questions surrounding life insurance and bankruptcy is whether your life insurance policy is considered an asset that can be seized by creditors. The answer to this question depends on a variety of factors, including the type of policy, the state in which you reside, and the specific exemptions available under bankruptcy law. In many states, life insurance policies are at least partially protected from creditors in bankruptcy. This protection is often based on the need to provide financial security for your beneficiaries in the event of your death. However, the extent of this protection can vary significantly from state to state, so it's important to consult with an attorney to understand the specific laws in your jurisdiction.

Navigating State-Specific Life Insurance Exemptions in Bankruptcy

Each state has its own set of laws that determine which assets are exempt from seizure in bankruptcy. These exemptions are designed to allow individuals to maintain a basic standard of living while they are going through the bankruptcy process. With regard to life insurance, some states offer generous exemptions that protect the entire cash value of the policy, while others offer more limited exemptions. For example, some states may exempt the cash value of a life insurance policy up to a certain dollar amount, while others may exempt the proceeds of a life insurance policy that are paid to a beneficiary upon the death of the insured. It's essential to research the specific exemptions available in your state to understand the extent to which your life insurance policy is protected from creditors.

Understanding the Cash Value of Life Insurance Policies

The cash value of a life insurance policy is the accumulated savings component of the policy. It's the amount of money that the policyholder can access through withdrawals or loans. The cash value grows over time as premiums are paid and interest is earned. Not all life insurance policies have a cash value component. Term life insurance policies, for example, provide coverage for a specific period of time and do not accumulate cash value. Permanent life insurance policies, such as whole life and universal life, do have a cash value component. The cash value of a life insurance policy can be a valuable asset, but it can also be at risk in bankruptcy if it's not properly protected.

Term Life Insurance vs Permanent Life Insurance and Bankruptcy Implications

The type of life insurance policy you have can significantly impact its treatment in bankruptcy. Term life insurance, which provides coverage for a specific period, generally has no cash value and is less likely to be considered an asset in bankruptcy. Permanent life insurance, such as whole life or universal life, builds cash value over time, making it potentially subject to seizure by creditors. However, as mentioned earlier, state laws often provide exemptions that protect at least a portion of the cash value of life insurance policies. Understanding the differences between term and permanent life insurance is crucial when considering your financial planning options and potential bankruptcy scenarios.

Life Insurance Policy Ownership and Bankruptcy Considerations

Who owns the life insurance policy can also affect its treatment in bankruptcy. If you are the owner of the policy, the cash value may be considered an asset that is subject to seizure. However, if the policy is owned by someone else, such as a spouse or a trust, it may be protected from your creditors. Transferring ownership of a life insurance policy to a third party can be a complex process, and it's important to consult with an attorney to ensure that the transfer is done properly and in compliance with all applicable laws.

Irrevocable Life Insurance Trusts for Asset Protection

An irrevocable life insurance trust (ILIT) is a type of trust that is specifically designed to own and manage life insurance policies. By transferring ownership of a life insurance policy to an ILIT, you can remove it from your estate and protect it from creditors. An ILIT can provide significant asset protection benefits, but it's important to understand the rules and regulations governing these trusts. Once a life insurance policy is transferred to an ILIT, the grantor (the person who created the trust) generally loses control over the policy. The trustee of the ILIT is responsible for managing the policy and distributing the proceeds to the beneficiaries upon the death of the insured.

Strategies for Protecting Life Insurance During Financial Hardship

There are several strategies you can use to protect your life insurance policy during periods of financial hardship. These strategies include: * **Consulting with an attorney:** An attorney can advise you on the specific laws in your state and help you develop a plan to protect your assets. * **Reviewing your policy:** Make sure you understand the terms of your life insurance policy and the extent to which it is protected from creditors. * **Transferring ownership:** Consider transferring ownership of your life insurance policy to a third party, such as a spouse or a trust. * **Converting to term life insurance:** If you have a permanent life insurance policy with a significant cash value, you may consider converting it to a term life insurance policy to reduce the risk of seizure. * **Purchasing life insurance within a retirement plan:** Certain retirement plans offer creditor protection for assets held within the plan, which may include life insurance. It's important to remember that these strategies may have tax implications, so it's essential to consult with a financial advisor or tax professional before making any changes to your life insurance policy.

The Role of Beneficiary Designations in Bankruptcy

The beneficiary designation on your life insurance policy can also play a role in bankruptcy. Generally, the death benefit paid to a beneficiary is protected from the insured's creditors. However, if the beneficiary is the insured's estate, the death benefit may be subject to the claims of creditors. It's important to carefully consider your beneficiary designations to ensure that your life insurance proceeds are distributed according to your wishes and protected from creditors to the greatest extent possible.

Life Insurance Loans and Bankruptcy Implications

Taking out a loan against the cash value of your life insurance policy can have implications in bankruptcy. While the loan itself may not be dischargeable in bankruptcy, it can reduce the cash value of the policy, which may affect the amount that is protected from creditors. It's important to carefully consider the risks and benefits of taking out a life insurance loan before doing so.

Life Insurance and Divorce: A Related Consideration

While not directly related to bankruptcy, divorce can also impact your life insurance policy. In many divorce settlements, one spouse is required to maintain a life insurance policy for the benefit of the other spouse or their children. If you are going through a divorce, it's important to discuss your life insurance policy with your attorney to ensure that it is properly addressed in the settlement agreement.

Specific Life Insurance Products for Asset Protection and Financial Planning

Several life insurance products are particularly well-suited for asset protection and financial planning. These include: * **Whole Life Insurance:** Offers guaranteed cash value growth and a fixed death benefit, making it a predictable and stable option. * **Universal Life Insurance:** Provides more flexibility in premium payments and death benefit amounts, allowing you to adjust your coverage as your needs change. * **Variable Life Insurance:** Offers the potential for higher returns by investing the cash value in a variety of investment options, but also carries more risk. * **Indexed Universal Life Insurance:** Combines the flexibility of universal life insurance with the potential for growth based on the performance of a market index. The best life insurance product for you will depend on your individual circumstances, financial goals, and risk tolerance.

Case Studies: Real-Life Examples of Life Insurance in Bankruptcy Scenarios

To illustrate the complexities of life insurance and bankruptcy, let's examine a few case studies: * **Case Study 1: The Smith Family:** John Smith filed for Chapter 7 bankruptcy due to overwhelming medical debt. He owned a whole life insurance policy with a cash value of $50,000. Under the laws of his state, only $25,000 of the cash value was exempt from seizure. As a result, John was required to surrender $25,000 of the cash value to his creditors. * **Case Study 2: The Jones Family:** Mary Jones filed for Chapter 13 bankruptcy after losing her job. She owned a term life insurance policy with a death benefit of $250,000. Because term life insurance generally has no cash value, Mary's policy was not considered an asset in bankruptcy and was not subject to seizure. * **Case Study 3: The Brown Family:** Robert Brown transferred ownership of his life insurance policy to an irrevocable life insurance trust several years before filing for bankruptcy. Because the policy was owned by the trust, it was protected from his creditors. These case studies highlight the importance of understanding the specific laws in your state and taking proactive steps to protect your life insurance policy.

Comparing Life Insurance Providers for Optimal Coverage and Value

Choosing the right life insurance provider is crucial for ensuring that you receive the coverage you need at a competitive price. Some of the leading life insurance providers include: * **New York Life:** A mutual company known for its financial strength and stability. * **Northwestern Mutual:** Another mutual company with a strong reputation for financial security and customer service. * **Prudential:** A large insurance company offering a wide range of life insurance products. * **MassMutual:** A mutual company with a long history of providing life insurance and financial services. * **Transamerica:** A large insurance company offering a variety of life insurance and investment products. When comparing life insurance providers, consider factors such as financial strength, policy options, pricing, and customer service.

Key Considerations When Selecting a Life Insurance Policy

Selecting the right life insurance policy is a complex decision that requires careful consideration of your individual circumstances. Here are some key factors to consider: * **Your Financial Needs:** How much coverage do you need to protect your loved ones in the event of your death? Consider factors such as funeral costs, outstanding debts, mortgage payments, and future living expenses. * **Your Budget:** How much can you afford to pay in premiums each month? * **Your Age and Health:** Your age and health will affect the cost of your life insurance policy. * **Your Risk Tolerance:** Are you comfortable with the risks associated with variable life insurance, or do you prefer the stability of whole life insurance? * **Your Long-Term Goals:** What are your long-term financial goals? Are you looking for a policy that can provide cash value accumulation for retirement or other purposes?

Life Insurance Policy Riders and Enhanced Coverage Options

Life insurance policy riders are optional add-ons that can enhance your coverage and provide additional benefits. Some common life insurance riders include: * **Accelerated Death Benefit Rider:** Allows you to access a portion of your death benefit if you are diagnosed with a terminal illness. * **Accidental Death Benefit Rider:** Pays an additional death benefit if you die as a result of an accident. * **Waiver of Premium Rider:** Waives your premium payments if you become disabled and unable to work. * **Child Term Rider:** Provides life insurance coverage for your children. * **Guaranteed Insurability Rider:** Allows you to purchase additional life insurance coverage in the future without having to undergo a medical exam. Riders can add value to your life insurance policy, but they also come at an additional cost. It's important to carefully consider the benefits and costs of each rider before adding it to your policy.

The Importance of Regular Life Insurance Policy Reviews

Your life insurance needs can change over time as your circumstances evolve. It's important to review your life insurance policy regularly to ensure that it still meets your needs. Some events that may warrant a review of your life insurance policy include: * **Marriage or Divorce:** * **Birth or Adoption of a Child:** * **Purchase of a Home:** * **Change in Employment:** * **Significant Increase or Decrease in Income:** * **Changes in Your Health:** By reviewing your life insurance policy regularly, you can ensure that you have the right amount of coverage and that your beneficiaries are properly designated.

Life Insurance and Estate Planning: A Comprehensive Approach

Life insurance is an important component of a comprehensive estate plan. It can provide funds to pay estate taxes, cover debts, and provide financial security for your loved ones. When creating your estate plan, it's important to consider how your life insurance policy will interact with your other assets and legal documents, such as your will and trust. Consulting with an estate planning attorney can help you develop a comprehensive plan that meets your individual needs and goals.

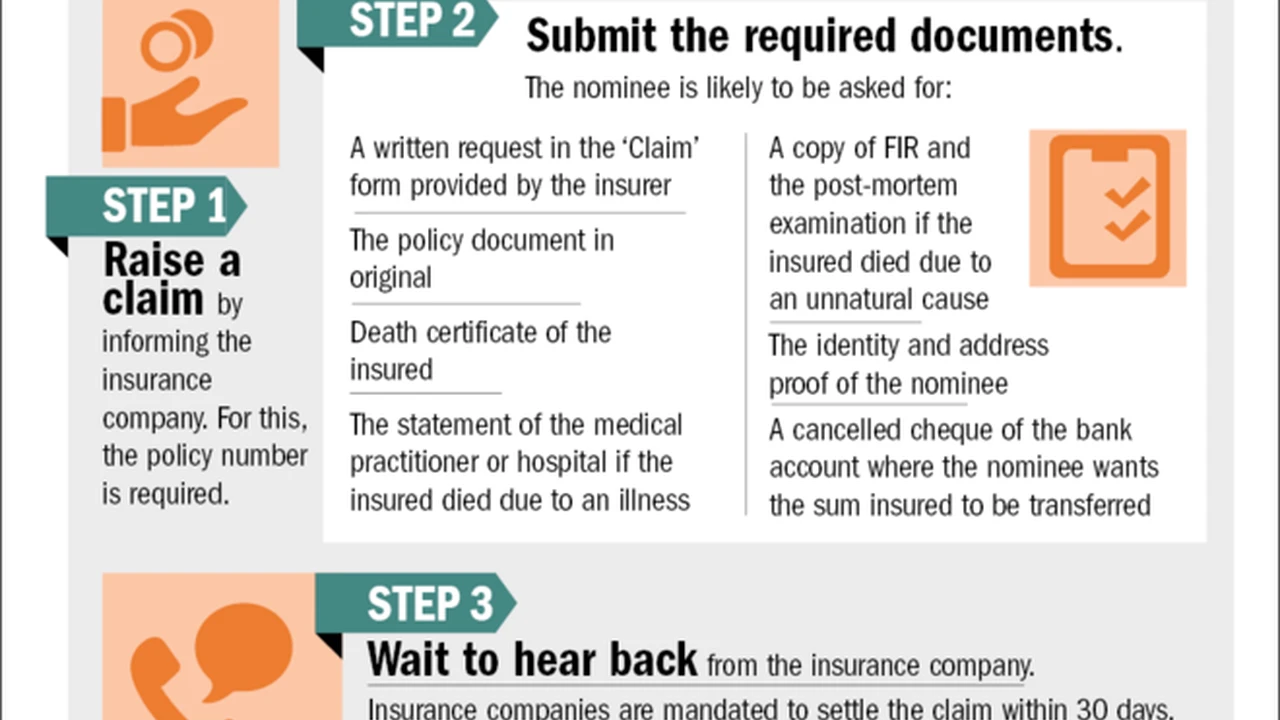

Life Insurance Claim Process: What to Expect and How to Prepare

In the unfortunate event of your death, your beneficiaries will need to file a claim to receive the death benefit from your life insurance policy. The claim process typically involves submitting a death certificate and a claim form to the insurance company. The insurance company will then review the claim and, if approved, will pay the death benefit to the beneficiaries. It's important to make sure that your beneficiaries are aware of your life insurance policy and know how to file a claim. You should also keep your policy documents in a safe place and provide your beneficiaries with access to them.

Life Insurance Taxation: Understanding the Tax Implications

Life insurance benefits are generally income tax-free to the beneficiary. However, there may be estate tax implications if the death benefit is included in your estate. Additionally, the cash value growth within a life insurance policy is generally tax-deferred. It's important to understand the tax implications of life insurance and to consult with a tax professional to ensure that you are minimizing your tax liability.

Finding Affordable Life Insurance: Tips and Strategies

Finding affordable life insurance requires research and comparison. Here are some tips and strategies for finding the best rates: * **Shop Around:** Get quotes from multiple insurance companies to compare pricing. * **Consider Term Life Insurance:** Term life insurance is generally more affordable than permanent life insurance. * **Improve Your Health:** Improving your health can lower your life insurance premiums. * **Avoid Risky Activities:** Engaging in risky activities can increase your life insurance premiums. * **Work with an Independent Agent:** An independent agent can help you compare quotes from multiple insurance companies and find the best policy for your needs.

Ethical Considerations in Life Insurance and Financial Planning

Ethical considerations are paramount in life insurance and financial planning. It's important to work with a financial advisor who is committed to acting in your best interests and providing unbiased advice. Some ethical considerations to keep in mind include: * **Transparency:** Your financial advisor should be transparent about their fees and commissions. * **Conflicts of Interest:** Your financial advisor should disclose any potential conflicts of interest. * **Suitability:** Your financial advisor should recommend products and services that are suitable for your individual needs and goals. * **Confidentiality:** Your financial advisor should maintain the confidentiality of your personal information.

The Future of Life Insurance: Trends and Innovations

The life insurance industry is constantly evolving, with new trends and innovations emerging all the time. Some of the key trends in the life insurance industry include: * **Increased Use of Technology:** Insurance companies are increasingly using technology to streamline the application process and provide better customer service. * **Personalized Insurance Products:** Insurance companies are offering more personalized insurance products that are tailored to individual needs and circumstances. * **Focus on Wellness:** Insurance companies are offering incentives for policyholders to improve their health and wellness. * **Growth of Online Insurance Platforms:** Online insurance platforms are making it easier for consumers to compare quotes and purchase life insurance policies. Staying informed about these trends can help you make informed decisions about your life insurance coverage.

Life Insurance for Business Owners: Protecting Your Business and Employees

Life insurance can be a valuable tool for business owners, providing protection for the business and its employees. Some common uses of life insurance for business owners include: * **Key Person Insurance:** Provides coverage for key employees who are critical to the success of the business. * **Buy-Sell Agreements:** Provides funding for the purchase of a deceased owner's share of the business. * **Executive Bonus Plans:** Provides life insurance coverage as a benefit for key executives. Life insurance can help business owners protect their businesses and provide financial security for their employees.

Navigating the Complexities of Life Insurance and Financial Regulations

Life insurance is subject to a complex web of federal and state regulations. These regulations are designed to protect consumers and ensure that insurance companies are financially sound. It's important to understand the regulations that govern life insurance in your state and to work with a reputable insurance company that is in compliance with all applicable laws.

Expert Advice on Maximizing the Benefits of Your Life Insurance Policy

To maximize the benefits of your life insurance policy, it's important to: * **Choose the Right Policy:** Select a policy that meets your individual needs and goals. * **Review Your Policy Regularly:** Make sure your policy still meets your needs as your circumstances change. * **Keep Your Beneficiaries Informed:** Let your beneficiaries know about your policy and how to file a claim. * **Consult with a Financial Advisor:** Get expert advice on how to integrate your life insurance policy into your overall financial plan. By following these tips, you can ensure that your life insurance policy provides the protection and financial security you need.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

-A-Powerful-Tool.webp)