How to File a Life Insurance Claim_ A Step-by-Step Guide

Understanding Life Insurance Claims The Basics

Life insurance provides a financial safety net for your loved ones after you're gone. But understanding how to actually file a claim when the time comes can seem daunting. This guide breaks down the process, step-by-step, so you can navigate it with confidence. We'll cover everything from gathering necessary documents to understanding payout options, and even touch on some specific product recommendations to help you plan for the future.

Life insurance isn't just one-size-fits-all. There are different types, each with its own benefits and drawbacks. Term life insurance, for example, provides coverage for a specific period, while whole life insurance offers lifelong protection and a cash value component. Understanding these differences is crucial when choosing the right policy and, subsequently, when filing a claim.

The primary purpose of a life insurance claim is to provide financial support to the beneficiaries named in the policy. This support can be used to cover funeral expenses, outstanding debts, living expenses, education costs, and more. The claim process involves notifying the insurance company of the policyholder's death, submitting the required documentation, and receiving the death benefit.

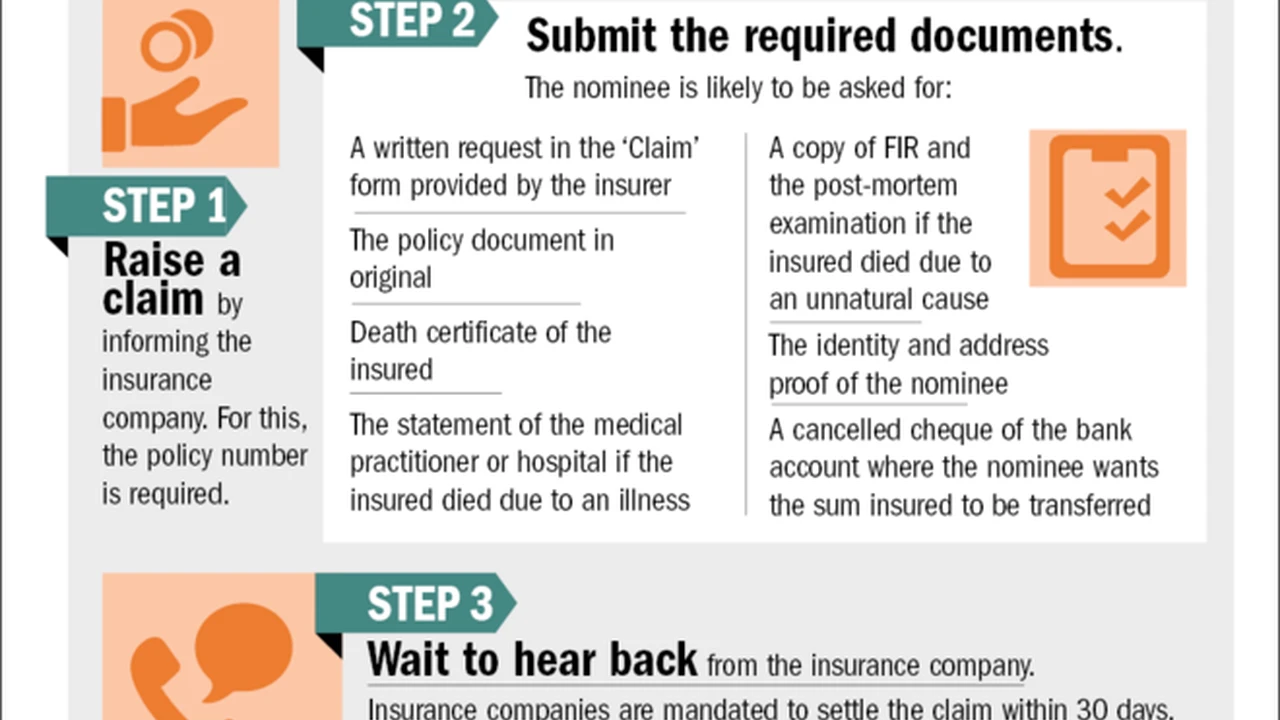

Gathering Essential Documents For Your Life Insurance Claim

One of the most crucial steps in filing a life insurance claim is gathering the necessary documents. Having these readily available will significantly speed up the process and reduce the chances of delays. Here's a checklist of what you'll typically need:

- Death Certificate: An official copy of the death certificate is absolutely essential. You'll need to obtain this from the vital records office in the county where the death occurred.

- Life Insurance Policy: A copy of the life insurance policy document. This contains crucial information such as the policy number, insured's name, beneficiary details, and coverage amount.

- Claim Form: The insurance company will provide a claim form that needs to be completed and submitted. This form typically asks for information about the deceased, the beneficiary, and the circumstances of the death.

- Beneficiary Identification: Proof of identity for the beneficiary, such as a driver's license, passport, or other government-issued ID.

- Additional Documents: Depending on the circumstances of the death, the insurance company may require additional documents, such as medical records, police reports (in case of an accident), or autopsy reports.

Pro Tip: Keep copies of all submitted documents for your records. This can be helpful if there are any discrepancies or if you need to refer back to the information later.

Notifying The Insurance Company Promptly and Accurately

Once you have gathered the necessary documents, the next step is to notify the insurance company as soon as possible. Most insurance companies have a dedicated claims department that you can contact by phone, email, or through their website. When you contact them, be prepared to provide the following information:

- Policy Number: The life insurance policy number.

- Insured's Name: The name of the deceased.

- Date of Death: The date the insured passed away.

- Your Contact Information: Your name, phone number, and email address.

The insurance company will then provide you with a claim form and instructions on how to submit it along with the required documentation. It's crucial to follow their instructions carefully to avoid any delays in processing your claim.

Be sure to ask the insurance representative about the expected timeline for processing the claim and what to expect during the process. This will help you manage your expectations and stay informed.

Completing The Life Insurance Claim Form Meticulously

The claim form is a critical document that needs to be completed accurately and thoroughly. Take your time to read each question carefully and provide the requested information. If you are unsure about anything, don't hesitate to contact the insurance company for clarification.

Here are some tips for completing the claim form:

- Use Black Ink: Always use black ink when filling out the form.

- Print Clearly: Write legibly so that the insurance company can easily read your responses.

- Answer All Questions: Make sure you answer all the questions on the form. If a question doesn't apply to you, write "N/A" (not applicable).

- Double-Check Your Answers: Before submitting the form, review your answers carefully to ensure they are accurate.

- Attach Required Documents: Ensure you attach all the required documents to the claim form.

Submitting an incomplete or inaccurate claim form can delay the processing of your claim. So, it's worth taking the time to complete it correctly.

Understanding Payout Options For Life Insurance Benefits

Life insurance benefits are typically paid out in one of several ways. Understanding these options can help you choose the one that best suits your needs:

- Lump Sum: The most common payout option is a lump sum, where the entire death benefit is paid out in a single payment. This provides immediate access to the funds and allows beneficiaries to use the money as they see fit.

- Annuity: An annuity provides a stream of income over a specified period or for the beneficiary's lifetime. This can be a good option for those who want a guaranteed income stream.

- Life Income Option: This option provides a guaranteed income for the beneficiary's lifetime. The amount of the income depends on the beneficiary's age and life expectancy.

- Specific Income For a Specific Period: This allows you to specify the amount of income and the period that the income will be paid out.

The best payout option for you will depend on your individual circumstances and financial goals. Consider factors such as your age, income needs, and investment experience when making your decision.

Navigating Potential Delays And Disputes In Life Insurance Claims

While most life insurance claims are processed smoothly, there can be instances where delays or disputes arise. Understanding the common causes of these issues and how to address them can help you navigate the process more effectively.

Common causes of delays include:

- Incomplete Documentation: Missing or incomplete documents are a frequent cause of delays.

- Policy Misrepresentation: If the policyholder misrepresented information on their application, such as their health history, it can lead to delays or even denial of the claim.

- Contestable Period: Life insurance policies typically have a contestable period, usually two years, during which the insurance company can investigate the policyholder's application for misrepresentation. If the policyholder dies during this period, the claim may be subject to a more thorough review.

- Unclear Beneficiary Designation: If the beneficiary designation is unclear or ambiguous, it can cause delays in determining who is entitled to the death benefit.

If you experience delays or disputes, here are some steps you can take:

- Contact the Insurance Company: Start by contacting the insurance company to inquire about the status of your claim and the reasons for the delay.

- Provide Additional Information: If the insurance company requests additional information, provide it promptly and accurately.

- Consult with an Attorney: If you are unable to resolve the issue with the insurance company, consider consulting with an attorney who specializes in life insurance claims.

- File a Complaint: You can file a complaint with your state's insurance department if you believe the insurance company is acting unfairly.

Understanding The Tax Implications Of Life Insurance Payouts

Life insurance payouts are generally tax-free to the beneficiary. However, there are some exceptions to this rule. It's essential to understand the tax implications of life insurance payouts to avoid any surprises.

Here are some key points to keep in mind:

- Death Benefit: The death benefit is generally income tax-free to the beneficiary.

- Interest: If the death benefit is left with the insurance company and earns interest, the interest is taxable as ordinary income.

- Estate Taxes: Life insurance proceeds may be subject to estate taxes if the policy is owned by the deceased's estate or if the proceeds are payable to the estate.

- Gift Taxes: If you transfer ownership of a life insurance policy to someone else, it may be subject to gift taxes.

It's always a good idea to consult with a tax advisor to understand the specific tax implications of your life insurance payout.

Specific Product Recommendations For Life Insurance Coverage

Choosing the right life insurance policy can be overwhelming, with so many options available. Here are a few specific product recommendations based on different needs and circumstances:

For Young Families: Term Life Insurance

Term life insurance is an affordable option for young families who need coverage for a specific period, such as the time it takes to raise children or pay off a mortgage. Consider policies from companies like:

- SelectQuote: Offers competitive rates and a wide range of term lengths.

- Haven Life: Provides a streamlined online application process and instant decision-making.

For Long-Term Protection: Whole Life Insurance

Whole life insurance offers lifelong protection and a cash value component that grows over time. This can be a good option for those who want a guaranteed death benefit and a source of retirement savings. Consider policies from companies like:

- New York Life: A reputable company with a long history of providing whole life insurance.

- MassMutual: Offers competitive rates and a variety of policy options.

For Investment Opportunities: Variable Life Insurance

Variable life insurance allows you to invest the cash value of your policy in a variety of investment options, such as stocks, bonds, and mutual funds. This can provide the potential for higher returns, but it also comes with more risk. Consider policies from companies like:

- Prudential: Offers a wide range of investment options and flexible policy features.

- Nationwide: Provides competitive rates and a variety of policy options.

Use Cases For Different Types Of Life Insurance Policies

Different life insurance policies are suitable for different situations. Here are some common use cases:

- Replacing Income: If you are the primary breadwinner in your family, life insurance can replace your income if you die, providing financial support for your loved ones.

- Paying Off Debt: Life insurance can be used to pay off outstanding debts, such as a mortgage, student loans, or credit card debt.

- Funding Education: Life insurance can be used to fund your children's education, ensuring they have the opportunity to attend college or university.

- Covering Funeral Expenses: Life insurance can be used to cover funeral expenses, which can be a significant financial burden.

- Estate Planning: Life insurance can be used as part of your estate planning strategy to provide liquidity and minimize estate taxes.

Product Comparison A Detailed Look At Leading Providers

Let's take a closer look at some leading life insurance providers and compare their key features and benefits:

Term Life Insurance Comparison

| Provider | Key Features | Pros | Cons |

|---|---|---|---|

| SelectQuote | Competitive rates, wide range of term lengths | Affordable, flexible | May require a medical exam |

| Haven Life | Streamlined online application, instant decision | Convenient, fast approval | Limited policy options |

| Ladder Life | Flexible coverage amounts, easy to adjust | Adaptable, user-friendly | May be more expensive than other options |

Whole Life Insurance Comparison

| Provider | Key Features | Pros | Cons |

|---|---|---|---|

| New York Life | Long history, financial strength | Guaranteed death benefit, cash value growth | Higher premiums |

| MassMutual | Competitive rates, variety of policy options | Affordable, flexible | Cash value growth may be slower |

| Northwestern Mutual | Strong financial ratings, dividend payments | Potential for higher returns, tax advantages | More complex policy structure |

Detailed Information On Policy Features And Pricing

Understanding the specific features and pricing of life insurance policies is crucial for making an informed decision. Here's a breakdown of some key considerations:

Policy Features

- Death Benefit: The amount of money that will be paid to your beneficiaries upon your death.

- Premium: The amount you pay regularly to keep your policy in force.

- Cash Value: The accumulated value of your policy that you can access through loans or withdrawals (available in whole life and variable life policies).

- Riders: Optional add-ons that provide additional coverage or benefits, such as a waiver of premium rider or an accelerated death benefit rider.

Pricing Factors

- Age: Older individuals typically pay higher premiums.

- Health: Individuals with pre-existing health conditions may pay higher premiums or be denied coverage.

- Lifestyle: Risky behaviors, such as smoking or excessive alcohol consumption, can increase premiums.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Policy Type: Whole life and variable life policies typically have higher premiums than term life policies.

To get an accurate idea of pricing, it's best to get quotes from multiple insurance companies and compare their rates and features. Online tools and independent insurance agents can help you with this process.

Staying Organized During The Claims Process Helpful Tips

The life insurance claim process can be complex and time-consuming. Staying organized is essential to ensure a smooth and efficient experience. Here are some helpful tips:

- Create a File: Create a physical or digital file to store all documents related to the claim, including the policy document, death certificate, claim form, and correspondence with the insurance company.

- Keep Copies: Make copies of all submitted documents for your records.

- Track Communications: Keep a log of all communications with the insurance company, including the date, time, and name of the person you spoke with.

- Set Reminders: Set reminders for important deadlines, such as the deadline for submitting the claim form or providing additional information.

- Stay in Contact: Stay in regular contact with the insurance company to check on the status of your claim and address any questions or concerns.

By staying organized, you can minimize stress and ensure that your claim is processed as quickly and efficiently as possible.

Seeking Professional Guidance When Needed Expert Advice

Navigating the life insurance claim process can be challenging, especially during a difficult time. Don't hesitate to seek professional guidance if you need help. Here are some resources that can provide expert advice:

- Insurance Agents: Independent insurance agents can provide unbiased advice and help you compare policies from multiple companies.

- Financial Advisors: Financial advisors can help you integrate life insurance into your overall financial plan and provide guidance on payout options.

- Attorneys: Attorneys who specialize in life insurance claims can provide legal advice and represent you if you experience delays or disputes.

- Consumer Advocacy Groups: Consumer advocacy groups can provide information and resources to help you understand your rights and navigate the claims process.

Seeking professional guidance can provide peace of mind and ensure that you are making informed decisions.

Common Misconceptions About Life Insurance Claims Debunked

There are many misconceptions about life insurance claims that can lead to confusion and anxiety. Let's debunk some of the most common myths:

- Myth: Life insurance claims are always denied. Fact: Most life insurance claims are paid out without any issues.

- Myth: You can't get life insurance if you have a pre-existing condition. Fact: While pre-existing conditions may affect your premiums, you can still get life insurance coverage.

- Myth: Life insurance is only for the wealthy. Fact: Life insurance is affordable for people of all income levels.

- Myth: You only need life insurance if you have children. Fact: Life insurance can be beneficial for anyone who wants to protect their loved ones financially.

- Myth: Life insurance is too complicated to understand. Fact: While life insurance can seem complex, there are many resources available to help you understand the basics.

By understanding the facts about life insurance claims, you can make informed decisions and protect your loved ones.

The Importance Of Reviewing Your Policy Regularly Updates and Changes

Life circumstances change over time, so it's essential to review your life insurance policy regularly to ensure it still meets your needs. Here are some situations that may warrant a review:

- Marriage: Update your beneficiary designation to include your spouse.

- Birth or Adoption of a Child: Increase your coverage amount to provide for your growing family.

- Divorce: Update your beneficiary designation to reflect your current relationship status.

- Job Change: Review your coverage amount to ensure it still meets your income replacement needs.

- Major Purchase: Increase your coverage amount to cover new debts, such as a mortgage.

- Retirement: Review your coverage amount to ensure it aligns with your retirement goals.

By reviewing your policy regularly, you can ensure that your life insurance coverage remains adequate and up-to-date.

Looking Ahead Preparing For The Future With Life Insurance

Life insurance is an essential part of financial planning that provides peace of mind and financial security for your loved ones. By understanding the different types of policies, the claim process, and the tax implications, you can make informed decisions and protect your family's future.

Remember to choose a reputable insurance company, review your policy regularly, and seek professional guidance when needed. With careful planning and preparation, you can ensure that your life insurance policy provides the financial protection your family needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)