Irrevocable Life Insurance Trust (ILIT)_ A Powerful Tool

-A-Powerful-Tool.webp)

Understanding the Irrevocable Life Insurance Trust ILIT Definition and Purpose

Let's dive right into what an Irrevocable Life Insurance Trust, or ILIT, actually is. Simply put, it's a type of trust specifically designed to own and manage a life insurance policy. But it's much more than just a fancy name. The "irrevocable" part is crucial – once established, the terms of the trust generally cannot be changed. This permanency is key to its main purpose: to remove life insurance proceeds from your taxable estate.

Why would you want to do that? Well, estate taxes can be a significant burden, potentially eating away at the inheritance you want to leave to your loved ones. By placing your life insurance policy within an ILIT, the death benefit typically avoids both estate taxes and generation-skipping transfer taxes (GSTT). This means more of your assets can be passed on to your beneficiaries.

Think of it this way: without an ILIT, the death benefit from your life insurance policy is considered part of your estate. If your estate exceeds the federal estate tax exemption (which fluctuates but is currently quite high), a significant portion of that benefit could be taxed at a hefty rate. An ILIT effectively shelters those funds.

Key Benefits of Establishing an ILIT Estate Tax Savings and Wealth Preservation

The primary advantage of an ILIT, as we've touched upon, is estate tax savings. Let's illustrate this with an example. Imagine your estate, including a $5 million life insurance policy, is valued at $15 million. Assuming the federal estate tax exemption is $12.92 million (as of 2023), the taxable portion of your estate would be $2.08 million ($15 million - $12.92 million). At a typical estate tax rate of 40%, this would result in an estate tax liability of $832,000.

Now, consider the same scenario but with the $5 million life insurance policy held within an ILIT. The taxable estate would now be $10 million, falling below the exemption threshold. This eliminates the estate tax liability entirely, saving your heirs $832,000! That's a substantial difference.

Beyond estate tax savings, ILITs offer several other benefits:

* **Creditor Protection:** In some jurisdictions, assets held within an ILIT may be protected from creditors' claims. This can provide an extra layer of security for your beneficiaries. * **Control and Management:** The trust document allows you to specify how the life insurance proceeds will be managed and distributed to your beneficiaries. This can be particularly important if your beneficiaries are minors or have special needs. * **Liquidity for Estate Taxes:** While the ILIT shields the life insurance proceeds from estate taxes, it can also provide liquidity to the estate itself. The trustee can use the funds to pay estate taxes on other assets, preventing the need to sell off valuable property. * **Generation-Skipping Transfer Tax (GSTT) Avoidance:** ILITs can be structured to avoid GSTT, which applies when assets are passed down to grandchildren or more remote descendants. * **Divorce Protection:** In certain states, assets held within an ILIT may be protected in the event of a beneficiary's divorce.ILIT Funding Strategies Gifting and Crummey Letters Explained

Funding an ILIT requires a bit of planning. Since you can't directly transfer assets to the trust without potential tax implications, the typical method involves making annual gifts to the trust. These gifts are then used by the trustee to pay the life insurance premiums.

However, gifts exceeding the annual gift tax exclusion amount (currently $17,000 per individual per year, as of 2023) can trigger gift tax. This is where "Crummey letters" come into play.

**Crummey Letters: The Key to Tax-Free Gifting**

A Crummey letter is a written notice sent to the beneficiaries of the ILIT informing them of their temporary right to withdraw the contribution made to the trust. This temporary withdrawal right, even if never exercised, transforms the gift into a "present interest" gift, qualifying it for the annual gift tax exclusion.

Here's how it works:

1. You make a contribution to the ILIT. 2. The trustee sends a Crummey letter to each beneficiary, informing them that they have a limited time (usually 30 days) to withdraw their share of the contribution. 3. The beneficiaries typically waive their right to withdraw the funds, allowing the trustee to use the contribution to pay the life insurance premiums.Because of the Crummey power, the gift is considered a "present interest" and qualifies for the annual gift tax exclusion. This allows you to fund the ILIT without incurring gift tax.

**Important Considerations for Crummey Letters:**

* **Proper Notice:** The Crummey letter must be properly drafted and sent to each beneficiary in a timely manner. * **Bona Fide Withdrawal Right:** The beneficiaries must have a genuine, unrestricted right to withdraw the funds. The trustee cannot discourage them from exercising this right. * **Record Keeping:** Maintain accurate records of all contributions, Crummey letters, and beneficiary waivers.**Other Funding Strategies:**

* **Existing Life Insurance Policy Transfer:** You can transfer an existing life insurance policy to the ILIT. However, be aware of the "three-year rule." If you die within three years of transferring the policy, the death benefit will still be included in your taxable estate. * **New Life Insurance Policy Purchase:** The ILIT can purchase a new life insurance policy directly. This avoids the three-year rule. The grantor (you) makes gifts to the ILIT, and the trustee uses those funds to purchase the policy.Choosing the Right Life Insurance Policy for Your ILIT Term vs Permanent Coverage

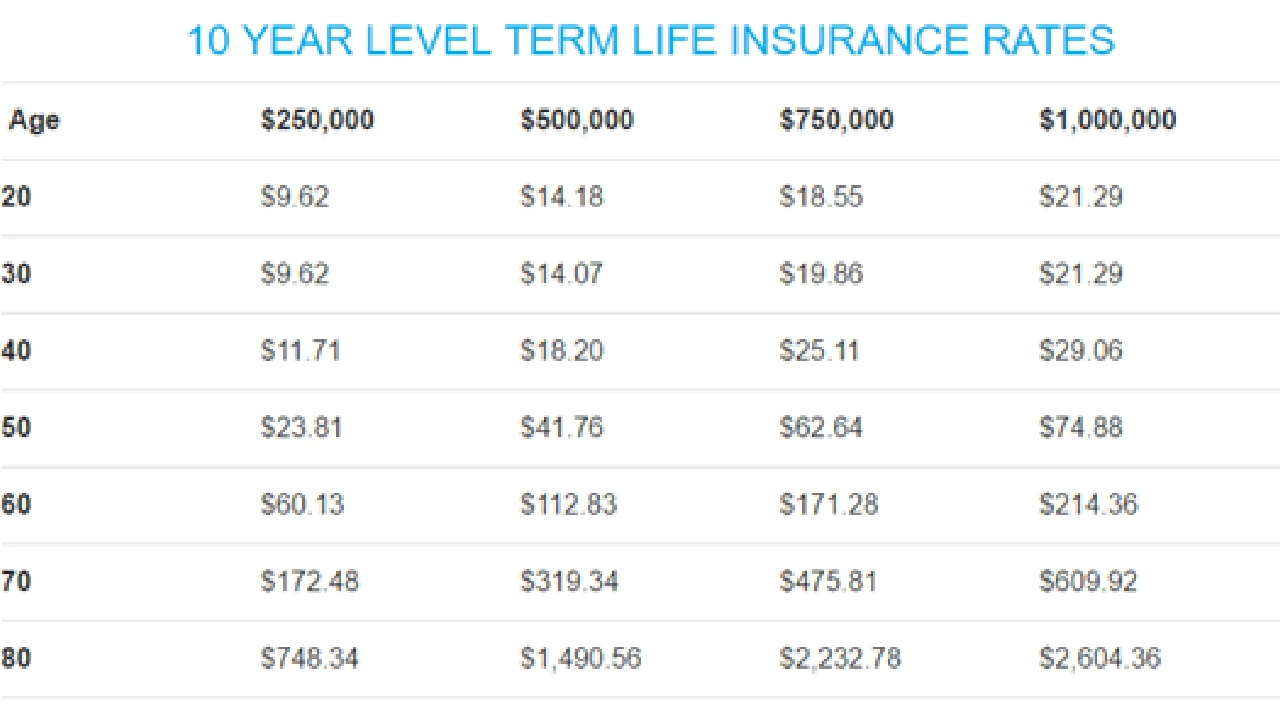

Selecting the appropriate life insurance policy is crucial for maximizing the benefits of your ILIT. The two main types of life insurance are term and permanent. Let's examine each type in the context of an ILIT.

**Term Life Insurance:**

* **Pros:** * Lower premiums, especially in the early years. * Suitable for covering specific financial needs for a defined period (e.g., until children are grown). * **Cons:** * Coverage expires at the end of the term. * Premiums increase upon renewal. * No cash value accumulation.**Permanent Life Insurance (Whole Life, Universal Life, Variable Life):**

* **Pros:** * Lifelong coverage. * Cash value accumulation. * Potential for tax-deferred growth of cash value. * **Cons:** * Higher premiums than term life insurance. * More complex policy features.**Which Type is Best for an ILIT?**

The ideal choice depends on your individual circumstances and financial goals. If your primary goal is to minimize premiums and you only need coverage for a specific period, term life insurance may be a suitable option. However, if you desire lifelong coverage and the potential for cash value accumulation, permanent life insurance is generally a better fit for an ILIT.

Here's a breakdown of different permanent life insurance options:

* **Whole Life Insurance:** Provides guaranteed level premiums, a guaranteed death benefit, and guaranteed cash value growth. It's a conservative option that offers predictability. * **Universal Life Insurance:** Offers more flexibility than whole life insurance. You can adjust the premium payments and death benefit within certain limits. The cash value grows based on current interest rates. * **Variable Life Insurance:** Allows you to invest the cash value in a variety of investment options, such as stocks, bonds, and mutual funds. This offers the potential for higher returns but also carries more risk. * **Indexed Universal Life Insurance (IUL):** A type of universal life insurance where the cash value growth is linked to the performance of a market index, such as the S&P 500. This offers the potential for higher returns than traditional universal life insurance while providing some downside protection.Specific Product Recommendations Within Permanent Life Insurance

While I cannot provide specific financial advice, I can offer some general recommendations based on the type of permanent life insurance you might consider for your ILIT:

* **For Conservative Investors (Whole Life):** New York Life, MassMutual, and Northwestern Mutual are generally considered strong, reputable companies offering whole life insurance. They often have strong financial ratings and a history of paying dividends. Look for policies with guaranteed cash value growth and competitive dividend rates. * **For Those Seeking Flexibility (Universal Life):** Companies like Transamerica and Prudential offer universal life policies with various riders and options, allowing you to customize the policy to your specific needs. Pay close attention to the policy's charges and fees, as these can impact the cash value growth. * **For Growth Potential (Variable Life):** Consider companies like Lincoln Financial and Nationwide for variable life policies. Carefully review the investment options available and choose those that align with your risk tolerance and investment goals. Remember that variable life insurance carries investment risk, and the cash value can fluctuate. * **For Market-Linked Growth (Indexed Universal Life):** Allianz Life and Pacific Life are well-known providers of IUL policies. Focus on policies with reasonable participation rates, caps, and spreads. Understand the index crediting method and how it impacts the cash value growth.**Disclaimer:** This is not a comprehensive list, and it's essential to conduct thorough research and consult with a qualified financial advisor before making any decisions.

ILIT Use Cases Real-World Scenarios and Applications

Let's explore some real-world scenarios where an ILIT can be a valuable estate planning tool:

* **High-Net-Worth Individuals:** Individuals with substantial assets (exceeding the estate tax exemption) can use an ILIT to significantly reduce their estate tax liability. * **Business Owners:** Business owners can use an ILIT to provide liquidity to their estate for paying estate taxes or funding a buy-sell agreement. The life insurance proceeds can be used to purchase the business from the estate, allowing the heirs to maintain control of the company. * **Families with Young Children:** An ILIT can provide financial security for young children in the event of the parents' death. The trustee can manage the life insurance proceeds and use them to pay for the children's education, healthcare, and other expenses. * **Individuals with Special Needs Dependents:** An ILIT can be used to provide for the long-term care of a special needs dependent without jeopardizing their eligibility for government benefits. The trust can be structured as a special needs trust, which allows the trustee to use the funds for supplemental needs without affecting the beneficiary's eligibility for Medicaid or Supplemental Security Income (SSI). * **Divorced Individuals:** An ILIT can be used to ensure that children from a previous marriage are provided for in the event of death. The life insurance proceeds can be used to fund a trust for the benefit of the children. * **Couples in Community Property States:** In community property states, assets acquired during the marriage are jointly owned by both spouses. An ILIT can be used to ensure that the life insurance proceeds are distributed according to the individual's wishes, rather than being subject to community property laws.ILIT vs Other Estate Planning Tools A Comparative Analysis

It's important to understand how an ILIT compares to other estate planning tools. Here's a brief overview:

* **Will:** A will is a legal document that outlines how your assets will be distributed after your death. However, assets passing through a will are subject to probate and estate taxes. * **Revocable Living Trust:** A revocable living trust allows you to manage your assets during your lifetime and transfer them to your beneficiaries after your death, avoiding probate. However, assets held in a revocable living trust are still subject to estate taxes. * **Irrevocable Trust (Other Than ILIT):** Irrevocable trusts can be used for various estate planning purposes, such as asset protection and Medicaid planning. Like ILITs, assets held in an irrevocable trust are generally not subject to estate taxes. However, the specific terms and benefits of an irrevocable trust will vary depending on its purpose. * **Qualified Personal Residence Trust (QPRT):** A QPRT allows you to transfer your home to your beneficiaries while retaining the right to live in it for a specified period. This can reduce estate taxes on the value of your home. * **Grantor Retained Annuity Trust (GRAT):** A GRAT allows you to transfer assets to your beneficiaries while receiving an annuity payment for a specified period. This can reduce estate taxes on the transferred assets.**When is an ILIT the Right Choice?**

An ILIT is particularly well-suited for individuals who:

* Have a significant life insurance policy. * Are concerned about estate taxes. * Want to provide for their beneficiaries in a controlled and managed manner. * Desire creditor protection for their life insurance proceeds.Setting Up an ILIT A Step-by-Step Guide

Here's a general overview of the steps involved in setting up an ILIT:

1. **Consult with an Estate Planning Attorney:** This is the most crucial step. An experienced attorney can help you determine if an ILIT is the right choice for your situation and guide you through the legal process. 2. **Choose a Trustee:** The trustee will be responsible for managing the ILIT and distributing the life insurance proceeds to your beneficiaries. You can choose a family member, friend, or professional trustee. 3. **Draft the Trust Document:** The trust document is the legal foundation of the ILIT. It outlines the terms of the trust, including the beneficiaries, the trustee's powers and responsibilities, and the distribution provisions. 4. **Obtain a Life Insurance Policy:** You can either transfer an existing life insurance policy to the ILIT or purchase a new policy directly. 5. **Fund the Trust:** Make annual gifts to the trust to cover the life insurance premiums. Remember to send Crummey letters to the beneficiaries to qualify the gifts for the annual gift tax exclusion. 6. **Maintain Accurate Records:** Keep detailed records of all contributions, Crummey letters, and beneficiary waivers. 7. **Review and Update the Trust:** Periodically review the ILIT document to ensure that it still meets your needs and reflects any changes in your circumstances.ILIT Costs and Fees Understanding the Financial Implications

Setting up and maintaining an ILIT involves several costs and fees:

* **Attorney Fees:** The cost of drafting the trust document can vary depending on the attorney's experience and the complexity of the trust. Expect to pay several thousand dollars for this service. * **Trustee Fees:** If you choose a professional trustee, they will charge an annual fee for their services. The fee is typically based on a percentage of the trust assets. * **Life Insurance Premiums:** The cost of the life insurance policy will depend on the type of policy, the amount of coverage, and your age and health. * **Administrative Costs:** There may be some administrative costs associated with maintaining the trust, such as accounting fees and filing fees.**Estimating the Total Cost:**

A very rough estimate for setting up an ILIT could range from $3,000 to $10,000+ in legal fees, depending on the complexity. Ongoing trustee fees, if using a professional trustee, can range from 0.5% to 2% of the trust assets annually. The life insurance premiums will be a separate and ongoing expense.

**Is an ILIT Worth the Cost?**

While the costs associated with an ILIT can be significant, the potential estate tax savings can often outweigh these costs, especially for high-net-worth individuals. It's essential to weigh the costs and benefits carefully before making a decision.

Common ILIT Mistakes to Avoid Ensuring Proper Implementation

Several common mistakes can undermine the effectiveness of an ILIT. Here are some to avoid:

* **Failing to Properly Draft the Trust Document:** A poorly drafted trust document can lead to legal challenges and unintended consequences. Work with an experienced estate planning attorney to ensure that the trust document is clear, comprehensive, and tailored to your specific needs. * **Failing to Properly Fund the Trust:** If you don't make regular contributions to the trust to cover the life insurance premiums, the policy could lapse, defeating the purpose of the ILIT. * **Failing to Send Crummey Letters:** Failing to send Crummey letters to the beneficiaries can jeopardize the annual gift tax exclusion, potentially leading to gift tax liability. * **Retaining Incidents of Ownership:** If you retain any incidents of ownership in the life insurance policy, such as the right to change the beneficiary or borrow against the policy, the death benefit will be included in your taxable estate. * **Acting as Your Own Trustee:** While you can name yourself as the initial trustee, it's generally advisable to appoint a successor trustee who is independent and unbiased. This can help avoid potential conflicts of interest. * **Failing to Review and Update the Trust:** Your circumstances may change over time, so it's important to review and update the ILIT document periodically to ensure that it still meets your needs.Advanced ILIT Strategies Optimizing for Maximum Benefit

For those seeking to maximize the benefits of their ILIT, here are some advanced strategies:

* **Spousal Lifetime Access Trust (SLAT):** A SLAT is an irrevocable trust that benefits your spouse during their lifetime. You can transfer assets to the SLAT, and your spouse can receive distributions from the trust. This can remove assets from your taxable estate while providing financial security for your spouse. After your spouse's death, the assets can pass to your children or other beneficiaries. * **Dynasty Trust:** A dynasty trust is a type of irrevocable trust that can last for multiple generations. This allows you to pass wealth down to your descendants without incurring estate taxes at each generation. Dynasty trusts are often used by wealthy families to preserve their wealth for future generations. * **Life Insurance Loan Strategy:** This strategy involves borrowing against the cash value of the life insurance policy to pay for expenses or make investments. The loan proceeds are not subject to income tax, and the interest on the loan may be tax-deductible. However, it's important to carefully consider the risks and benefits of this strategy before implementing it. * **Using an ILIT in Conjunction with a Family Limited Partnership (FLP):** An FLP can be used to transfer ownership of a business or other assets to family members while retaining control. The FLP interests can then be transferred to an ILIT, further reducing estate taxes.ILIT and Divorce Protecting Assets in Case of Marital Dissolution

Divorce can significantly impact estate planning, and it's important to consider how an ILIT might be affected. In general, assets held within an ILIT are considered separate property and are not subject to division in a divorce. However, there are some exceptions:

* **Commingling of Assets:** If you commingle marital assets with the ILIT assets, the ILIT may be considered marital property and subject to division. * **Fraudulent Transfer:** If you transfer assets to the ILIT shortly before a divorce with the intent to defraud your spouse, the transfer may be deemed fraudulent and reversed by the court. * **Beneficiary Designation:** If your spouse is named as a beneficiary of the ILIT, they may be entitled to receive benefits even after the divorce. It's important to update the beneficiary designation after a divorce.**Protecting Your ILIT in a Divorce:**

* **Keep Separate Records:** Maintain separate records of all contributions to the ILIT and ensure that marital assets are not commingled with the ILIT assets. * **Avoid Transfers Shortly Before Divorce:** Avoid transferring assets to the ILIT shortly before a divorce, as this may be viewed as a fraudulent transfer. * **Update Beneficiary Designations:** Update the beneficiary designations after a divorce to remove your former spouse as a beneficiary. * **Consult with a Divorce Attorney:** Consult with a divorce attorney to ensure that your ILIT is properly protected in the event of a divorce.ILIT and State Laws Navigating Jurisdictional Differences

State laws can significantly impact the effectiveness of an ILIT. Here are some key areas where state laws can vary:

* **Trust Laws:** State laws govern the creation, administration, and termination of trusts. It's important to ensure that the ILIT complies with the trust laws of the state where it is established. * **Creditor Protection Laws:** State laws determine the extent to which assets held within a trust are protected from creditors' claims. Some states offer stronger creditor protection than others. * **Community Property Laws:** In community property states, assets acquired during the marriage are jointly owned by both spouses. This can affect the ownership and distribution of assets held within an ILIT. * **Rule Against Perpetuities:** The rule against perpetuities limits the duration of trusts. Some states have abolished the rule against perpetuities, allowing dynasty trusts to last indefinitely.**Choosing the Right Jurisdiction:**

In some cases, it may be beneficial to establish the ILIT in a state with more favorable trust laws. This is known as "trust situs planning." However, it's important to carefully consider the potential tax and legal implications before changing the situs of a trust.

Staying Compliant with ILIT Regulations Avoiding Tax Pitfalls

Maintaining compliance with ILIT regulations is crucial to avoid tax penalties and ensure that the ILIT achieves its intended purpose. Here are some key compliance considerations:

* **Gift Tax Reporting:** You must file a gift tax return (Form 709) for any gifts made to the ILIT that exceed the annual gift tax exclusion amount. * **Crummey Notice Requirements:** Ensure that Crummey letters are properly drafted and sent to the beneficiaries in a timely manner. * **Trust Income Tax Reporting:** The ILIT may be required to file an income tax return (Form 1041) if it generates income. * **Annual Valuation:** The life insurance policy held within the ILIT must be valued annually. * **Record Keeping:** Maintain accurate records of all contributions, Crummey letters, beneficiary waivers, and other relevant documents.Future of ILITs Trends and Developments in Estate Planning

The estate planning landscape is constantly evolving, and it's important to stay informed about the latest trends and developments. Some key trends affecting ILITs include:

* **Changes in Estate Tax Laws:** Estate tax laws are subject to change, which can impact the effectiveness of ILITs. It's important to monitor these changes and adjust your estate plan accordingly. * **Increased Use of Technology:** Technology is playing an increasingly important role in estate planning, with tools and platforms that can help streamline the process and improve efficiency. * **Growing Focus on Digital Assets:** Digital assets, such as cryptocurrency and social media accounts, are becoming an increasingly important part of estate planning. It's important to consider how these assets will be managed and distributed after your death. * **Greater Emphasis on Sustainable Investing:** Sustainable investing is gaining popularity, and many individuals are incorporating environmental, social, and governance (ESG) factors into their investment decisions. This trend is also influencing estate planning, with some individuals choosing to invest in socially responsible assets within their trusts.By staying informed about these trends and developments, you can ensure that your ILIT remains an effective estate planning tool for years to come.

Seeking Professional Advice When is it Necessary

While this article provides a comprehensive overview of ILITs, it's essential to seek professional advice from an experienced estate planning attorney and financial advisor before making any decisions. An attorney can help you draft the trust document and ensure that it complies with all applicable laws. A financial advisor can help you choose the right life insurance policy and develop a funding strategy that meets your needs.

Here are some situations where seeking professional advice is particularly important:

* **You have a high-net-worth estate.** * **You have complex family circumstances, such as a blended family or a special needs dependent.** * **You own a business.** * **You are concerned about estate taxes.** * **You want to ensure that your assets are protected from creditors.** * **You are considering using advanced ILIT strategies.** By working with qualified professionals, you can create an ILIT that is tailored to your specific needs and helps you achieve your estate planning goals.:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)