Can You Borrow Against Your Life Insurance Policy_

Life Insurance A Cornerstone of Financial Planning

Life insurance isn't just a policy it's a promise a commitment to protect your loved ones in the event of your passing. It's a cornerstone of sound financial planning providing a safety net that can help secure their future. But understanding life insurance goes beyond simply knowing it exists. It requires delving into the different types policies their benefits and how they fit into your overall financial strategy.

The Importance of Life Insurance for Different Life Stages

The need for life insurance evolves as you move through different life stages. In your 20s and 30s with potential student loan debt and perhaps a young family life insurance can provide crucial financial support to your spouse or dependents. As you progress in your career and accumulate assets life insurance can help cover estate taxes and ensure a smooth transfer of wealth to your heirs. Even in retirement life insurance can play a role in legacy planning and charitable giving.

Exploring the Different Types of Life Insurance Policies

Navigating the world of life insurance requires understanding the two main categories term life insurance and permanent life insurance. Each offers unique benefits and caters to different needs and financial goals.

Term Life Insurance A Simple and Affordable Solution

Term life insurance provides coverage for a specific period typically ranging from 10 to 30 years. It's often the most affordable option making it ideal for individuals and families on a budget. If you die within the term the policy pays out a death benefit to your beneficiaries. If the term expires and you still need coverage you can typically renew the policy although premiums will likely be higher based on your age and health at the time of renewal.

Key Features of Term Life Insurance:

- Affordable Premiums: Generally lower than permanent life insurance especially for younger individuals.

- Specific Term Length: Coverage lasts for a predetermined period offering flexibility to align with specific financial needs.

- Death Benefit Protection: Provides a lump-sum payment to beneficiaries upon the insured's death during the term.

- Renewable Option: Policies can often be renewed at the end of the term although premiums may increase.

Permanent Life Insurance Long Term Financial Security

Permanent life insurance as the name suggests provides lifelong coverage. It also includes a cash value component that grows over time on a tax-deferred basis. This cash value can be borrowed against or withdrawn providing a source of funds for various financial needs. There are several types of permanent life insurance including whole life universal life and variable life each with its own unique features and benefits.

Key Features of Permanent Life Insurance:

- Lifelong Coverage: Provides protection for your entire life as long as premiums are paid.

- Cash Value Accumulation: A portion of your premiums goes towards building cash value which grows tax-deferred.

- Borrowing Options: You can borrow against the cash value of your policy providing access to funds when needed.

- Policy Loans and Withdrawals: Offers flexibility to access the cash value for various financial purposes.

Understanding Whole Life Insurance Guaranteed Protection and Growth

Whole life insurance is a type of permanent life insurance that offers guaranteed death benefit guaranteed cash value growth and level premiums throughout your lifetime. It's a conservative option that provides stability and predictability.

Key Features of Whole Life Insurance:

- Guaranteed Death Benefit: The death benefit is guaranteed to be paid to your beneficiaries.

- Guaranteed Cash Value Growth: The cash value grows at a guaranteed rate providing a predictable return.

- Level Premiums: Premiums remain the same throughout the life of the policy.

- Policy Loans: You can borrow against the cash value of your policy at a guaranteed interest rate.

Exploring Universal Life Insurance Flexibility and Customization

Universal life insurance offers more flexibility than whole life insurance. It allows you to adjust your premiums and death benefit within certain limits. The cash value growth is tied to current interest rates which can fluctuate over time.

Key Features of Universal Life Insurance:

- Flexible Premiums: You can adjust your premium payments within certain limits.

- Adjustable Death Benefit: You can increase or decrease the death benefit subject to certain requirements.

- Interest Rate Based Growth: The cash value growth is tied to current interest rates.

- Policy Loans and Withdrawals: Offers flexibility to access the cash value for various financial purposes.

Delving into Variable Life Insurance Investment Potential and Risk

Variable life insurance offers the potential for higher returns by allowing you to invest the cash value in a variety of subaccounts similar to mutual funds. However it also comes with more risk as the cash value and death benefit can fluctuate based on market performance.

Key Features of Variable Life Insurance:

- Investment Options: You can invest the cash value in a variety of subaccounts.

- Potential for Higher Returns: The cash value can grow faster than other types of permanent life insurance.

- Market Risk: The cash value and death benefit can fluctuate based on market performance.

- Professional Management: Investment options are typically managed by professional fund managers.

Life Insurance Riders Enhancing Your Coverage

Life insurance riders are optional add-ons to your policy that can provide additional benefits and protection. Common riders include:

- Accelerated Death Benefit Rider: Allows you to access a portion of the death benefit if you are diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become disabled and unable to work.

- Accidental Death and Dismemberment Rider: Pays an additional death benefit if you die as a result of an accident.

- Child Term Rider: Provides coverage for your children.

Determining the Right Amount of Life Insurance Coverage

Calculating the right amount of life insurance coverage is crucial to ensure your loved ones are adequately protected. Consider factors such as:

- Income Replacement: How much income would your family need to replace if you were to pass away?

- Outstanding Debts: What debts would need to be paid off such as mortgages student loans and credit card debt?

- Future Expenses: What future expenses would your family face such as college tuition and childcare costs?

- Funeral Expenses: How much would it cost to cover your funeral expenses?

A financial advisor can help you assess your individual needs and determine the appropriate amount of coverage.

Life Insurance Premiums Factors Affecting the Cost

Several factors influence the cost of life insurance premiums including:

- Age: Younger individuals typically pay lower premiums.

- Health: Individuals in good health typically pay lower premiums.

- Gender: Women typically pay lower premiums than men.

- Lifestyle: Smokers and individuals with risky hobbies may pay higher premiums.

- Policy Type: Term life insurance is generally less expensive than permanent life insurance.

- Coverage Amount: Higher coverage amounts result in higher premiums.

Comparing Life Insurance Quotes Finding the Best Value

It's essential to compare life insurance quotes from multiple insurers to find the best value. Consider factors such as:

- Premiums: Compare the premiums for different policies and coverage amounts.

- Policy Features: Evaluate the features and benefits of each policy.

- Financial Strength: Choose an insurer with a strong financial rating.

- Customer Service: Research the insurer's customer service reputation.

Online tools and independent insurance agents can help you compare quotes and find the right policy for your needs.

Life Insurance and Estate Planning Protecting Your Legacy

Life insurance can play a significant role in estate planning helping to ensure a smooth transfer of assets to your heirs. It can be used to:

- Pay Estate Taxes: Life insurance proceeds can be used to pay estate taxes reducing the burden on your heirs.

- Fund Trusts: Life insurance can be used to fund trusts providing for the long-term care of beneficiaries.

- Provide Liquidity: Life insurance can provide liquidity to pay off debts and expenses.

- Equalize Inheritance: Life insurance can be used to equalize inheritance among heirs.

Understanding Life Insurance Beneficiaries and Contingent Beneficiaries

When purchasing life insurance you'll need to designate beneficiaries who will receive the death benefit. You should also name contingent beneficiaries who will receive the death benefit if the primary beneficiaries are deceased or unable to receive the funds.

It's important to review your beneficiary designations regularly and update them as needed due to life changes such as marriage divorce or the birth of a child.

Life Insurance and Business Planning Protecting Your Business

Life insurance can also be a valuable tool for business planning. It can be used to:

- Fund Buy-Sell Agreements: Life insurance can be used to fund buy-sell agreements allowing the remaining business owners to purchase the shares of a deceased owner.

- Key Person Insurance: Key person insurance provides coverage for key employees whose loss would significantly impact the business.

- Business Loan Protection: Life insurance can be used to protect the business from the loss of a key individual who has personally guaranteed a business loan.

Life Insurance and Charitable Giving Leaving a Lasting Impact

Life insurance can be used to make a significant charitable gift. You can name a charity as the beneficiary of your policy or create a charitable remainder trust funded with life insurance proceeds.

This allows you to support your favorite causes while also potentially receiving tax benefits.

Life Insurance Policy Reviews Ensuring Adequate Coverage

It's important to review your life insurance policies periodically to ensure they still meet your needs. Life changes such as marriage divorce the birth of a child or a change in income can impact your insurance needs.

A financial advisor can help you review your policies and make any necessary adjustments.

Debunking Common Life Insurance Myths Understanding the Facts

There are many misconceptions about life insurance. Let's debunk some common myths:

- Myth: Life insurance is only for older people. Fact: Life insurance is important at all ages especially if you have dependents.

- Myth: Life insurance is too expensive. Fact: Term life insurance can be very affordable.

- Myth: I don't need life insurance because I have savings. Fact: Life insurance can provide a much larger death benefit than your savings.

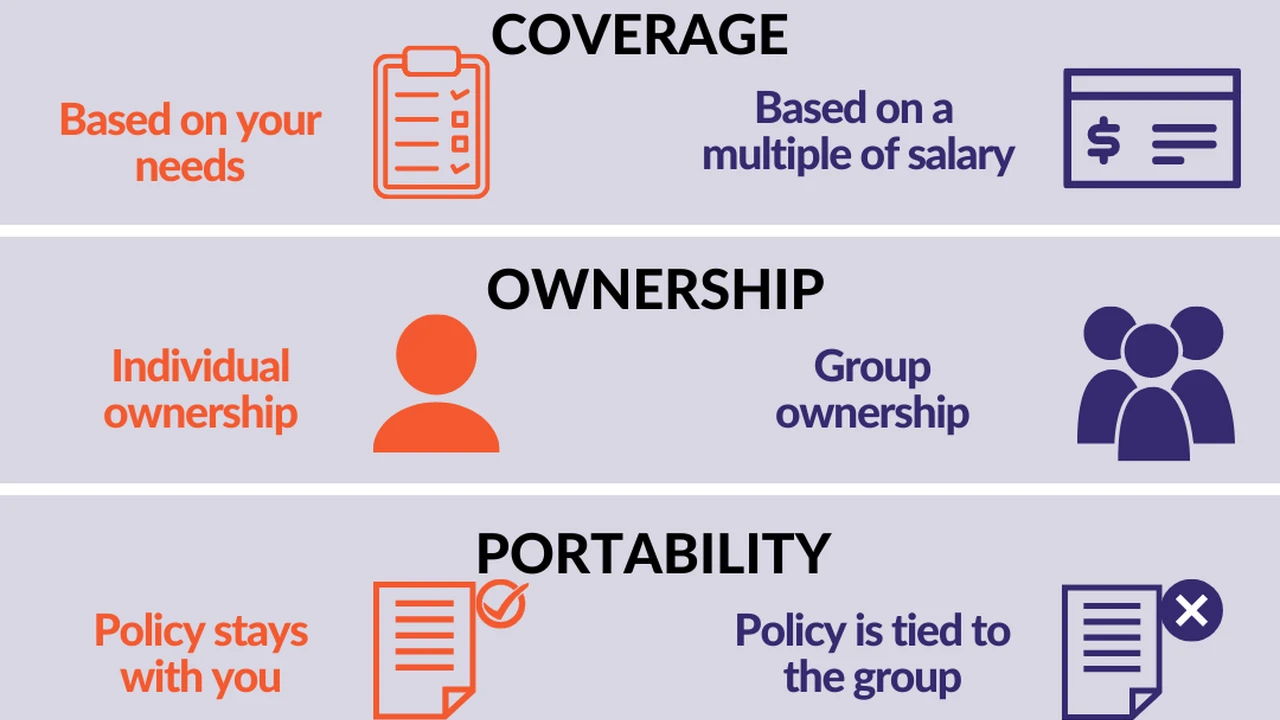

- Myth: My employer's life insurance is enough. Fact: Employer-provided life insurance may not be sufficient and it may not be portable if you leave your job.

Life Insurance Claims Understanding the Process

When a death occurs the beneficiaries will need to file a claim with the life insurance company to receive the death benefit. The claims process typically involves:

- Obtaining a Death Certificate: A certified copy of the death certificate is required.

- Submitting a Claim Form: The beneficiary will need to complete a claim form provided by the insurance company.

- Providing Policy Information: The beneficiary will need to provide the policy number and other relevant information.

- Proof of Identification: The beneficiary will need to provide proof of identification.

The insurance company will review the claim and typically pay the death benefit within a few weeks.

Life Insurance Taxation Understanding the Rules

Life insurance death benefits are generally income tax-free to the beneficiaries. However there may be estate tax implications depending on the size of the estate.

The cash value growth in permanent life insurance is tax-deferred. Policy loans are generally not taxable as long as the policy remains in force.

It's important to consult with a tax advisor to understand the specific tax implications of life insurance.

Life Insurance Regulations Protecting Consumers

Life insurance is regulated by state insurance departments. These departments oversee the insurance companies and ensure they are financially sound and operating fairly.

Consumers can contact their state insurance department to file complaints or obtain information about insurance companies.

Understanding Life Insurance Living Benefits and Chronic Illness

Some life insurance policies offer living benefits which allow you to access a portion of the death benefit if you are diagnosed with a qualifying chronic illness. This can help cover medical expenses and other costs associated with long-term care.

Living benefits riders can provide valuable financial support during times of need.

Life Insurance and Annuities Exploring Retirement Income Options

Life insurance and annuities are both financial products that can help with retirement planning. Life insurance provides protection for your loved ones while annuities provide a stream of income during retirement.

You can use life insurance to create a legacy for your family and annuities to ensure you have a steady income stream throughout your retirement years.

Choosing the Right Life Insurance Agent Finding a Trusted Advisor

Choosing the right life insurance agent is crucial to ensure you get the right coverage for your needs. Look for an agent who is:

- Knowledgeable: The agent should be knowledgeable about different types of life insurance policies and riders.

- Experienced: The agent should have experience in helping clients choose the right coverage.

- Independent: An independent agent can offer policies from multiple insurers.

- Trustworthy: The agent should be trustworthy and have your best interests at heart.

Ask for referrals and check online reviews to find a reputable agent.

Life Insurance for Seniors Addressing Unique Needs

Life insurance for seniors can address unique needs such as:

- Paying for Final Expenses: Life insurance can help cover funeral expenses and other final costs.

- Leaving a Legacy: Life insurance can be used to leave a legacy for your family.

- Funding Long-Term Care: Life insurance can be used to fund long-term care expenses.

- Estate Planning: Life insurance can be used to pay estate taxes and equalize inheritance.

Life Insurance for Young Adults Starting Early

Purchasing life insurance as a young adult offers several advantages:

- Lower Premiums: Premiums are typically lower for younger individuals.

- Long-Term Protection: You can lock in coverage for the long term.

- Financial Security: Life insurance can provide financial security for your loved ones.

- Cash Value Growth: Permanent life insurance offers the potential for cash value growth.

Life Insurance Policy Lapses Understanding the Consequences

If you stop paying premiums your life insurance policy may lapse. This means that the coverage will terminate and your beneficiaries will not receive a death benefit.

It's important to keep your policies in force by paying premiums on time. If you are struggling to afford your premiums consider reducing the coverage amount or switching to a more affordable policy.

Life Insurance and Mental Health Addressing Stigma and Needs

Mental health conditions can sometimes affect the availability and cost of life insurance. It's important to be honest and transparent with the insurance company about your mental health history.

Many insurers are becoming more understanding of mental health conditions and are willing to provide coverage to individuals who are managing their mental health effectively.

Life Insurance and Travel Insurance Complementary Protection

Life insurance and travel insurance provide complementary protection. Life insurance protects your loved ones in the event of your death while travel insurance protects you from financial losses due to travel-related emergencies.

Consider purchasing both life insurance and travel insurance to ensure you are adequately protected.

Life Insurance Scams Avoiding Fraudulent Schemes

Be aware of life insurance scams. Common scams include:

- Unsolicited Offers: Be wary of unsolicited offers for life insurance.

- High-Pressure Tactics: Avoid agents who use high-pressure tactics.

- Unlicensed Agents: Only work with licensed insurance agents.

- Requests for Personal Information: Be cautious about providing personal information to unknown individuals.

Verify the agent's credentials with your state insurance department and research the insurance company before purchasing a policy.

Life Insurance and Investing Building a Financial Portfolio

Life insurance can be part of a well-diversified investment portfolio. Permanent life insurance offers the potential for tax-deferred cash value growth which can supplement your other investments.

However it's important to remember that life insurance is primarily designed to provide protection not to generate high returns. Consult with a financial advisor to determine how life insurance fits into your overall investment strategy.

Recommended Life Insurance Products

While specific recommendations depend heavily on individual circumstances I can provide general guidance based on common needs. Always consult with a qualified financial advisor for personalized advice.

For Young Families: Term Life Insurance with Ladder

Product: Ladder Term Life Insurance

Use Case: Protecting young families with mortgages and childcare expenses. Ladder offers a flexible online application process and the ability to "ladder" your coverage adjusting it as your needs change.

Details: Ladder offers term lengths from 10 to 30 years. Coverage amounts range from $100,000 to $8 million. The application process is streamlined and requires no medical exam for many applicants. Premiums are competitive and vary based on age health and coverage amount.

For Estate Planning: Lincoln Financial MoneyGuard III

Product: Lincoln Financial MoneyGuard III (Linked Benefit Life Insurance)

Use Case: Estate planning and long-term care protection. MoneyGuard III combines life insurance with long-term care benefits providing access to funds for healthcare expenses if needed.

Details: This product offers a guaranteed death benefit and a long-term care benefit that can be used to pay for nursing home care assisted living or in-home care. The policy is funded with a single premium or a series of premiums. The long-term care benefit is typically a multiple of the death benefit. This is a complex product and requires careful consideration of your individual needs and financial situation. Pricing varies significantly based on age health and the chosen benefit levels.

For Business Owners: New York Life Whole Life

Product: New York Life Whole Life

Use Case: Business succession planning and key person insurance. New York Life is a mutual company meaning it is owned by its policyholders. This can translate to stronger financial stability and potential dividends.

Details: New York Life offers a traditional whole life policy with guaranteed death benefit guaranteed cash value growth and level premiums. The policy can be used to fund buy-sell agreements or provide coverage for key employees. New York Life is known for its strong financial ratings and its long history of paying dividends. Pricing is competitive with other whole life policies. Due to the complexity of business insurance needs consulting with a specialized advisor is highly recommended.

Product Comparison: Term vs Whole Life

| Feature | Term Life Insurance | Whole Life Insurance | |----------------|--------------------------|--------------------------| | Coverage Length | Specific Term (e.g. 20 years) | Lifelong | | Cash Value | No Cash Value | Cash Value Accumulation | | Premiums | Generally Lower | Generally Higher | | Flexibility | Less Flexible | More Flexible | | Best For | Temporary Needs Budget Conscious | Long-Term Needs Estate Planning |

Life Insurance a Gift That Keeps on Giving

Life insurance is more than just a financial product it's a gift a promise of security and peace of mind for your loved ones. By understanding the different types of policies their benefits and how they fit into your overall financial plan you can make informed decisions and ensure your family is protected for years to come.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)