Can You Get a Life Insurance Refund_

Explore various life insurance policy options, understand their costs, and discover strategies for saving money on life insurance premiums while ensuring adequate coverage.

Understanding the Basics of Life Insurance and Saving Money

Life insurance. It's a topic that many people avoid, often associating it with mortality and complex financial planning. However, understanding life insurance is crucial for protecting your loved ones and ensuring their financial security in the event of your passing. And, perhaps surprisingly, there are numerous strategies you can employ to save money on your premiums without sacrificing essential coverage.

Let's start with the basics. Life insurance is a contract between you and an insurance company. You pay premiums, and in exchange, the insurer promises to pay a designated beneficiary a sum of money (the death benefit) upon your death. This death benefit can be used to cover a variety of expenses, including:

- Funeral costs

- Outstanding debts (mortgages, loans, credit card debt)

- Living expenses for your family

- Future education costs for your children

- Estate taxes

The key to saving money on life insurance lies in understanding the different types of policies available, comparing quotes from multiple insurers, and making informed decisions about the coverage you need.

Term Life Insurance A Cost Effective Solution for Savings

Term life insurance is often the most affordable option, particularly for younger individuals and families. It provides coverage for a specific period of time (the term), such as 10, 20, or 30 years. If you die within the term, your beneficiary receives the death benefit. If you outlive the term, the coverage expires, and you may need to renew the policy or purchase a new one. Renewing often comes at a higher premium, reflecting your increased age and potential health risks.

Why is term life insurance generally cheaper? Because it's a simpler product. It only pays out if you die during the term. Unlike permanent life insurance, it doesn't accumulate cash value. This lack of cash value is what makes it more cost-effective.

Use Cases for Term Life Insurance:

- Young Families: Provides financial protection for young children in case of a parent's untimely death. The death benefit can help cover childcare, education, and living expenses.

- Mortgage Protection: Ensures that your mortgage will be paid off if you die, allowing your family to remain in their home.

- Income Replacement: Replaces the income of a primary earner, providing financial stability for the surviving family members.

- Temporary Needs: Covers specific financial obligations that will eventually disappear, such as college tuition or a business loan.

Strategies for Saving Money on Term Life Insurance Premiums

- Buy Early: Premiums are generally lower when you're younger and healthier.

- Shop Around: Compare quotes from multiple insurers to find the best rates.

- Consider a Shorter Term: If you only need coverage for a specific period, a shorter term can save you money.

- Improve Your Health: Maintaining a healthy lifestyle can lower your premiums.

- Avoid Riders: Riders are optional add-ons that can increase the cost of your policy.

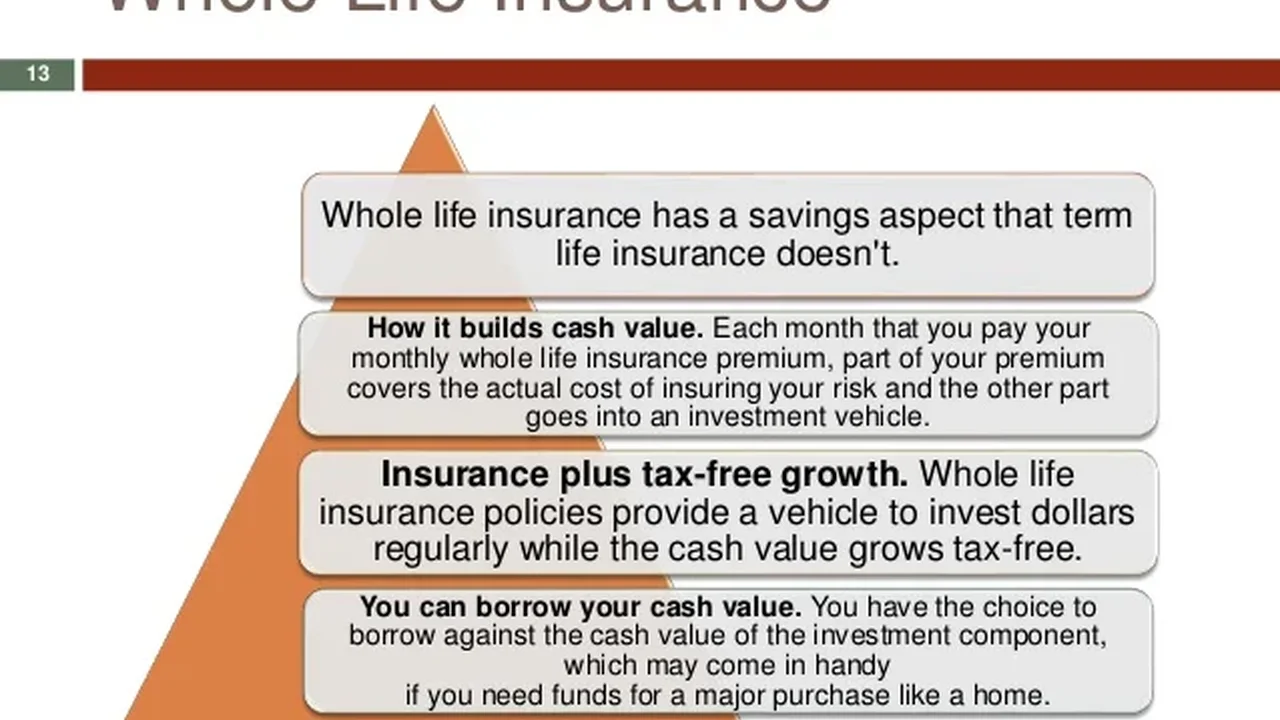

Permanent Life Insurance Exploring Whole Life and Universal Life for Long Term Savings

Permanent life insurance provides lifelong coverage and, unlike term life, accumulates cash value over time. This cash value grows on a tax-deferred basis and can be borrowed against or withdrawn during your lifetime. There are several types of permanent life insurance, including whole life and universal life.

Whole Life Insurance: Offers guaranteed death benefit, guaranteed cash value growth, and fixed premiums. It's the most traditional type of permanent life insurance and is often considered the most conservative.

Universal Life Insurance: Offers more flexibility than whole life insurance. You can adjust your premiums and death benefit within certain limits. The cash value growth is tied to market interest rates, which can fluctuate. There are also variations like Indexed Universal Life (IUL) and Variable Universal Life (VUL) where the cash value growth is linked to market indexes or investments, respectively, offering potentially higher returns but also carrying more risk.

Why is permanent life insurance more expensive? Because it provides lifelong coverage and accumulates cash value. The insurer takes on more risk and needs to manage the cash value account.

Use Cases for Permanent Life Insurance:

- Estate Planning: Provides funds to pay estate taxes and other expenses associated with settling an estate.

- Wealth Transfer: Allows you to pass wealth to your heirs in a tax-efficient manner.

- Long-Term Care Needs: Some policies offer riders that can help cover long-term care expenses.

- Supplemental Retirement Income: The cash value can be used to supplement your retirement income.

Strategies for Saving Money on Permanent Life Insurance Premiums

- Consider a Lower Death Benefit: A lower death benefit will result in lower premiums.

- Shop Around: Compare quotes from multiple insurers to find the best rates.

- Pay Premiums Annually: Paying premiums annually can often result in a discount.

- Explore Policy Loans Carefully: While you can borrow against the cash value, interest accrues and can reduce the overall benefit.

- Understand Policy Fees: Be aware of any fees associated with the policy, such as administrative fees or surrender charges.

Comparing Term Life and Permanent Life Insurance Saving Money Through Policy Selection

Choosing between term life and permanent life insurance depends on your individual needs and financial goals. Here's a comparison to help you decide:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Lifelong |

| Cash Value | No cash value | Accumulates cash value |

| Premiums | Generally lower | Generally higher |

| Flexibility | Less flexible | More flexible (especially universal life) |

| Suitability | Suitable for temporary needs and budget-conscious individuals | Suitable for long-term needs, estate planning, and wealth transfer |

Example Scenario: A young family with a mortgage and young children might choose term life insurance to provide financial protection during the years when their children are dependent on them and while they are paying off their mortgage. Once the mortgage is paid off and the children are grown, the need for life insurance may diminish.

Example Scenario: A high-net-worth individual might choose permanent life insurance for estate planning purposes, to provide funds to pay estate taxes and pass wealth to their heirs.

Lifestyle Choices and Their Impact on Life Insurance Premiums Saving Money by Living Healthier

Your lifestyle choices can significantly impact your life insurance premiums. Insurers assess your risk based on factors such as your age, health, occupation, and lifestyle. Adopting a healthier lifestyle can lead to lower premiums.

Factors That Can Increase Your Life Insurance Premiums

- Smoking: Smokers typically pay significantly higher premiums than non-smokers.

- Obesity: Being overweight or obese can increase your risk of health problems, leading to higher premiums.

- High Blood Pressure: Uncontrolled high blood pressure can increase your risk of heart disease and stroke.

- High Cholesterol: High cholesterol can increase your risk of heart disease.

- Diabetes: Diabetes can increase your risk of various health complications.

- Dangerous Occupations: Working in a dangerous occupation, such as construction or logging, can increase your premiums.

- Risky Hobbies: Participating in risky hobbies, such as skydiving or mountain climbing, can increase your premiums.

Strategies for Lowering Your Life Insurance Premiums Through Lifestyle Changes

- Quit Smoking: Quitting smoking is one of the most effective ways to lower your premiums.

- Lose Weight: Losing weight can improve your health and lower your premiums.

- Control Your Blood Pressure: Controlling your blood pressure can reduce your risk of heart disease and stroke.

- Lower Your Cholesterol: Lowering your cholesterol can reduce your risk of heart disease.

- Manage Your Diabetes: Managing your diabetes can reduce your risk of complications.

- Choose a Safer Occupation: If possible, consider switching to a safer occupation.

- Avoid Risky Hobbies: Consider avoiding or reducing your participation in risky hobbies.

Riders and Add-ons Weighing the Costs and Benefits for Potential Savings

Life insurance policies often come with optional riders and add-ons that can provide additional coverage or benefits. While these riders can be valuable, they also increase the cost of your policy. It's important to carefully weigh the costs and benefits of each rider to determine if it's worth the extra expense. Sometimes, skipping the rider is the best way to save money.

Common Life Insurance Riders

- Accidental Death Benefit Rider: Pays an additional death benefit if you die as a result of an accident.

- Accelerated Death Benefit Rider: Allows you to access a portion of the death benefit if you are diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premiums if you become disabled and unable to work.

- Child Term Rider: Provides term life insurance coverage for your children.

- Long-Term Care Rider: Helps cover long-term care expenses.

Evaluating the Value of Riders

Before adding a rider to your policy, consider the following:

- Cost: How much will the rider increase your premiums?

- Coverage: What specific benefits does the rider provide?

- Probability: How likely are you to need the coverage provided by the rider?

- Alternatives: Are there other ways to obtain the same coverage, such as through a separate insurance policy or government program?

Example: If you have a family history of cancer, you might consider an accelerated death benefit rider. However, if you already have adequate health insurance coverage, the rider may not be necessary.

Shopping Around and Comparing Life Insurance Quotes Saving Money Through Research

One of the most effective ways to save money on life insurance is to shop around and compare quotes from multiple insurers. Different insurers have different underwriting criteria and pricing models, so you can often find significant variations in premiums for the same coverage.

Tips for Comparing Life Insurance Quotes

- Get Quotes from Multiple Insurers: Obtain quotes from at least three to five different insurers.

- Compare the Same Coverage: Ensure that you're comparing quotes for the same death benefit amount and policy type.

- Consider the Insurer's Financial Strength: Choose an insurer with a strong financial rating from a reputable rating agency, such as A.M. Best or Standard & Poor's.

- Read the Fine Print: Carefully review the policy terms and conditions to understand the coverage, exclusions, and any fees.

- Work with an Independent Agent: An independent agent can help you compare quotes from multiple insurers and find the best policy for your needs.

Online Resources for Comparing Life Insurance Quotes

Several online resources can help you compare life insurance quotes, including:

- Policygenius: A popular online insurance marketplace that allows you to compare quotes from multiple insurers.

- SelectQuote: Another online insurance marketplace that offers a wide range of life insurance products.

- Quotacy: An online insurance agency that focuses on term life insurance.

Group Life Insurance Through Employers Potential Savings and Limitations

Many employers offer group life insurance as a benefit to their employees. Group life insurance is typically term life insurance and is often offered at a lower cost than individual life insurance. However, group life insurance also has some limitations.

Advantages of Group Life Insurance

- Lower Cost: Group rates are typically lower than individual rates.

- Simplified Underwriting: Group life insurance often has simplified underwriting, meaning you may not need to undergo a medical exam.

- Convenience: You can enroll in group life insurance through your employer, making it easy to obtain coverage.

Limitations of Group Life Insurance

- Limited Coverage: The death benefit amount may be limited.

- Portability: You may lose coverage if you leave your job.

- Lack of Control: You have less control over the policy terms and conditions.

Should you rely solely on group life insurance? Generally, no. Group life insurance can be a good supplement to individual life insurance, but it should not be your only source of coverage. The coverage amount may not be sufficient to meet your needs, and you may lose coverage if you leave your job.

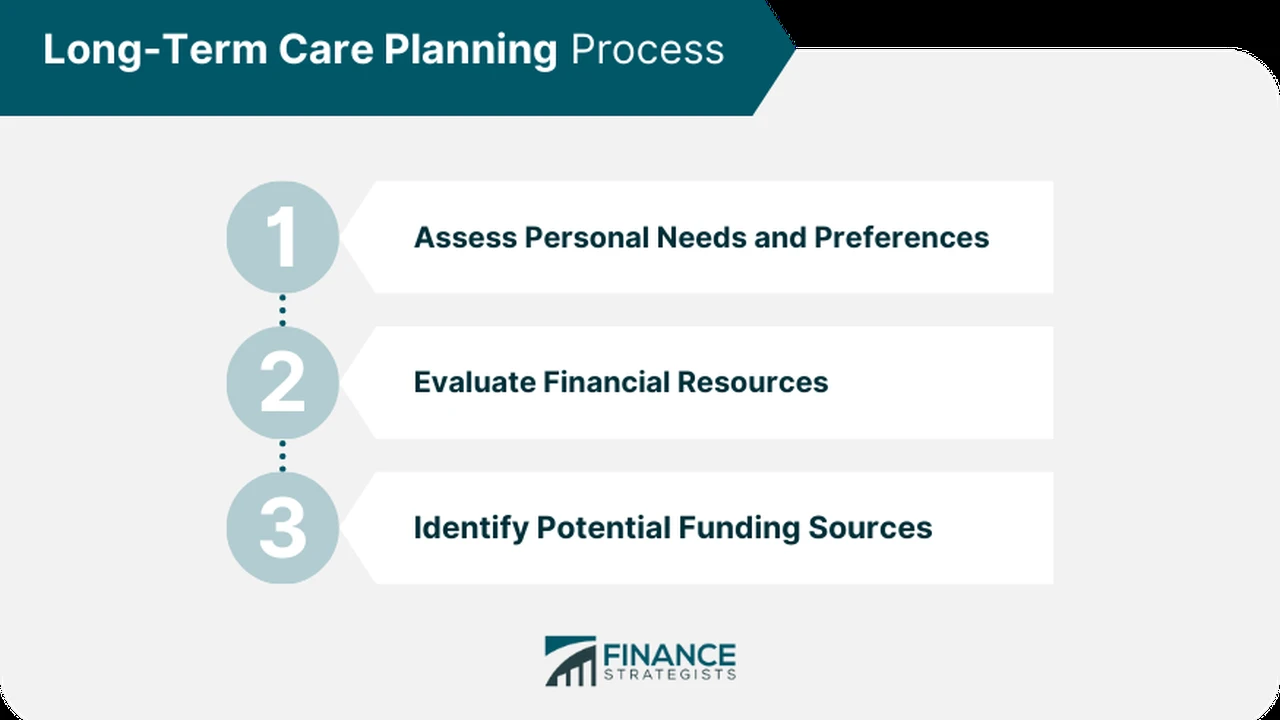

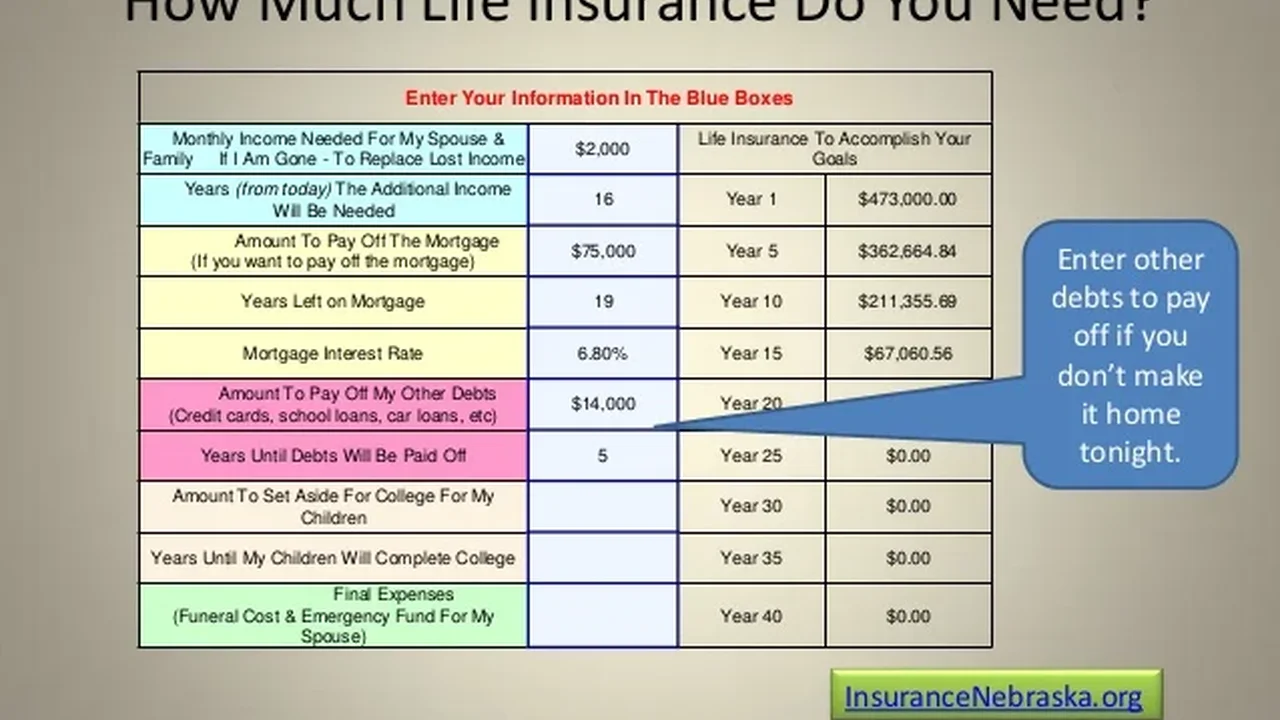

Life Insurance Needs Analysis Determining the Right Coverage Amount for Savings

Determining the right amount of life insurance coverage is crucial for ensuring that your loved ones are adequately protected. A life insurance needs analysis can help you assess your financial obligations and determine how much coverage you need. Overinsuring means paying too much in premiums, so accurately assessing your needs is key to saving money.

Factors to Consider in a Life Insurance Needs Analysis

- Outstanding Debts: Include your mortgage, loans, credit card debt, and other outstanding debts.

- Living Expenses: Estimate the living expenses for your family, including housing, food, transportation, and healthcare.

- Future Education Costs: Consider the cost of college or other educational expenses for your children.

- Funeral Costs: Estimate the cost of your funeral and burial expenses.

- Income Replacement: Determine how much income your family would need to replace if you were to die.

- Estate Taxes: Consider the potential estate taxes that your estate may be subject to.

Methods for Calculating Your Life Insurance Needs

- The DIME Method: This method considers your debts, income, mortgage, and education expenses.

- The Income Replacement Method: This method calculates how much income your family would need to replace if you were to die.

- Online Calculators: Several online calculators can help you estimate your life insurance needs.

Reviewing Your Life Insurance Policy Regularly Adjusting Coverage for Savings

Your life insurance needs can change over time, so it's important to review your policy regularly and adjust your coverage as needed. Life events such as marriage, the birth of a child, a new job, or a change in your financial situation can all impact your life insurance needs. Adjusting your coverage appropriately can lead to savings.

When to Review Your Life Insurance Policy

- Marriage: You may need to increase your coverage to protect your spouse.

- Birth of a Child: You will likely need to increase your coverage to protect your children.

- New Job: You may need to adjust your coverage based on your new income and benefits.

- Change in Financial Situation: You may need to adjust your coverage based on changes in your debts, assets, or income.

- Every Few Years: Even if there are no major life events, it's a good idea to review your policy every few years to ensure that it still meets your needs.

Strategies for Adjusting Your Life Insurance Coverage

- Increase Coverage: If your needs have increased, you may need to purchase additional coverage.

- Decrease Coverage: If your needs have decreased, you may be able to reduce your coverage and save money on premiums.

- Change Policy Type: You may want to consider switching from term life to permanent life or vice versa, depending on your changing needs.

- Shop Around: Even if you're happy with your current insurer, it's always a good idea to shop around and compare quotes to ensure that you're getting the best rates.

Life Insurance Policy Options Specific Product Recommendations and Detailed Information

Navigating the world of life insurance can be daunting. Here are some specific product recommendations, along with detailed information, to help you make informed decisions. Please note that these are examples and not financial advice; consult with a qualified professional for personalized recommendations.

Term Life Insurance Recommendations

- Haven Life: Haven Life offers simple, affordable term life insurance policies online. They are backed by MassMutual and offer a streamlined application process. Their rates are generally competitive, and they offer a variety of term lengths.

- Key Features: 100% online application, no medical exam required for some applicants, competitive rates, backed by MassMutual.

- Use Case: Ideal for young families or individuals looking for affordable term life insurance with a simple application process.

- Pricing: Varies based on age, health, and coverage amount. Sample rates can be found on their website.

- SelectQuote: SelectQuote is an online insurance marketplace that allows you to compare quotes from multiple insurers. They work with a wide range of insurance companies, so you can find the best rates for your specific needs.

- Key Features: Compares quotes from multiple insurers, wide range of policy options, access to licensed agents.

- Use Case: Ideal for individuals who want to compare quotes from multiple insurers and find the best rates.

- Pricing: Quotes vary based on insurer, age, health, and coverage amount.

- Ladder Life: Ladder Life offers flexible term life insurance that you can adjust as your needs change. You can increase or decrease your coverage amount online, without having to undergo a new medical exam.

- Key Features: Flexible coverage, adjustable online, no medical exam required for some applicants, competitive rates.

- Use Case: Ideal for individuals who anticipate changes in their life insurance needs over time.

- Pricing: Varies based on age, health, and coverage amount. Sample rates can be found on their website.

Permanent Life Insurance Recommendations

- New York Life: New York Life is a mutual insurance company that offers a variety of permanent life insurance policies, including whole life and universal life. They are known for their financial strength and stability.

- Key Features: Strong financial strength, variety of policy options, access to experienced agents.

- Use Case: Ideal for individuals looking for permanent life insurance from a financially stable company.

- Pricing: Varies based on policy type, age, health, and coverage amount. Consult with a New York Life agent for a quote.

- Northwestern Mutual: Northwestern Mutual is another mutual insurance company that offers a variety of permanent life insurance policies. They are also known for their financial strength and stability.

- Key Features: Strong financial strength, variety of policy options, access to experienced agents.

- Use Case: Ideal for individuals looking for permanent life insurance from a financially stable company.

- Pricing: Varies based on policy type, age, health, and coverage amount. Consult with a Northwestern Mutual agent for a quote.

- Pacific Life: Pacific Life offers a range of universal life insurance policies, including indexed universal life (IUL) policies. IUL policies offer the potential for higher returns, but also carry more risk.

- Key Features: Variety of universal life policies, including IUL policies, potential for higher returns, access to experienced agents.

- Use Case: Ideal for individuals looking for permanent life insurance with the potential for higher returns.

- Pricing: Varies based on policy type, age, health, and coverage amount. Consult with a Pacific Life agent for a quote.

Life Insurance and Estate Planning Integrating Life Insurance for Wealth Preservation

Life insurance plays a crucial role in estate planning, providing funds to pay estate taxes, settle debts, and ensure a smooth transfer of assets to your heirs. Properly integrating life insurance into your estate plan can help preserve wealth and minimize taxes.

How Life Insurance Can Benefit Your Estate Plan

- Paying Estate Taxes: Life insurance can provide funds to pay estate taxes, preventing your heirs from having to sell assets to cover these expenses.

- Settling Debts: Life insurance can be used to pay off outstanding debts, such as mortgages and loans.

- Providing Liquidity: Life insurance provides immediate liquidity to your estate, allowing your executor to manage expenses and distribute assets more efficiently.

- Funding a Trust: Life insurance can be used to fund a trust, providing ongoing financial support for your beneficiaries.

Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance Trust (ILIT) is a type of trust that is specifically designed to hold life insurance policies. By transferring your life insurance policy to an ILIT, you can remove the death benefit from your taxable estate, potentially saving your heirs significant estate taxes.

Consult with an Estate Planning Attorney

Estate planning is a complex process, so it's important to consult with an experienced estate planning attorney to develop a plan that meets your specific needs and goals. An attorney can help you determine the appropriate amount of life insurance coverage, structure your life insurance policy to minimize taxes, and create an ILIT if necessary.

Common Misconceptions About Life Insurance Debunking Myths for Informed Savings

There are many misconceptions about life insurance that can prevent people from making informed decisions about their coverage. Debunking these myths is crucial for ensuring that you get the right coverage at the best price.

Myth 1: Life Insurance is Too Expensive

Reality: Term life insurance can be surprisingly affordable, especially if you buy it when you're young and healthy. Even permanent life insurance can be affordable if you choose a lower death benefit amount or a policy with flexible premiums.

Myth 2: I Don't Need Life Insurance Because I'm Young and Healthy

Reality: Accidents and unexpected illnesses can happen at any age. Life insurance provides financial protection for your loved ones in the event of your untimely death, regardless of your age or health.

Myth 3: I Only Need Life Insurance if I Have Children

Reality: Life insurance can be beneficial even if you don't have children. It can be used to pay off debts, cover funeral expenses, and provide financial support for your spouse or other loved ones.

Myth 4: My Employer-Provided Life Insurance is Enough

Reality: Employer-provided life insurance is often limited in coverage and may not be portable if you leave your job. It's generally a good idea to supplement your employer-provided coverage with an individual life insurance policy.

Myth 5: Life Insurance is Only for the Rich

Reality: Life insurance is for anyone who wants to protect their loved ones financially. It's an essential part of responsible financial planning, regardless of your income or net worth.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)