Annual Renewable Term Life Insurance_ Pros and Cons

This comprehensive guide explores various strategies for saving money on life insurance helping you understand your options optimize your coverage and secure your financial future without breaking the bank.

Understanding the Basics of Life Insurance and Cost Factors

Before diving into specific strategies it's crucial to understand the fundamentals of life insurance and the factors that influence its cost. Life insurance provides a financial safety net for your loved ones in the event of your death. It can help cover expenses such as funeral costs mortgage payments education and everyday living expenses.

Several factors determine the premium you pay for life insurance including:

- Age: Younger individuals typically pay lower premiums as they are statistically less likely to die during the policy term.

- Health: Your health status plays a significant role. Pre-existing conditions smoking and overall health can increase your premiums.

- Lifestyle: Risky hobbies or occupations can also lead to higher premiums.

- Coverage Amount: The more coverage you need the higher your premiums will be.

- Policy Type: Different types of life insurance policies have varying costs. Term life insurance is generally more affordable than permanent life insurance.

- Policy Term: For term life insurance longer terms usually result in higher premiums.

Term Life Insurance vs Permanent Life Insurance Understanding the Cost Differences

One of the most important decisions you'll make is choosing between term life insurance and permanent life insurance. Understanding the differences in cost and features is essential for making an informed decision.

Term Life Insurance Cost Savings and Benefits

Term life insurance provides coverage for a specific period typically 10 20 or 30 years. If you die within the term your beneficiaries receive a death benefit. If the term expires and you're still alive the coverage ends. Term life insurance is generally more affordable than permanent life insurance because it only provides coverage for a limited time.

Benefits of Term Life Insurance:

- Affordability: Lower premiums compared to permanent life insurance.

- Simplicity: Easier to understand and manage.

- Flexibility: You can choose a term length that aligns with your financial needs such as covering a mortgage or raising children.

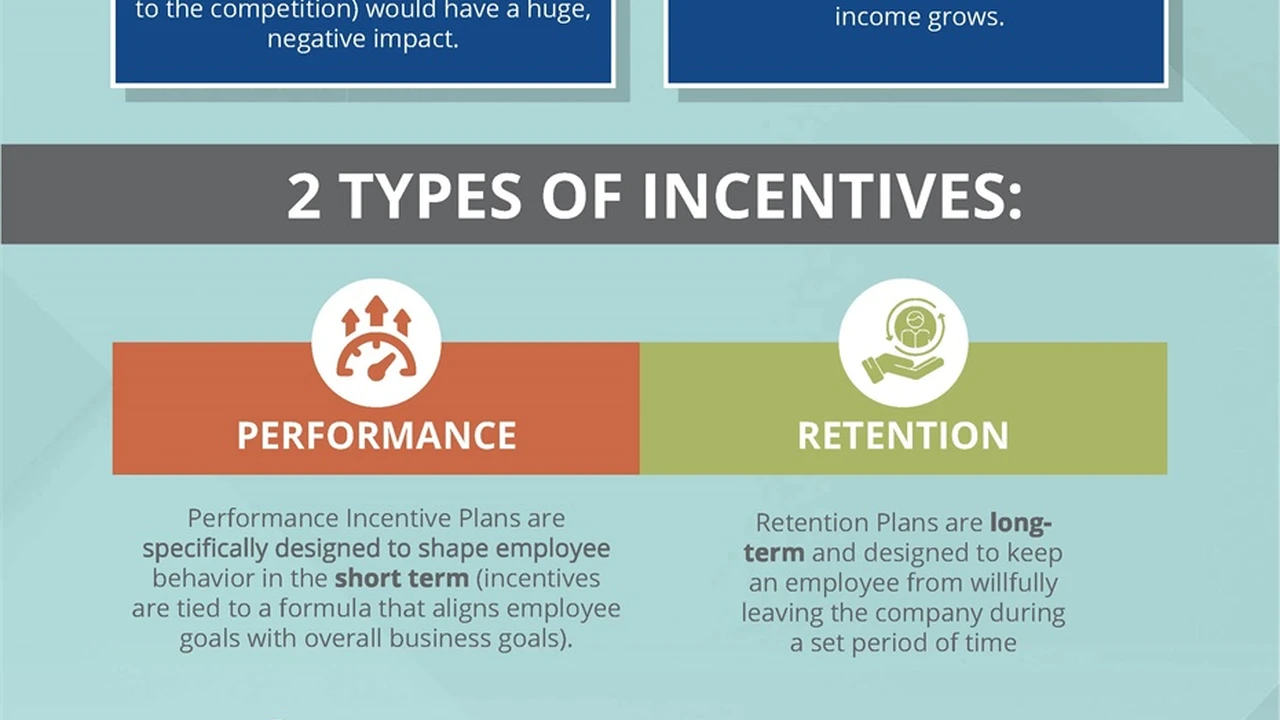

Permanent Life Insurance Cost Considerations and Advantages

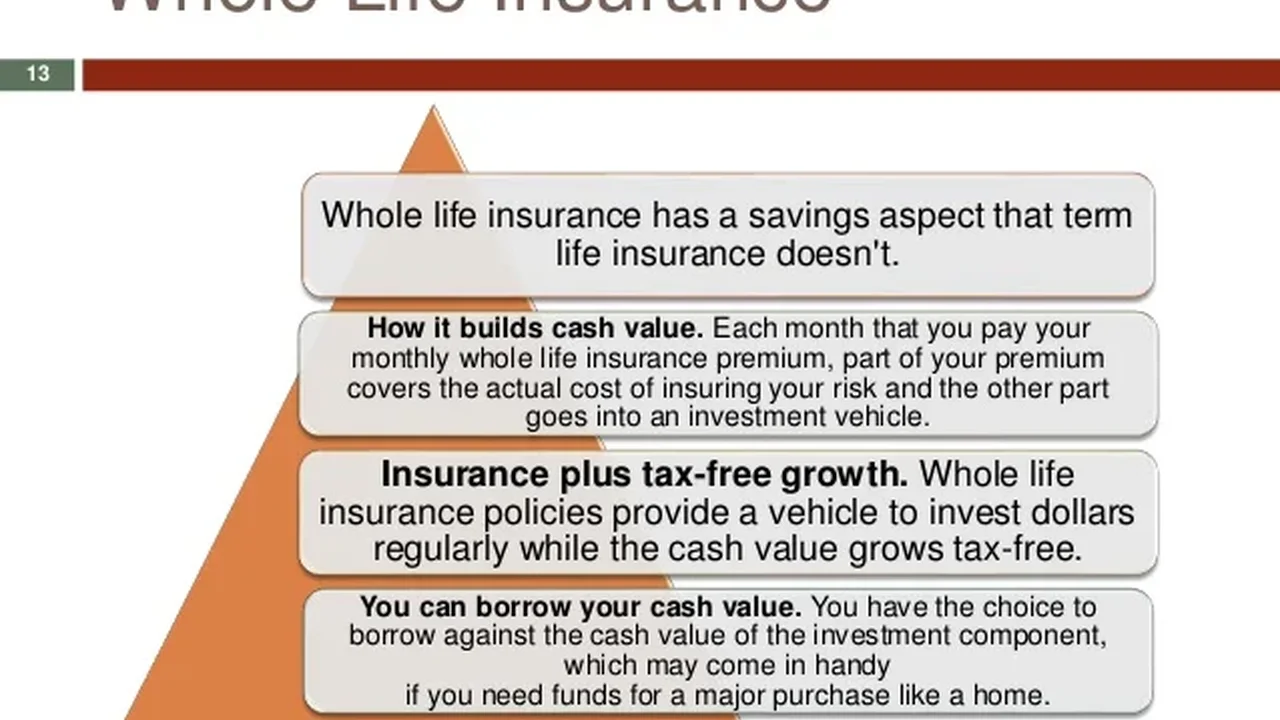

Permanent life insurance provides coverage for your entire life as long as you pay the premiums. It also includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn making it a potentially valuable asset.

Types of Permanent Life Insurance:

- Whole Life Insurance: Offers a guaranteed death benefit and a fixed rate of return on the cash value.

- Universal Life Insurance: Provides more flexibility in premium payments and death benefit amounts. The cash value grows based on current interest rates.

- Variable Life Insurance: Allows you to invest the cash value in various investment options such as stocks and bonds. The cash value fluctuates based on market performance.

Advantages of Permanent Life Insurance:

- Lifelong Coverage: Provides coverage for your entire life.

- Cash Value Accumulation: The cash value grows tax-deferred and can be used for various financial needs.

- Estate Planning: Can be used for estate planning purposes such as paying estate taxes or providing for heirs.

Cost Comparison: Permanent life insurance is significantly more expensive than term life insurance due to the lifelong coverage and cash value component. Consider your financial goals and needs when choosing between the two.

Strategies for Lowering Life Insurance Premiums Smart Financial Planning

Now let's explore specific strategies you can use to lower your life insurance premiums.

Comparing Quotes from Multiple Insurance Companies Finding the Best Rates

One of the most effective ways to save money on life insurance is to compare quotes from multiple insurance companies. Rates can vary significantly between companies so it's essential to shop around and find the best deal. Use online quote comparison tools or work with an independent insurance agent to get quotes from several insurers.

Example: Let's say you're a healthy 35-year-old male looking for a 20-year term life insurance policy with a death benefit of $500000. Company A might offer a premium of $300 per year while Company B offers a premium of $350 per year. By comparing quotes you can save $50 per year which adds up to $1000 over the 20-year term.

Improving Your Health and Lifestyle Healthy Habits Lower Premiums

Your health and lifestyle have a direct impact on your life insurance premiums. Maintaining a healthy lifestyle can significantly reduce your costs.

Tips for Improving Your Health:

- Quit Smoking: Smoking is a major risk factor that can significantly increase your premiums.

- Maintain a Healthy Weight: Being overweight or obese can increase your risk of health problems and lead to higher premiums.

- Exercise Regularly: Regular exercise can improve your overall health and lower your premiums.

- Eat a Balanced Diet: A healthy diet can reduce your risk of chronic diseases and improve your overall health.

- Manage Stress: High stress levels can negatively impact your health. Find healthy ways to manage stress such as meditation or yoga.

Example: If you're a smoker and you quit smoking you could see a significant reduction in your life insurance premiums. Some insurance companies may require you to be smoke-free for a certain period typically 12 months before they offer non-smoker rates.

Choosing the Right Coverage Amount Assessing Your Financial Needs

It's important to choose the right coverage amount to meet your financial needs. Overestimating your coverage needs can lead to higher premiums while underestimating your coverage can leave your loved ones financially vulnerable.

Factors to Consider When Determining Coverage Amount:

- Outstanding Debts: Consider your mortgage student loans and other debts.

- Future Expenses: Factor in future expenses such as education costs and childcare expenses.

- Income Replacement: Calculate how much income your family would need to maintain their current lifestyle.

- Funeral Costs: Account for funeral expenses which can be significant.

Rule of Thumb: A common rule of thumb is to purchase life insurance coverage that is 7-10 times your annual income. However it's important to personalize this calculation based on your specific circumstances.

Opting for a Longer Term Life Insurance Policy Long-Term Savings

While it may seem counterintuitive opting for a longer term life insurance policy can sometimes result in lower overall costs. This is because you're locking in a lower premium rate for a longer period. If you anticipate needing coverage for an extended period a longer term policy can be a good option.

Example: A 20-year term policy might have a slightly higher annual premium than a 10-year term policy. However if you renew the 10-year policy after the initial term the premiums will likely be significantly higher due to your age. A 20-year policy locks in the lower rate for a longer period potentially saving you money in the long run.

Considering Group Life Insurance Through Your Employer Employee Benefits

Many employers offer group life insurance as part of their benefits package. Group life insurance is typically more affordable than individual life insurance because the risk is spread across a larger group of people. Consider enrolling in your employer's group life insurance plan if it's available.

Advantages of Group Life Insurance:

- Affordability: Lower premiums compared to individual life insurance.

- Convenience: Easy to enroll through your employer.

- No Medical Exam: Some group life insurance plans don't require a medical exam.

Limitations of Group Life Insurance:

- Coverage Amount: The coverage amount may be limited.

- Portability: You may lose coverage if you leave your job.

Riders and Options to Reduce Life Insurance Costs Customizing Your Policy

Life insurance policies often come with riders and options that can affect the cost. Understanding these riders and options can help you customize your policy and potentially reduce your premiums.

Common Riders and Options:

- Accelerated Death Benefit Rider: Allows you to access a portion of the death benefit if you're diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become disabled.

- Return of Premium Rider: Returns your premium payments if you outlive the policy term.

Choosing the Right Riders: Consider your individual needs and circumstances when choosing riders. Some riders may be beneficial while others may not be necessary. Adding unnecessary riders can increase your premiums.

Specific Product Recommendations and Use Cases Optimizing Your Life Insurance

Let's look at some specific product recommendations and use cases to help you optimize your life insurance strategy.

Best Term Life Insurance Companies for Young Families Financial Security

For young families looking for affordable and straightforward coverage term life insurance is often the best option. Here are some of the top term life insurance companies:

- Haven Life: Offers a simple online application process and competitive rates.

- Ladder Life: Provides flexible coverage options and the ability to decrease your coverage amount as your needs change.

- SelectQuote: An online broker that allows you to compare quotes from multiple insurance companies.

Use Case: A young couple with two children can purchase a 20-year term life insurance policy to cover their mortgage and provide financial support for their children in the event of their death.

Top Permanent Life Insurance Options for Estate Planning Protecting Your Assets

For individuals looking for lifelong coverage and estate planning benefits permanent life insurance may be a better choice. Here are some of the top permanent life insurance options:

- New York Life: Offers a variety of whole life insurance policies with guaranteed death benefits and cash value accumulation.

- Northwestern Mutual: Provides a range of permanent life insurance options and financial planning services.

- MassMutual: Offers competitive rates and a strong financial rating.

Use Case: A high-net-worth individual can use a permanent life insurance policy to pay estate taxes and provide for their heirs.

Affordable Life Insurance for Seniors Protecting Your Loved Ones

Seniors may need life insurance to cover final expenses or provide for their surviving spouse. Here are some affordable life insurance options for seniors:

- Colonial Penn: Offers guaranteed acceptance life insurance policies with no medical exam required.

- AARP Life Insurance Program from New York Life: Provides a range of life insurance options for AARP members.

- Gerber Life: Offers affordable life insurance policies for seniors with simplified underwriting.

Use Case: A senior can purchase a small whole life insurance policy to cover funeral expenses and other final costs.

Life Insurance Product Comparisons Detailed Analysis

Let's compare some popular life insurance products to help you make an informed decision.

Term Life Insurance Comparison Haven Life vs Ladder Life

Haven Life:

- Pros: Simple online application process competitive rates backed by MassMutual.

- Cons: Limited coverage options not available in all states.

- Pricing: Generally competitive rates for young healthy individuals.

Ladder Life:

- Pros: Flexible coverage options ability to decrease coverage amount as needs change.

- Cons: May not be the cheapest option for all individuals.

- Pricing: Varies depending on age health and coverage amount.

Recommendation: Haven Life is a good option for individuals looking for a simple and affordable term life insurance policy. Ladder Life is a better choice for individuals who need more flexibility in their coverage options.

Permanent Life Insurance Comparison New York Life vs Northwestern Mutual

New York Life:

- Pros: Guaranteed death benefit and cash value accumulation strong financial rating.

- Cons: Higher premiums compared to other options.

- Pricing: More expensive than other permanent life insurance options but offers guaranteed benefits.

Northwestern Mutual:

- Pros: Wide range of permanent life insurance options financial planning services.

- Cons: Can be more complex than other options.

- Pricing: Varies depending on the policy type and coverage amount.

Recommendation: New York Life is a good option for individuals who prioritize guaranteed benefits and cash value accumulation. Northwestern Mutual is a better choice for individuals who need more comprehensive financial planning services.

Detailed Information on Life Insurance Pricing Factors and Considerations

Understanding the factors that influence life insurance pricing is essential for finding the best rates. Here's a more detailed look at some of the key considerations.

Age and Life Insurance Premiums The Impact of Aging

As you age your life insurance premiums will increase. This is because the risk of death increases with age. The younger you are when you purchase life insurance the lower your premiums will be.

Example: A 25-year-old might pay $200 per year for a 20-year term life insurance policy while a 45-year-old might pay $400 per year for the same policy.

Health and Medical History Medical Underwriting

Your health and medical history play a significant role in determining your life insurance premiums. Insurance companies use medical underwriting to assess your risk of death. This involves reviewing your medical records asking about your health history and potentially requiring a medical exam.

Pre-existing Conditions: Pre-existing conditions such as diabetes heart disease and cancer can increase your premiums or even make it difficult to obtain coverage.

Lifestyle Choices and Risky Behaviors Impact on Life Insurance Rates

Your lifestyle choices can also affect your life insurance premiums. Risky behaviors such as smoking excessive alcohol consumption and dangerous hobbies can increase your premiums.

Smoking: Smokers typically pay significantly higher premiums than non-smokers.

Policy Type and Coverage Amount Balancing Cost and Protection

The type of life insurance policy you choose and the amount of coverage you need will also affect your premiums. Term life insurance is generally more affordable than permanent life insurance. The more coverage you need the higher your premiums will be.

Financial Stability and Credit Score Financial Health and Life Insurance

While not as direct as health or age some insurance companies may consider your credit score or financial stability when determining your premiums. A poor credit score could indicate higher risk and potentially lead to slightly higher rates.

Optimizing Your Life Insurance Strategy for Long-Term Savings and Financial Security

Saving money on life insurance is about more than just finding the lowest premium. It's about optimizing your life insurance strategy to meet your long-term financial goals.

Regularly Reviewing Your Life Insurance Needs Adapting to Changing Circumstances

Your life insurance needs will change over time as your circumstances evolve. It's important to regularly review your life insurance needs and adjust your coverage accordingly. Major life events such as marriage having children buying a home or changing jobs can impact your life insurance needs.

Working with an Independent Insurance Agent Expert Advice and Guidance

An independent insurance agent can provide valuable advice and guidance in choosing the right life insurance policy. Independent agents work with multiple insurance companies and can help you compare quotes and find the best deal. They can also help you understand the different policy options and riders available.

Considering a Life Insurance Trust Estate Planning and Asset Protection

A life insurance trust can be a valuable tool for estate planning and asset protection. A life insurance trust is a legal entity that owns your life insurance policy. This can help protect the death benefit from creditors and estate taxes.

Staying Informed About Life Insurance Industry Trends Market Updates

The life insurance industry is constantly evolving. Staying informed about industry trends and market updates can help you make informed decisions about your life insurance coverage. Read industry publications attend seminars and consult with financial professionals to stay up-to-date.

By understanding the basics of life insurance exploring different strategies and staying informed you can save money on life insurance and secure your financial future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

-A-Powerful-Tool.webp)