Group Life Insurance_ Benefits and Limitations

Understanding the Fundamentals of Group Life Insurance Policies

Group life insurance is a type of life insurance offered by employers or organizations to their members. It's often provided as a benefit, making it accessible to employees who might not otherwise seek individual life insurance. The coverage is typically term life insurance, meaning it's in effect for a specific period, usually as long as the individual is employed or a member of the organization.

What is Group Life Insurance A Comprehensive Overview

At its core, group life insurance is a contract between an insurance company and a group, such as a company or association. The insurance company provides coverage to the members of the group, and the employer or organization usually pays all or part of the premiums. This collective approach allows for lower premiums than individual policies because the risk is spread across a larger pool of people.

The Mechanics of Group Life Insurance Coverage How It Works

When an employee enrolls in group life insurance, they designate a beneficiary who will receive a death benefit if they pass away while covered. The amount of the death benefit is usually a multiple of the employee's salary, such as one or two times their annual earnings. Some policies may also offer supplemental coverage, allowing employees to purchase additional insurance for themselves or their dependents.

Exploring the Benefits of Group Life Insurance Coverage

Group life insurance offers several advantages, making it an attractive option for both employers and employees.

Affordability and Accessibility The Cost-Effective Advantage

One of the primary benefits is affordability. Group rates are typically lower than individual life insurance rates because the risk is spread across a larger group. This makes coverage accessible to employees who might not be able to afford individual policies.

Convenience and Ease of Enrollment Streamlined Application Processes

Enrollment is usually straightforward and convenient. Employees can often enroll during open enrollment periods without having to undergo a medical exam. This is particularly beneficial for individuals with pre-existing health conditions who might find it difficult to obtain individual coverage.

Guaranteed Issue Coverage Overcoming Health Challenges

Many group life insurance policies offer guaranteed issue coverage, meaning that employees are automatically approved for coverage regardless of their health status. This can be a significant advantage for individuals with health issues who might be denied coverage or charged higher premiums for individual policies.

Portability Options Ensuring Continuous Coverage

Some group life insurance policies offer portability, allowing employees to continue their coverage even if they leave their job. This can provide peace of mind for individuals who want to maintain life insurance protection without having to shop for a new policy.

Understanding the Limitations of Group Life Insurance Plans

While group life insurance offers many benefits, it also has some limitations that individuals should be aware of.

Limited Coverage Amounts Assessing Adequacy

The coverage amount offered by group life insurance is often limited to a multiple of the employee's salary. This may not be sufficient to meet the needs of all individuals, especially those with significant financial obligations such as a mortgage, student loans, or dependent children.

Lack of Customization Tailoring to Individual Needs

Group life insurance policies are typically standardized and offer limited customization options. Employees may not be able to choose the coverage amount, beneficiary designations, or policy features that best meet their individual needs.

Dependence on Employment Status Job Security and Policy Continuation

Coverage is usually tied to employment status. If an employee leaves their job, they may lose their group life insurance coverage. This can be a concern for individuals who are unsure about their job security or who anticipate changing jobs in the future.

Potential for Rate Increases The Impact of Group Dynamics

Group life insurance rates can increase over time, especially if the group experiences a high number of claims. This can make the coverage less affordable for employees, particularly those on fixed incomes.

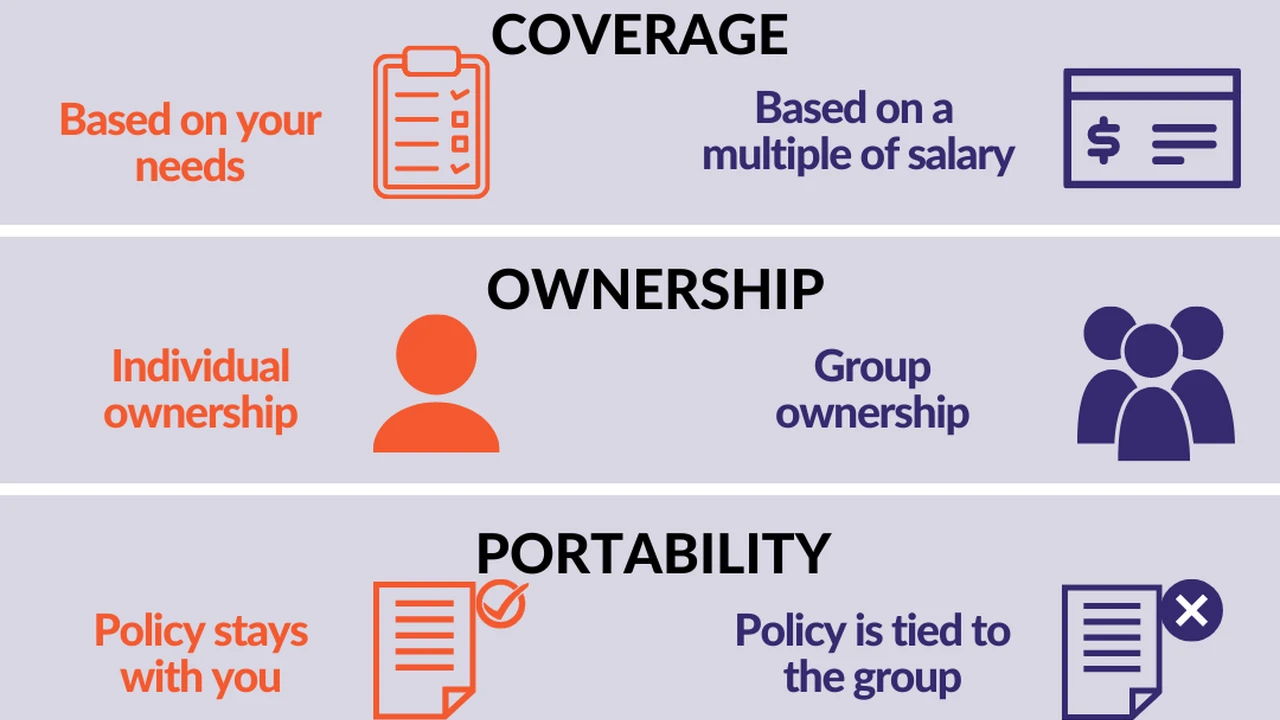

Group Life Insurance vs Individual Life Insurance A Comparative Analysis

Deciding between group and individual life insurance requires careful consideration of your individual needs and circumstances.

Coverage Amounts and Flexibility Meeting Specific Financial Goals

Individual life insurance policies typically offer higher coverage amounts and greater flexibility than group policies. You can choose the coverage amount, policy type, and beneficiary designations that best meet your needs. This is especially important if you have significant financial obligations or complex estate planning needs.

Portability and Control Maintaining Coverage Through Life Changes

Individual life insurance policies are portable, meaning you can take them with you if you change jobs or retire. You also have more control over the policy, including the ability to make changes to the coverage amount, beneficiary designations, and policy features.

Underwriting and Health Considerations Navigating Medical Requirements

Individual life insurance policies typically require a medical exam and underwriting process. This can be a disadvantage for individuals with pre-existing health conditions, who may be denied coverage or charged higher premiums. However, it can also be an advantage for healthy individuals, who may be able to obtain lower premiums than they would with a group policy.

Cost and Long-Term Value Evaluating Premium Structures

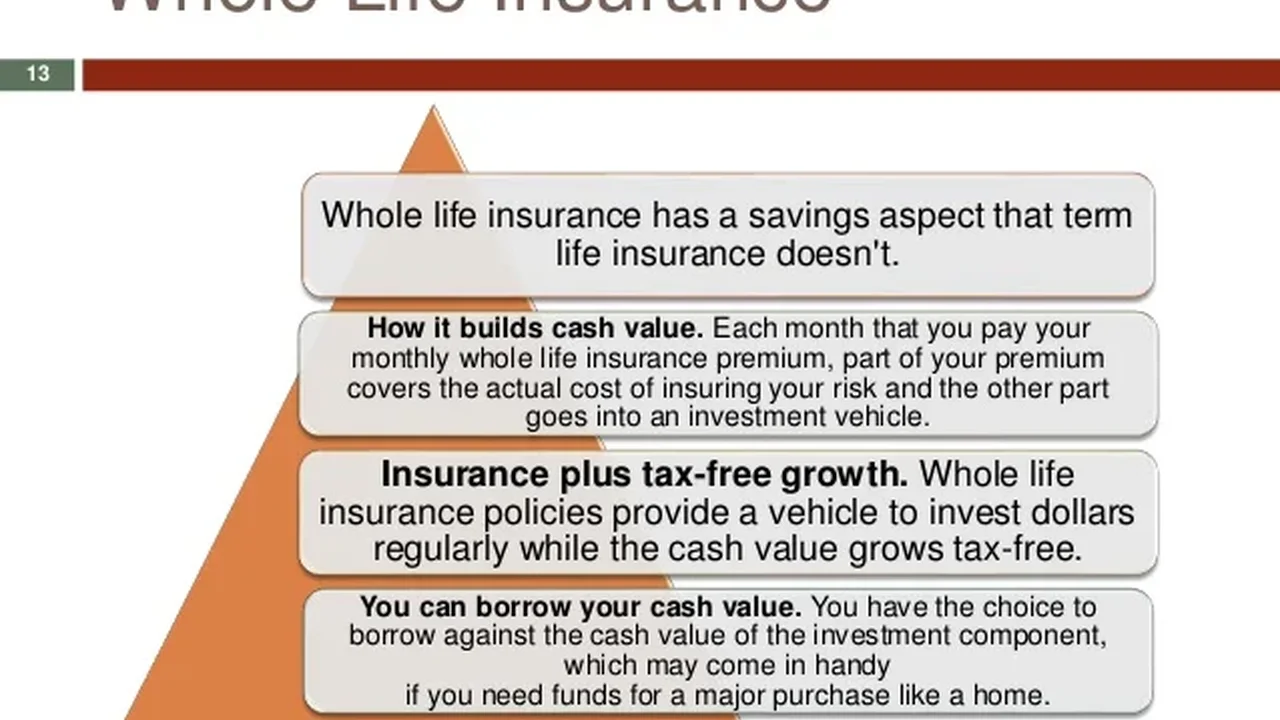

Group life insurance is typically more affordable in the short term, but individual life insurance may offer better long-term value. Group rates can increase over time, while individual policy premiums are often guaranteed for a specific period. Additionally, some individual life insurance policies offer cash value accumulation, which can provide a source of funds for future needs.

Specific Product Recommendations and Use Cases

While I cannot provide specific financial advice, I can offer some general information about types of life insurance products and their potential use cases.

Term Life Insurance For Temporary Coverage Needs

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It's a cost-effective option for individuals who need coverage for a specific purpose, such as paying off a mortgage or providing for dependent children.

Use Case Protecting a Mortgage

A common use case for term life insurance is to protect a mortgage. If the policyholder dies before the mortgage is paid off, the death benefit can be used to pay off the remaining balance, allowing their family to stay in their home.

Use Case Funding College Education

Term life insurance can also be used to fund a child's college education. The death benefit can be used to cover tuition, fees, and other expenses, ensuring that the child can pursue their educational goals even if the parent dies.

Whole Life Insurance For Lifelong Protection and Cash Value

Whole life insurance provides coverage for the policyholder's entire life and also accumulates cash value over time. It's a more expensive option than term life insurance, but it offers lifelong protection and a potential source of funds for future needs.

Use Case Estate Planning and Legacy Building

Whole life insurance can be used for estate planning purposes. The death benefit can be used to pay estate taxes or provide an inheritance for heirs. The cash value can also be used to supplement retirement income or fund other financial goals.

Use Case Long-Term Care Planning

Some whole life insurance policies offer riders that can be used to pay for long-term care expenses. If the policyholder needs long-term care, the rider can provide funds to cover the cost of nursing home care, assisted living, or home health care.

Universal Life Insurance For Flexible Coverage and Investment Options

Universal life insurance is a type of permanent life insurance that offers more flexibility than whole life insurance. Policyholders can adjust their premium payments and death benefit within certain limits. They can also choose from a variety of investment options to grow the policy's cash value.

Use Case Retirement Income Supplementation

Universal life insurance can be used to supplement retirement income. The cash value can be withdrawn or borrowed to provide funds for living expenses. The policyholder can also annuitize the cash value to create a stream of income for life.

Use Case Funding Future Business Ventures

Universal life insurance can be used to fund future business ventures. The cash value can be borrowed to provide capital for starting or expanding a business.

Detailed Information Such as Pricing and Policy Features

The cost of life insurance varies depending on several factors, including the policyholder's age, health, gender, and the coverage amount. Policy features also vary depending on the type of policy and the insurance company.

Factors Affecting Life Insurance Premiums Age Health and Lifestyle

Age is one of the primary factors affecting life insurance premiums. Younger individuals typically pay lower premiums because they are considered to be at lower risk of dying. Health is another important factor. Individuals with pre-existing health conditions may be charged higher premiums or denied coverage altogether. Lifestyle factors such as smoking, drinking, and engaging in risky activities can also affect premiums.

Understanding Policy Riders and Additional Benefits

Many life insurance policies offer riders, which are optional features that provide additional benefits. Common riders include accelerated death benefit riders, which allow the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, and waiver of premium riders, which waive premium payments if the policyholder becomes disabled.

Navigating the Application and Underwriting Process

The application and underwriting process for life insurance can vary depending on the insurance company and the type of policy. Typically, applicants will need to complete an application form and undergo a medical exam. The insurance company will then review the application and medical exam results to determine whether to approve the application and what premium rate to charge.

Strategic Considerations for Choosing the Right Life Insurance Policy

Choosing the right life insurance policy is a complex decision that requires careful consideration of your individual needs and circumstances.

Assessing Your Financial Needs and Obligations

The first step is to assess your financial needs and obligations. This includes determining how much coverage you need to protect your family in the event of your death. Consider your mortgage balance, student loans, credit card debt, and other financial obligations. Also, consider the cost of raising children, paying for college, and other future expenses.

Comparing Different Policy Types and Features

Once you have assessed your financial needs, you can begin to compare different policy types and features. Consider the pros and cons of term life insurance, whole life insurance, and universal life insurance. Also, consider the different riders and additional benefits that are available.

Working with a Financial Advisor For Personalized Guidance

It's often helpful to work with a financial advisor who can provide personalized guidance and help you choose the right life insurance policy for your needs. A financial advisor can help you assess your financial needs, compare different policy options, and make informed decisions about your life insurance coverage.

Case Studies Real-World Examples of Group Life Insurance in Action

Let's examine a few hypothetical scenarios to illustrate the benefits and limitations of group life insurance.

Scenario 1 Young Professional Starting a Family

A young professional starting a family might find group life insurance a convenient and affordable way to get some initial coverage. However, they should also consider supplementing it with an individual policy to ensure adequate protection as their family grows and their financial obligations increase.

Scenario 2 Established Employee with Pre-Existing Conditions

An established employee with pre-existing conditions might find group life insurance particularly valuable due to the guaranteed issue coverage. This could be their only option for obtaining life insurance coverage at a reasonable price.

Scenario 3 Employee Planning for Retirement

An employee planning for retirement might find that their group life insurance coverage is insufficient to meet their estate planning needs. They should consider purchasing an individual policy to provide additional coverage and ensure that their heirs receive the inheritance they desire.

Navigating the Claims Process for Group Life Insurance

Understanding the claims process is crucial for beneficiaries. This ensures a smoother experience during a difficult time.

Required Documentation and Procedures

The claims process typically involves submitting a death certificate, the policy document, and a claim form to the insurance company. The beneficiary may also need to provide additional information, such as proof of identity and relationship to the deceased.

Common Challenges and How to Overcome Them

Common challenges can include delays in processing the claim due to incomplete documentation or disputes over beneficiary designations. To avoid these challenges, it's important to ensure that all required documentation is submitted promptly and accurately. It's also important to review and update beneficiary designations regularly.

The Future of Group Life Insurance Trends and Innovations

The group life insurance industry is constantly evolving to meet the changing needs of employers and employees.

Technological Advancements and Digital Enrollment

Technological advancements are making it easier for employees to enroll in group life insurance and manage their policies online. Digital enrollment platforms streamline the application process and provide employees with access to policy information and resources.

Personalized Coverage Options and Wellness Programs

Insurance companies are increasingly offering personalized coverage options and wellness programs to help employees improve their health and reduce their risk of death. These programs can include incentives for participating in health screenings, exercise programs, and smoking cessation programs.

Final Thoughts on Group Life Insurance A Balanced Perspective

Group life insurance can be a valuable benefit for employees, providing affordable and accessible coverage. However, it's important to understand its limitations and to consider supplementing it with an individual policy if necessary. By carefully assessing your needs and comparing different policy options, you can choose the right life insurance coverage to protect your family and achieve your financial goals.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)