How Much Life Insurance Do You Really Need_

Choosing the right life insurance policy can feel overwhelming. This comprehensive guide breaks down the complexities, offering specific product recommendations, real-world use cases, detailed comparisons, and pricing information to help you make an informed decision. We'll explore term life, whole life, universal life, and variable life insurance, ensuring you understand the nuances of each and find the perfect fit for your unique circumstances.

Understanding Life Insurance Basics And Policy Types

Let's start with the fundamentals. Life insurance is a contract between you and an insurance company. You pay premiums, and in exchange, the insurer promises to pay a death benefit to your beneficiaries upon your death. This death benefit can be used to cover funeral expenses, pay off debts, replace lost income, fund education, and more.

There are primarily two main categories of life insurance: term life and permanent life. Within these categories, there are several sub-types.

Term Life Insurance Explained

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. If you die within that term, the death benefit is paid out. If the term expires and you're still alive, the coverage ends. Some term policies can be renewed or converted to permanent policies, but often at a higher premium.

Advantages of Term Life Insurance

Term life is generally the most affordable type of life insurance, especially for younger, healthier individuals. It's straightforward and easy to understand, making it a good choice for people who need a large amount of coverage for a specific period, such as while they're raising children or paying off a mortgage.

Disadvantages of Term Life Insurance

Term life insurance doesn't build cash value. Once the term expires, the coverage disappears unless you renew or convert the policy. Premiums can increase significantly upon renewal, especially as you get older.

Term Life Insurance Use Cases

Imagine Sarah, a 35-year-old mother of two young children. She wants to ensure her family is financially secure if she were to pass away unexpectedly. She purchases a 20-year term life insurance policy with a death benefit of $500,000. This would be enough to cover the remaining mortgage balance, fund her children's college education, and provide a financial cushion for her family.

Permanent Life Insurance Explained

Permanent life insurance provides lifelong coverage, as long as you continue to pay the premiums. It also builds cash value over time, which you can borrow against or withdraw from.

Types of Permanent Life Insurance

There are several types of permanent life insurance, including:

- Whole Life Insurance: Offers a guaranteed death benefit and a fixed premium. The cash value grows at a guaranteed rate.

- Universal Life Insurance: Offers more flexibility than whole life. Premiums and death benefits can be adjusted within certain limits. The cash value growth is tied to current interest rates.

- Variable Life Insurance: Allows you to invest the cash value in a variety of sub-accounts, similar to mutual funds. This offers the potential for higher returns but also carries more risk.

- Variable Universal Life Insurance: Combines the flexibility of universal life with the investment options of variable life.

Advantages of Permanent Life Insurance

Permanent life insurance provides lifelong coverage and builds cash value, which can be a valuable asset. It offers more flexibility than term life insurance, with options to adjust premiums and death benefits. It can also be used for estate planning purposes.

Disadvantages of Permanent Life Insurance

Permanent life insurance is significantly more expensive than term life insurance. The cash value growth may not keep pace with inflation. The investment options in variable and variable universal life insurance can be risky.

Permanent Life Insurance Use Cases

Consider John, a 50-year-old business owner. He wants to provide for his family and also create a legacy for future generations. He purchases a whole life insurance policy with a death benefit of $1 million. This will not only provide financial security for his family but also create an estate that can be passed on to his children and grandchildren.

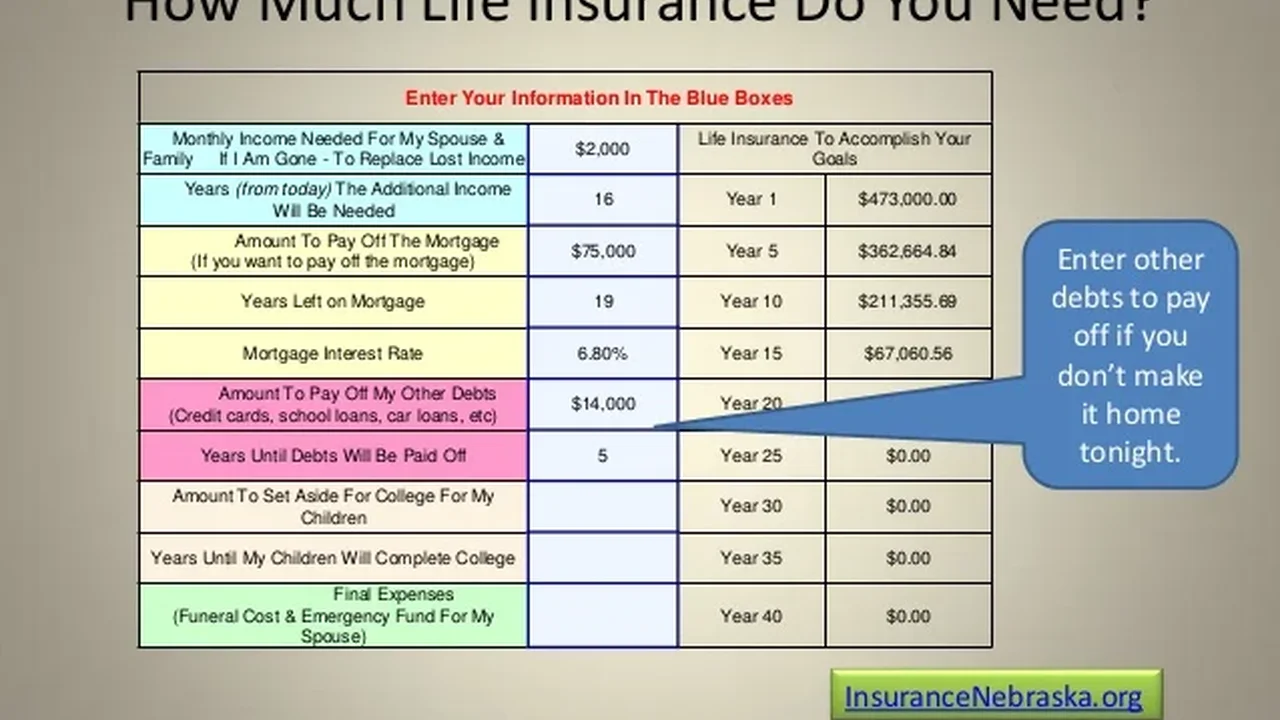

Determining Your Life Insurance Needs With Accurate Calculations

How much life insurance do you really need? This is a crucial question. The answer depends on your individual circumstances, including your income, debts, assets, and family responsibilities. Here's a step-by-step guide to calculating your life insurance needs:

- Calculate Your Expenses: Consider your funeral expenses, outstanding debts (mortgage, loans, credit card balances), and ongoing living expenses for your family.

- Estimate Your Income Replacement Needs: Determine how much income your family would need to replace if you were to pass away. Consider the number of years your family would need income replacement and the rate of inflation.

- Factor in Future Education Costs: If you have children, factor in the cost of their college education.

- Consider Your Assets: Include any savings, investments, and other assets that your family could use to cover expenses.

- Subtract Your Assets from Your Expenses and Income Replacement Needs: The difference is the amount of life insurance you need.

Many online calculators can help you estimate your life insurance needs. Consider using multiple calculators and consulting with a financial advisor for personalized advice.

Reviewing Top Life Insurance Companies And Their Offerings

Choosing the right life insurance company is just as important as choosing the right policy. Here are some of the top life insurance companies based on financial strength, customer service, and product offerings:

- New York Life: Known for its financial strength and mutual ownership structure. Offers a wide range of whole life and term life insurance policies.

- Northwestern Mutual: Another strong mutual company with a reputation for excellent customer service. Offers a variety of life insurance products, including whole life, term life, and universal life.

- State Farm: A well-known and trusted insurance provider. Offers a range of life insurance policies, including term life, whole life, and universal life.

- Prudential: A large and established insurance company with a wide range of financial products. Offers a variety of life insurance policies, including term life, whole life, universal life, and variable life.

- Transamerica: A leading provider of life insurance, retirement, and investment products. Offers a variety of life insurance policies, including term life, whole life, universal life, and indexed universal life.

When choosing a life insurance company, consider their financial strength rating (from companies like A.M. Best and Standard & Poor's), customer service ratings, and the range of products they offer.

Understanding Life Insurance Policy Riders And Additional Benefits

Life insurance policies often come with riders, which are optional add-ons that provide additional benefits. Here are some common life insurance riders:

- Accelerated Death Benefit Rider: Allows you to access a portion of the death benefit if you are diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become disabled and unable to work.

- Accidental Death Benefit Rider: Pays an additional death benefit if you die as a result of an accident.

- Child Term Rider: Provides term life insurance coverage for your children.

- Guaranteed Insurability Rider: Allows you to purchase additional life insurance coverage at a later date without having to undergo a medical exam.

Consider whether any of these riders would be beneficial for your specific circumstances.

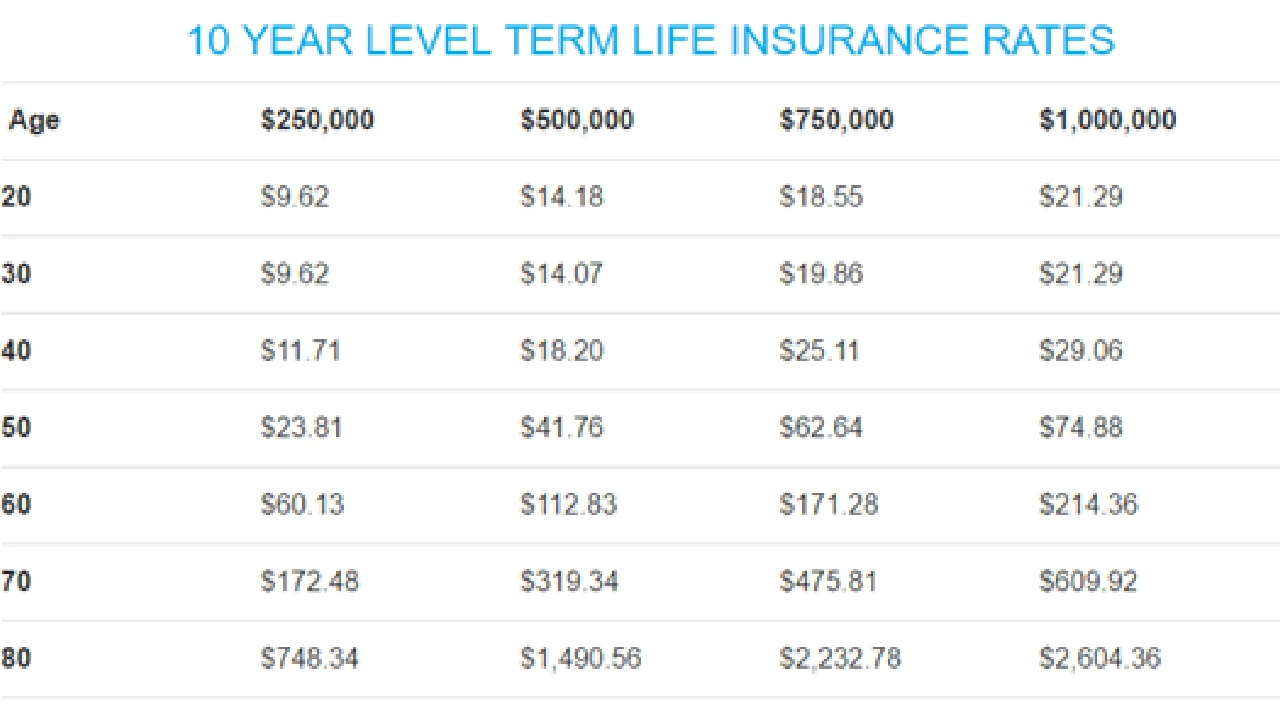

Term Life Insurance Product Recommendations And Pricing Examples

Let's dive into some specific term life insurance product recommendations and pricing examples. Keep in mind that these are just examples, and your actual premiums may vary depending on your age, health, and other factors. Always get a personalized quote from an insurance company.

Policygenius Term Life Insurance Marketplace

Policygenius is an online insurance marketplace that allows you to compare quotes from multiple insurance companies. This can be a great way to find the best rates on term life insurance.

Pricing Example

A healthy 35-year-old male could expect to pay around $30 per month for a 20-year term life insurance policy with a death benefit of $500,000. A healthy 35-year-old female could expect to pay around $25 per month for the same policy.

SelectQuote Term Life Insurance Comparison

SelectQuote is another online insurance marketplace that offers personalized quotes from multiple insurance companies. They also have licensed agents who can help you navigate the process.

Pricing Example

Similar to Policygenius, a healthy 35-year-old male could expect to pay around $30 per month for a 20-year term life insurance policy with a death benefit of $500,000. A healthy 35-year-old female could expect to pay around $25 per month for the same policy.

Direct Term Life Insurance From Haven Life

Haven Life offers term life insurance policies directly online, without the need for a medical exam in some cases. This can be a convenient option for healthy individuals.

Pricing Example

Haven Life's pricing is generally competitive. A healthy 35-year-old male could expect to pay around $28 per month for a 20-year term life insurance policy with a death benefit of $500,000. A healthy 35-year-old female could expect to pay around $23 per month for the same policy.

Whole Life Insurance Product Recommendations And Pricing Examples

Whole life insurance is more complex and expensive than term life insurance. It's important to understand the benefits and drawbacks before purchasing a whole life policy. Here are some examples:

New York Life Whole Life Insurance

New York Life is known for its strong financial stability and its whole life insurance products. Their policies offer guaranteed cash value growth and lifelong coverage.

Pricing Example

A 35-year-old male could expect to pay around $500-$700 per month for a whole life insurance policy with a death benefit of $500,000. The exact premium will depend on the specific policy features and the individual's health.

Northwestern Mutual Whole Life Insurance

Northwestern Mutual is another highly rated company that offers competitive whole life insurance policies. They are known for their excellent customer service and financial strength.

Pricing Example

Similar to New York Life, a 35-year-old male could expect to pay around $500-$700 per month for a whole life insurance policy with a death benefit of $500,000.

MassMutual Whole Life Insurance

MassMutual offers participating whole life insurance policies that can earn dividends. This can increase the cash value and death benefit over time.

Pricing Example

The premium for a MassMutual whole life insurance policy would be comparable to New York Life and Northwestern Mutual, around $500-$700 per month for a 35-year-old male with a $500,000 death benefit.

Universal Life Insurance Product Recommendations And Pricing Examples

Universal life insurance offers more flexibility than whole life insurance, but it also carries more risk. The cash value growth is tied to current interest rates, which can fluctuate.

Transamerica Universal Life Insurance

Transamerica offers a variety of universal life insurance policies with different features and benefits.

Pricing Example

A 35-year-old male could expect to pay around $300-$500 per month for a universal life insurance policy with a death benefit of $500,000. The actual premium will depend on the interest rate and the policy features.

Prudential Universal Life Insurance

Prudential offers universal life insurance policies with guaranteed death benefits and flexible premium payments.

Pricing Example

Similar to Transamerica, a 35-year-old male could expect to pay around $300-$500 per month for a Prudential universal life insurance policy with a death benefit of $500,000.

Variable Life Insurance Product Recommendations And Pricing Examples

Variable life insurance offers the potential for higher returns, but it also carries the most risk. The cash value is invested in sub-accounts, similar to mutual funds.

Nationwide Variable Life Insurance

Nationwide offers variable life insurance policies with a variety of investment options.

Pricing Example

A 35-year-old male could expect to pay around $350-$550 per month for a variable life insurance policy with a death benefit of $500,000. The actual premium will depend on the investment choices and the market performance.

Lincoln Financial Variable Life Insurance

Lincoln Financial offers variable life insurance policies with a focus on tax-advantaged wealth accumulation.

Pricing Example

Similar to Nationwide, a 35-year-old male could expect to pay around $350-$550 per month for a Lincoln Financial variable life insurance policy with a death benefit of $500,000.

Comparing Life Insurance Policy Costs And Coverage Options

It's crucial to compare life insurance policies from multiple companies before making a decision. Consider the following factors:

- Premiums: How much will you pay each month or year?

- Death Benefit: How much will your beneficiaries receive upon your death?

- Cash Value Growth: How quickly will the cash value grow? (For permanent policies)

- Policy Features: What riders and other benefits are included?

- Company Financial Strength: How financially stable is the insurance company?

- Customer Service: What is the company's reputation for customer service?

Use online comparison tools and consult with a financial advisor to get personalized recommendations.

Real World Life Insurance Claim Scenarios And Payout Examples

Let's look at some real-world life insurance claim scenarios and payout examples to understand how life insurance can benefit your family.

Scenario 1: Accidental Death

John, a 40-year-old father of two, was killed in a car accident. He had a term life insurance policy with a death benefit of $500,000. His wife, Mary, received the death benefit, which she used to pay off the mortgage, fund her children's college education, and cover ongoing living expenses.

Scenario 2: Terminal Illness

Susan, a 60-year-old woman, was diagnosed with terminal cancer. She had a whole life insurance policy with an accelerated death benefit rider. She used the accelerated death benefit to pay for medical expenses and improve her quality of life during her final months.

Scenario 3: Business Owner Death

David, a 55-year-old business owner, passed away unexpectedly. He had a life insurance policy that was used to fund a buy-sell agreement with his business partner. This allowed his partner to buy out his share of the business, providing financial security for his family.

Frequently Asked Questions About Life Insurance Policies

Here are some frequently asked questions about life insurance policies:

- Q: How often should I review my life insurance policy? A: You should review your life insurance policy at least once a year, or whenever there is a significant change in your life, such as a marriage, birth of a child, or change in income.

- Q: Can I have more than one life insurance policy? A: Yes, you can have more than one life insurance policy. There is no limit to the amount of life insurance you can purchase.

- Q: Is life insurance taxable? A: The death benefit from a life insurance policy is generally not taxable. However, the cash value growth in a permanent life insurance policy may be taxable upon withdrawal.

- Q: What happens if I stop paying my premiums? A: If you stop paying your premiums on a term life insurance policy, the coverage will lapse. If you stop paying your premiums on a permanent life insurance policy, the policy may lapse, or you may be able to use the cash value to pay the premiums.

Making An Informed Decision About Your Life Insurance Future

Choosing the right life insurance policy is a significant decision that requires careful consideration. By understanding the different types of policies, calculating your needs, comparing companies, and considering riders, you can make an informed decision that protects your family's financial future. Don't hesitate to seek professional advice from a financial advisor or insurance agent. They can help you navigate the complexities of life insurance and find the best policy for your unique circumstances. Remember to prioritize your family's needs and choose a policy that provides adequate coverage at an affordable price. Your peace of mind, knowing your loved ones are protected, is invaluable.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)