Life Insurance and Long-Term Care Planning

Understanding Advanced Life Insurance Planning

Let's dive deep into the world of advanced life insurance planning. It's more than just buying a policy; it's about crafting a strategic financial plan that leverages life insurance to achieve specific goals. We're talking about sophisticated techniques used by high-net-worth individuals, business owners, and anyone looking to maximize the benefits of their life insurance policies.

Think of it as taking your life insurance from a simple safety net to a powerful financial tool. It's about understanding the nuances of different policy types, tax implications, and how to integrate life insurance into a broader estate planning strategy.

The Role of Life Insurance in Estate Planning

Life insurance plays a crucial role in estate planning. It can provide liquidity to pay estate taxes, replace income for surviving family members, and even fund charitable giving. But the key is to structure your life insurance strategy correctly.

For example, an Irrevocable Life Insurance Trust (ILIT) can be used to own a life insurance policy, shielding the death benefit from estate taxes. This is a common strategy for those with significant assets who want to minimize their tax burden and ensure their heirs receive the maximum inheritance.

Consider the scenario of John, a successful entrepreneur with a multi-million dollar estate. Without proper planning, a significant portion of his assets could be eaten up by estate taxes. By establishing an ILIT and funding it with a life insurance policy, John can ensure that his family receives the full value of his estate, without the worry of hefty tax bills.

Life Insurance for Business Owners Key Person Insurance

Business owners often face unique challenges when it comes to succession planning and protecting their business from unforeseen events. Key person insurance is a critical tool in this context.

Key person insurance is essentially life insurance on a key employee or owner whose death would significantly impact the company's profitability. The business owns the policy and is the beneficiary. If the key person dies, the death benefit can be used to cover lost revenue, recruit and train a replacement, or even buy out the deceased's share of the business.

Imagine a small software company where the lead developer is the driving force behind their flagship product. If that developer were to pass away unexpectedly, the company could face significant setbacks. Key person insurance would provide the financial resources needed to weather the storm and keep the business afloat.

Premium Financing Strategies for Life Insurance

Premium financing is a strategy that allows individuals or businesses to pay for large life insurance policies over time using a loan. This can be particularly useful for those who want to obtain a significant amount of coverage but don't have the immediate cash flow to pay the premiums upfront.

The loan is typically secured by the cash value of the life insurance policy. While premium financing can be an attractive option, it's important to understand the risks involved, including interest rate fluctuations and the potential for the policy to lapse if the loan isn't properly managed.

Let's say Sarah, a high-income earner, wants to purchase a $10 million life insurance policy to protect her family. However, she doesn't want to tie up a large sum of cash in premiums. Premium financing allows her to obtain the coverage she needs while preserving her liquidity.

Understanding Indexed Universal Life Insurance IUL Policies

Indexed Universal Life (IUL) insurance is a type of permanent life insurance that offers a death benefit along with a cash value component that grows based on the performance of a specific market index, such as the S&P 500. The key benefit is that your cash value growth is linked to the market, but you're typically protected from downside risk.

With an IUL policy, your cash value isn't directly invested in the market. Instead, the insurance company uses a portion of your premium to purchase options on the market index. This allows you to participate in market gains up to a certain cap, while also providing a floor that protects your cash value from losses during market downturns.

However, it's important to understand the fees associated with IUL policies, including premium charges, administrative fees, and surrender charges. Also, the cap on market gains can limit your potential upside.

Variable Universal Life Insurance VUL Policies

Variable Universal Life (VUL) insurance is another type of permanent life insurance that offers a death benefit and a cash value component. Unlike IUL policies, VUL policies allow you to directly invest your cash value in a variety of sub-accounts, which are similar to mutual funds. This gives you greater control over your investment strategy and the potential for higher returns, but also exposes you to greater risk.

With a VUL policy, you can choose from a range of sub-accounts that invest in stocks, bonds, and other asset classes. The performance of these sub-accounts directly impacts the growth of your cash value. This means that your cash value can fluctuate significantly based on market conditions.

VUL policies also come with fees, including premium charges, administrative fees, and mortality and expense (M&E) charges. It's crucial to carefully review these fees before investing in a VUL policy.

Comparing IUL and VUL Policies Which is Right for You

Choosing between IUL and VUL policies depends on your risk tolerance, investment goals, and financial situation. IUL policies offer downside protection and potential market-linked growth, while VUL policies offer greater investment control and the potential for higher returns, but also greater risk.

If you're risk-averse and prefer a more conservative approach, an IUL policy might be a better fit. If you're comfortable with market risk and want more control over your investments, a VUL policy might be more suitable.

It's essential to consult with a qualified financial advisor to determine which type of policy is best for your individual needs.

Life Insurance and Charitable Giving Planned Giving Strategies

Life insurance can be a powerful tool for charitable giving. By naming a charity as the beneficiary of your life insurance policy, you can make a significant donation to your favorite cause without impacting your current assets.

You can also establish a Charitable Remainder Trust (CRT) and fund it with a life insurance policy. The CRT provides income to you or your beneficiaries for a specified period, and the remaining assets go to the charity upon your death.

These strategies can provide significant tax benefits while also supporting the causes you care about.

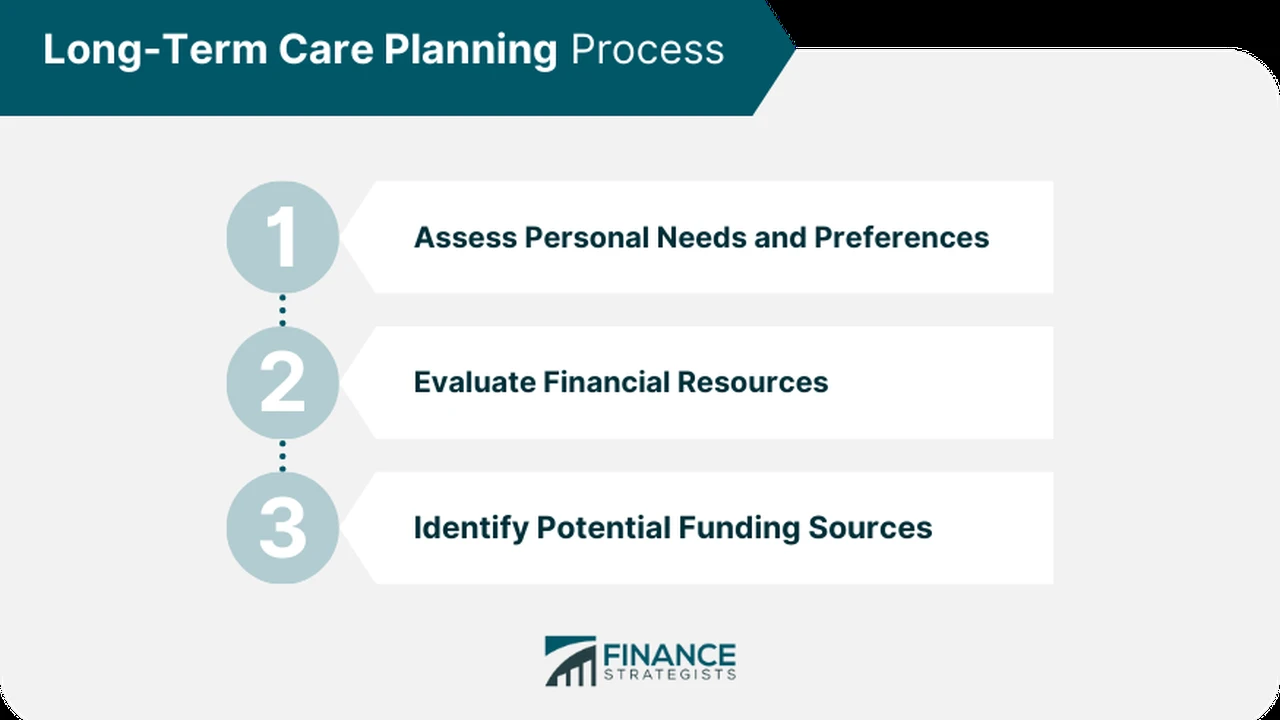

Life Insurance and Special Needs Planning Protecting Loved Ones

If you have a loved one with special needs, life insurance can be an essential component of your financial plan. It can provide the financial resources needed to ensure their long-term care and well-being.

You can establish a Special Needs Trust (SNT) and fund it with a life insurance policy. The SNT can be used to pay for supplemental needs, such as medical expenses, therapy, and recreational activities, without jeopardizing your loved one's eligibility for government benefits.

This ensures that your loved one receives the support they need throughout their life.

Life Insurance and Retirement Planning Supplementing Your Income

While life insurance is primarily designed to provide a death benefit, it can also be used to supplement your retirement income. Certain types of permanent life insurance policies, such as IUL and VUL, accumulate cash value that can be accessed during retirement.

You can withdraw funds from your cash value or take out a loan against your policy. However, it's important to understand the tax implications of these strategies. Withdrawals may be taxable, and loans can accrue interest.

This should be considered a secondary benefit and not the primary purpose of purchasing life insurance.

Life Insurance Trust Strategies ILITs and More

Life insurance trusts, particularly Irrevocable Life Insurance Trusts (ILITs), are powerful tools for estate planning. An ILIT owns your life insurance policy, which can help shield the death benefit from estate taxes. This is particularly important for those with significant assets who want to minimize their tax burden and ensure their heirs receive the maximum inheritance.

The ILIT is irrevocable, meaning that you can't change the terms of the trust once it's established. This ensures that the life insurance proceeds are used according to your wishes.

Properly structuring an ILIT requires careful planning and legal expertise.

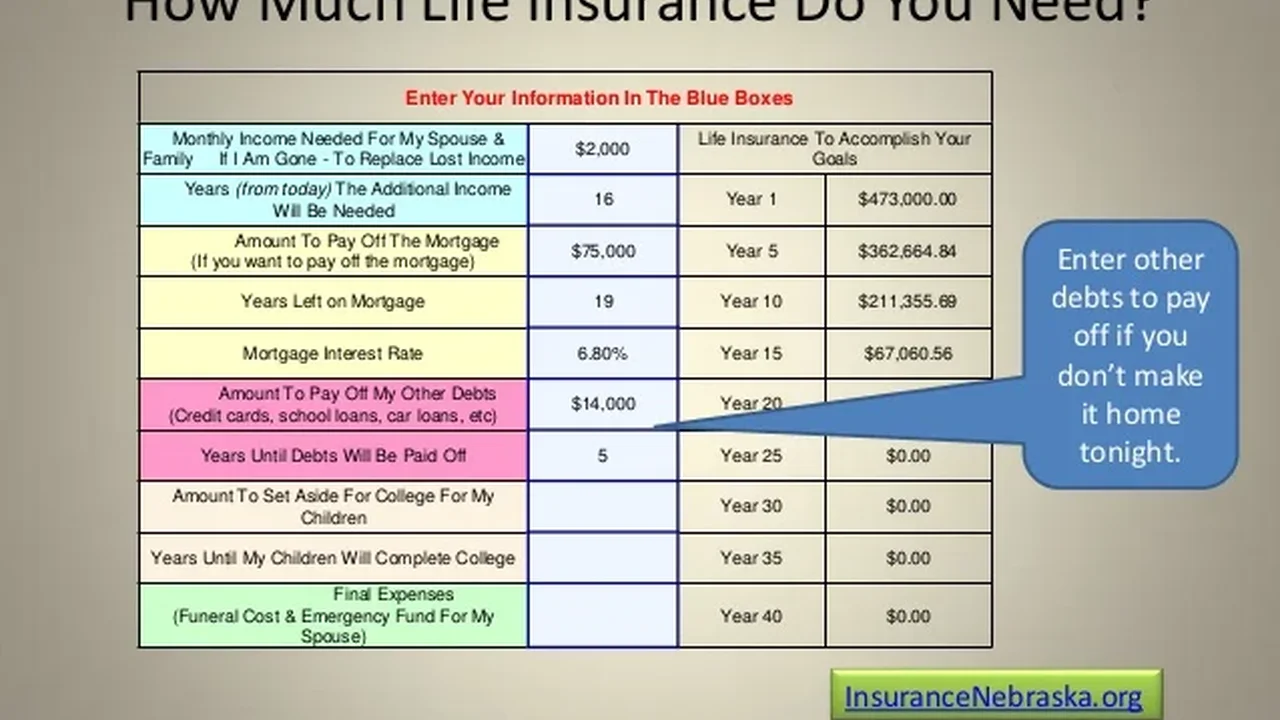

Reviewing Life Insurance Needs Regularly Staying Up to Date

Your life insurance needs can change over time as your circumstances evolve. It's important to review your policies regularly to ensure that they still meet your needs.

Consider factors such as changes in your income, family size, debt levels, and financial goals. You may need to increase your coverage, adjust your beneficiary designations, or explore different policy options.

Regular reviews will help you stay on track and ensure that your life insurance provides the protection you need.

Specific Product Recommendations and Use Cases

Let's get into some specific product recommendations. Remember, this is not financial advice, and you should consult with a qualified financial professional before making any decisions. These are examples based on common product features, and actual product details can vary.

Example 1: Nationwide YourLife IUL

Nationwide YourLife IUL is a popular Indexed Universal Life insurance policy. It offers a death benefit, cash value accumulation linked to market indices, and downside protection.

Use Case: Consider a 40-year-old individual looking for long-term financial security and potential cash value growth. They want life insurance coverage and are comfortable with moderate market risk. They are also interested in potential tax-advantaged cash accumulation for retirement.

Features:

- Death benefit protection

- Cash value growth linked to market indices (e.g., S&P 500)

- Downside protection to limit losses

- Various crediting methods to choose from

- Policy loan options

Pricing: The cost of Nationwide YourLife IUL depends on various factors, including age, health, coverage amount, and chosen crediting method. It's important to get a personalized quote to determine the actual cost.

Example 2: Protective Life Custom Choice UL

Protective Life Custom Choice UL is a Universal Life insurance policy that offers flexible premiums and adjustable death benefits. It's designed for those who want control over their policy and the ability to adjust it as their needs change.

Use Case: Imagine a 35-year-old individual with a growing family and fluctuating income. They need life insurance coverage but want the flexibility to adjust their premiums as their income changes. They also want the option to increase or decrease their death benefit as their family's needs evolve.

Features:

- Flexible premiums

- Adjustable death benefits

- Cash value accumulation

- Policy loan options

Pricing: The cost of Protective Life Custom Choice UL depends on factors such as age, health, coverage amount, and chosen premium payment schedule. Again, a personalized quote is necessary.

Example 3: New York Life Whole Life

New York Life Whole Life is a traditional Whole Life insurance policy that offers guaranteed death benefit, guaranteed cash value growth, and potential dividends.

Use Case: Envision a 50-year-old individual seeking guaranteed long-term financial security and estate planning benefits. They value stability and are looking for a policy that provides a guaranteed death benefit and cash value growth.

Features:

- Guaranteed death benefit

- Guaranteed cash value growth

- Potential dividends

- Policy loan options

Pricing: Whole Life policies typically have higher premiums than term life insurance policies due to the guaranteed benefits. The cost of New York Life Whole Life depends on factors such as age, health, and coverage amount.

Product Comparison Table

Here's a simplified comparison of the products mentioned above:

| Product | Type | Key Features | Risk Level | Use Case |

|---|---|---|---|---|

| Nationwide YourLife IUL | Indexed Universal Life | Market-linked growth, Downside protection | Moderate | Long-term growth, Moderate risk tolerance |

| Protective Life Custom Choice UL | Universal Life | Flexible premiums, Adjustable death benefit | Low to Moderate | Fluctuating income, Need for flexibility |

| New York Life Whole Life | Whole Life | Guaranteed benefits, Potential dividends | Low | Long-term security, Estate planning |

Detailed Information on Pricing Factors

Several factors influence the pricing of life insurance policies. Understanding these factors can help you make informed decisions and find the best policy for your needs.

- Age: Older individuals typically pay higher premiums because they have a shorter life expectancy.

- Health: Healthier individuals generally qualify for lower premiums. Insurance companies assess your health through medical exams and questionnaires.

- Gender: Women typically pay lower premiums than men because they have a longer life expectancy.

- Coverage Amount: The higher the coverage amount, the higher the premium.

- Policy Type: Term life insurance policies generally have lower premiums than permanent life insurance policies.

- Lifestyle: Risky behaviors, such as smoking or engaging in extreme sports, can increase your premiums.

- Riders: Adding riders to your policy, such as a critical illness rider or a waiver of premium rider, can increase your premiums.

Navigating the Application Process

Applying for life insurance typically involves the following steps:

- Choose a Policy: Research different policy types and choose one that meets your needs.

- Get a Quote: Obtain quotes from multiple insurance companies.

- Complete an Application: Fill out the application form accurately and honestly.

- Undergo a Medical Exam: You may be required to undergo a medical exam.

- Review the Policy: Carefully review the policy before signing it.

- Pay the Premium: Pay the premium to activate the policy.

Common Mistakes to Avoid

Here are some common mistakes to avoid when purchasing life insurance:

- Not getting enough coverage: Make sure you have enough coverage to meet your family's needs.

- Not comparing quotes: Compare quotes from multiple insurance companies to find the best deal.

- Not reading the fine print: Carefully review the policy before signing it.

- Not updating your policy: Review your policy regularly to ensure that it still meets your needs.

The Future of Advanced Life Insurance Strategies

The world of advanced life insurance strategies is constantly evolving. New products and techniques are being developed all the time. It's important to stay informed about the latest trends and developments to ensure that you're making the most of your life insurance policies.

Expect to see more innovation in areas such as digital underwriting, personalized insurance products, and the integration of life insurance with other financial planning tools.

Working with a Qualified Financial Advisor

Navigating the complexities of advanced life insurance planning can be challenging. Working with a qualified financial advisor can provide valuable guidance and help you develop a personalized strategy that meets your specific needs.

A good financial advisor will take the time to understand your financial goals, risk tolerance, and family situation. They will then recommend the most appropriate life insurance products and strategies for you.

Look for an advisor who is experienced, knowledgeable, and trustworthy.

This information is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any decisions about your life insurance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)