Comparing Life Insurance Quotes_ A Step-by-Step Guide

Looking for ways to save money on life insurance? This comprehensive guide provides a step-by-step approach to comparing life insurance quotes, understanding different policy types, and finding the best coverage at the most affordable price. Let's dive in!

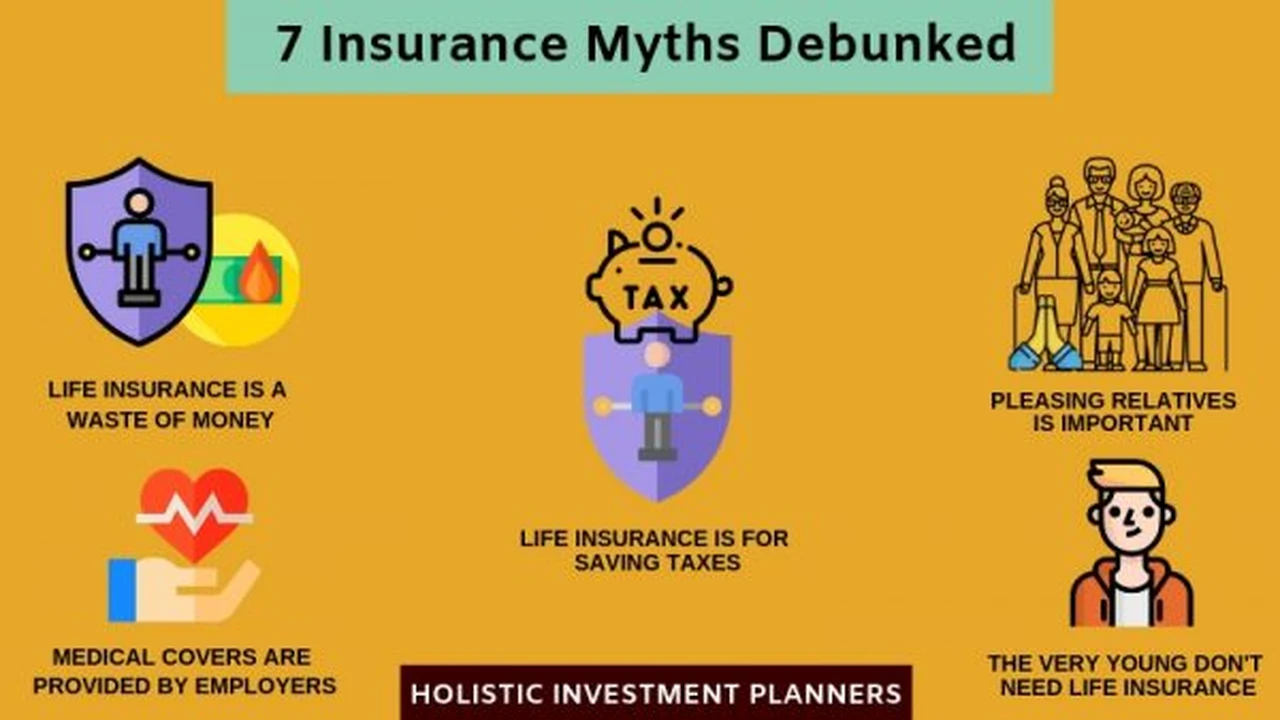

Understanding Life Insurance Basics to Save Money

Before we jump into saving money, let's cover the fundamentals. What exactly is life insurance, and why do people need it? Life insurance is a contract between you and an insurance company. You pay premiums, and in exchange, the insurance company promises to pay a death benefit to your beneficiaries if you die during the policy term (for term life) or at any time (for permanent life).

The primary purpose of life insurance is to provide financial security for your loved ones after you're gone. This can cover expenses like:

- Mortgage payments

- Outstanding debts

- Education expenses for children

- Living expenses for surviving spouse and dependents

- Funeral costs and other end-of-life expenses

There are two main types of life insurance: term life and permanent life.

Term Life Insurance: Affordable Coverage for a Specific Period

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. If you die within the term, your beneficiaries receive the death benefit. If you outlive the term, the coverage ends. Term life is generally more affordable than permanent life, especially when you're younger. This makes it a good option for people who need coverage for a specific period, such as while they're raising children or paying off a mortgage.

Pros of Term Life Insurance:

- Lower premiums compared to permanent life insurance

- Simple and easy to understand

- Ideal for covering specific financial obligations

Cons of Term Life Insurance:

- Coverage ends after the term expires

- Premiums may increase upon renewal

- No cash value accumulation

Permanent Life Insurance: Lifelong Coverage with Cash Value

Permanent life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It also includes a cash value component that grows over time on a tax-deferred basis. You can borrow against the cash value or withdraw it, although doing so will reduce the death benefit. There are several types of permanent life insurance, including whole life, universal life, and variable life.

Pros of Permanent Life Insurance:

- Lifelong coverage

- Cash value accumulation

- Potential for tax-deferred growth

Cons of Permanent Life Insurance:

- Higher premiums compared to term life insurance

- More complex than term life insurance

- Cash value growth may be affected by market performance (for variable life)

Comparing Life Insurance Quotes Online for the Best Rates

The first step in saving money on life insurance is to compare quotes from multiple insurance companies. Don't settle for the first quote you receive. Online quote comparison tools make it easy to get quotes from dozens of insurers in minutes.

Where to Find Life Insurance Quotes Online:

- Independent Insurance Brokers: These brokers work with multiple insurance companies and can help you find the best rates and coverage options.

- Online Life Insurance Marketplaces: These websites allow you to compare quotes from multiple insurers side-by-side.

- Direct Insurance Companies: You can also get quotes directly from individual insurance companies.

What Information You'll Need to Get a Quote:

- Age: Older individuals typically pay higher premiums.

- Gender: Women generally pay lower premiums than men.

- Health: Your health history and current health status will affect your rates.

- Lifestyle: Factors like smoking, alcohol consumption, and risky hobbies can increase premiums.

- Coverage Amount: The amount of death benefit you need will determine the premium.

- Policy Term: The length of the policy term (for term life) will affect the premium.

Affordable Life Insurance Policies: Finding the Right Coverage Amount

Determining the right amount of life insurance coverage is crucial. You don't want to be underinsured and leave your loved ones financially vulnerable, but you also don't want to overpay for more coverage than you need. A common rule of thumb is to purchase coverage that's 7-10 times your annual income. However, this is just a starting point. You should also consider your specific financial obligations and needs.

Factors to Consider When Determining Coverage Amount:

- Outstanding Debts: Consider your mortgage, student loans, credit card debt, and other debts.

- Income Replacement: How much income would your family need to replace if you were no longer around?

- Education Expenses: If you have children, consider the cost of their education.

- Living Expenses: Estimate your family's ongoing living expenses, such as housing, food, utilities, and transportation.

- Funeral Costs: Factor in the cost of funeral arrangements and other end-of-life expenses.

Using a Life Insurance Needs Calculator:

Many websites offer life insurance needs calculators that can help you estimate the appropriate coverage amount. These calculators take into account your income, debts, expenses, and other factors to provide a more personalized recommendation.

Life Insurance Policy Types and How They Impact Cost

As mentioned earlier, there are several types of life insurance policies, each with its own features and costs. Understanding the different policy types can help you choose the most affordable option for your needs.

Whole Life Insurance: Comprehensive Coverage with Guaranteed Growth

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and a guaranteed cash value growth rate. Premiums are typically fixed and remain level throughout the policy's duration. Whole life is generally the most expensive type of life insurance, but it offers the most stability and predictability.

Key Features of Whole Life Insurance:

- Lifelong coverage

- Guaranteed cash value growth

- Fixed premiums

- Potential for dividends

Universal Life Insurance: Flexible Premiums and Adjustable Death Benefit

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life. You can adjust your premiums and death benefit within certain limits. The cash value growth rate is typically tied to a market index, such as the S&P 500. Universal life offers more potential for growth than whole life, but it also carries more risk.

Key Features of Universal Life Insurance:

- Lifelong coverage

- Flexible premiums

- Adjustable death benefit

- Cash value growth tied to a market index

Variable Life Insurance: Investment-Based Coverage with High Risk and Reward

Variable life insurance is a type of permanent life insurance that allows you to invest the cash value in a variety of investment options, such as stocks, bonds, and mutual funds. The cash value growth rate is directly tied to the performance of your investments. Variable life offers the highest potential for growth, but it also carries the highest risk. Your cash value can fluctuate significantly based on market conditions.

Key Features of Variable Life Insurance:

- Lifelong coverage

- Investment-based cash value growth

- Choice of investment options

- High risk and reward potential

Leveraging Life Insurance Riders for Additional Protection and Savings

Life insurance riders are optional add-ons to your policy that provide additional benefits or coverage. Some riders can help you save money on your premiums or provide additional protection in specific situations.

Accelerated Death Benefit Rider: Accessing Funds for Terminal Illness

An accelerated death benefit rider allows you to access a portion of your death benefit if you're diagnosed with a terminal illness. This can help you cover medical expenses, hospice care, or other end-of-life costs.

Waiver of Premium Rider: Premium Protection During Disability

A waiver of premium rider waives your premiums if you become disabled and are unable to work. This ensures that your coverage remains in place even if you can't afford to pay the premiums.

Child Term Rider: Affordable Coverage for Children

A child term rider provides coverage for your children. It's typically a very affordable way to provide a small death benefit in the event of a child's death.

Accidental Death and Dismemberment (AD&D) Rider: Enhanced Payout for Accidental Death

An AD&D rider provides an additional payout if you die in an accident or lose a limb. This rider can be a cost-effective way to increase your coverage amount.

Healthy Lifestyle and Lower Life Insurance Premiums: A Direct Correlation

Your health plays a significant role in determining your life insurance premiums. Maintaining a healthy lifestyle can help you qualify for lower rates.

How Your Health Affects Life Insurance Rates:

- Weight: Being overweight or obese can increase your premiums.

- Blood Pressure: High blood pressure can increase your risk of heart disease and stroke, leading to higher premiums.

- Cholesterol: High cholesterol levels can also increase your risk of heart disease.

- Smoking: Smokers pay significantly higher premiums than non-smokers.

- Medical History: A history of serious illnesses, such as cancer, heart disease, or diabetes, can increase your premiums.

Tips for Improving Your Health and Lowering Premiums:

- Quit Smoking: Quitting smoking is one of the best things you can do for your health and your life insurance rates.

- Maintain a Healthy Weight: Eating a healthy diet and exercising regularly can help you maintain a healthy weight.

- Control Blood Pressure and Cholesterol: Work with your doctor to manage your blood pressure and cholesterol levels.

- Get Regular Checkups: Regular checkups can help you detect and treat health problems early.

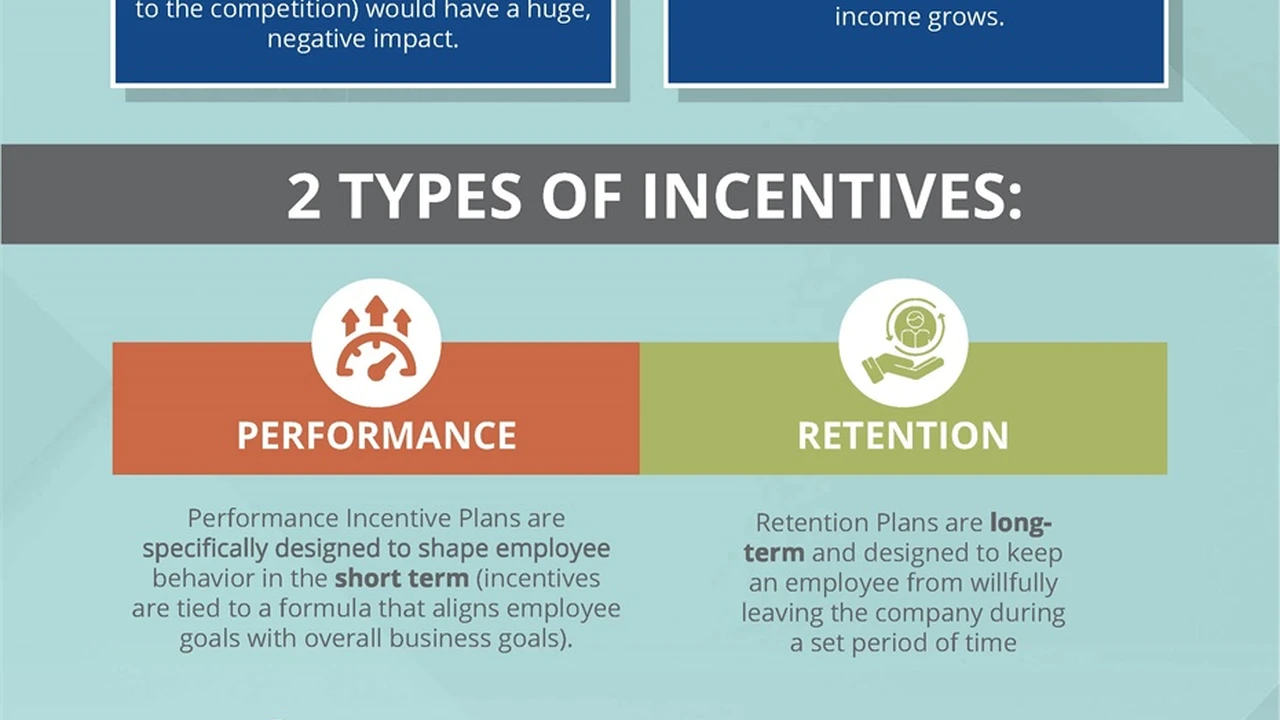

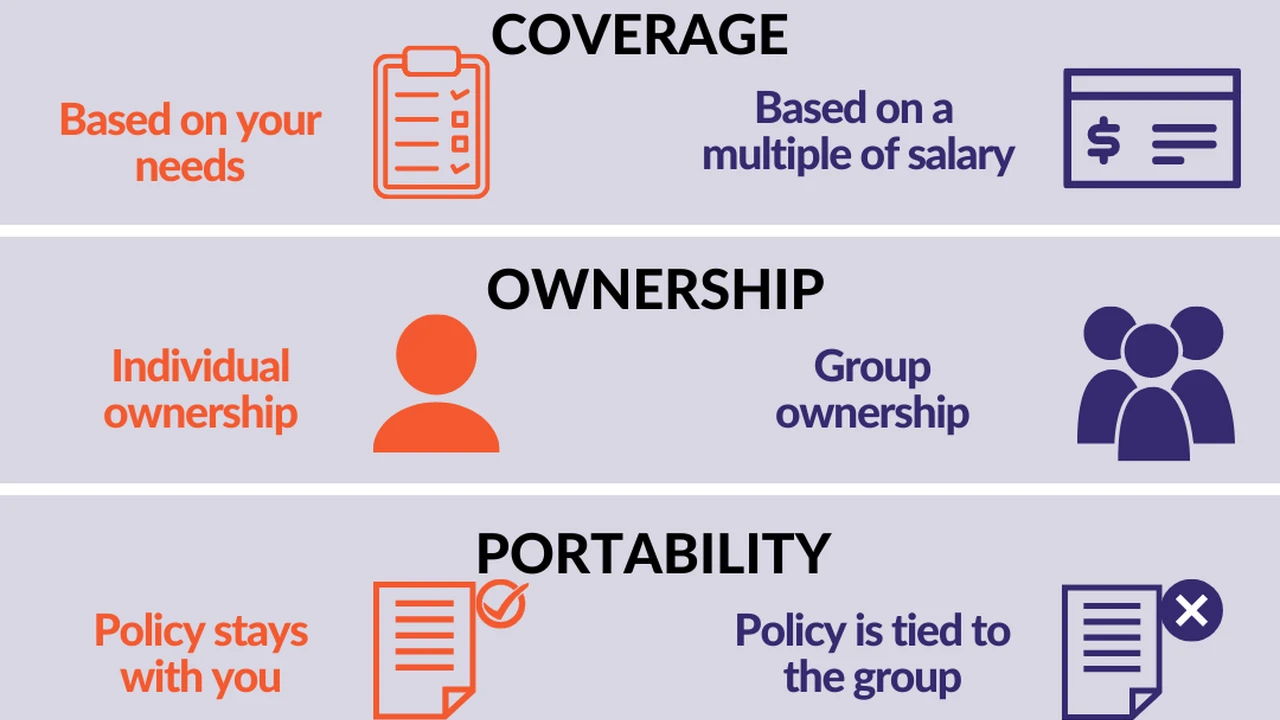

Group Life Insurance vs Individual Life Insurance: Weighing the Pros and Cons

You may have access to group life insurance through your employer. Group life insurance is typically less expensive than individual life insurance, but it may not provide enough coverage for your needs. It's important to weigh the pros and cons of each type of coverage.

Group Life Insurance:

- Pros: Typically less expensive than individual life insurance, easy to obtain, often offered as a benefit by employers.

- Cons: Coverage amount may be limited, coverage may end if you leave your job, may not be portable.

Individual Life Insurance:

- Pros: Customizable coverage amount, portable (coverage stays with you even if you change jobs), more control over policy features.

- Cons: Typically more expensive than group life insurance, requires individual underwriting.

Annual Review of Your Life Insurance Policy: Ensuring Adequate Coverage

Your life insurance needs may change over time as your financial situation and family circumstances evolve. It's important to review your policy annually to ensure that you have adequate coverage.

When to Review Your Life Insurance Policy:

- Marriage: Marriage may necessitate increased coverage to protect your spouse.

- Birth or Adoption of a Child: Adding a child to your family significantly increases your financial responsibilities.

- Purchase of a Home: A mortgage is a substantial debt that should be covered by life insurance.

- Job Change: A new job may offer different life insurance benefits.

- Significant Increase in Income: As your income increases, you may need more coverage to replace your lost earnings.

- Divorce: Divorce may require you to adjust your beneficiary designations and coverage amount.

No Medical Exam Life Insurance: Simplified Underwriting for Faster Approval

If you're concerned about undergoing a medical exam, you may consider no medical exam life insurance. These policies typically have a simplified underwriting process and don't require a medical exam. However, they may come with higher premiums and lower coverage amounts.

Types of No Medical Exam Life Insurance:

- Simplified Issue Life Insurance: Requires answering a few health questions.

- Guaranteed Issue Life Insurance: No health questions asked, but coverage amounts are typically limited.

Life Insurance for Seniors: Affordable Options for Older Adults

Life insurance for seniors can be more expensive than life insurance for younger adults, but there are still affordable options available. Consider term life insurance or final expense insurance to cover funeral costs and other end-of-life expenses.

Types of Life Insurance for Seniors:

- Term Life Insurance: Provides coverage for a specific period, typically 10 or 20 years.

- Final Expense Insurance: Designed to cover funeral costs and other end-of-life expenses.

- Guaranteed Acceptance Life Insurance: No health questions asked, but coverage amounts are typically limited.

Life Insurance for People with Pre-Existing Conditions: Finding Coverage Despite Health Challenges

If you have a pre-existing condition, such as diabetes, heart disease, or cancer, you may find it more challenging to obtain life insurance. However, it's still possible to find coverage. Work with an independent insurance broker who specializes in high-risk cases.

Tips for Finding Life Insurance with Pre-Existing Conditions:

- Work with an Independent Insurance Broker: An independent broker can help you find the best rates and coverage options from multiple insurers.

- Be Honest About Your Health History: Don't try to hide any pre-existing conditions. This could lead to your policy being canceled.

- Shop Around: Get quotes from multiple insurers to compare rates and coverage options.

- Consider a Guaranteed Acceptance Policy: If you have difficulty qualifying for traditional life insurance, consider a guaranteed acceptance policy.

Saving Money on Life Insurance: The Importance of Early Planning

The best way to save money on life insurance is to start planning early. The younger and healthier you are, the lower your premiums will be. Don't wait until you're older or have health problems to purchase life insurance. Start shopping around for quotes today and protect your loved ones' financial future.

Product Recommendations for Affordable Life Insurance

Based on our research and analysis, here are a few life insurance companies that consistently offer competitive rates and excellent customer service:

- Bestow: Offers affordable term life insurance with a completely online application process.

- Haven Life: Another popular online term life insurance provider with competitive rates and a simple application process. Haven Life is backed by MassMutual.

- Ladder: Offers flexible term life insurance with the ability to increase or decrease your coverage amount as your needs change.

- SelectQuote: An independent insurance broker that can help you compare quotes from multiple insurers.

- Policygenius: An online life insurance marketplace that allows you to compare quotes from multiple insurers side-by-side.

Detailed Product Comparison: Bestow vs Haven Life vs Ladder

Let's take a closer look at three of the top online term life insurance providers: Bestow, Haven Life, and Ladder.

Bestow:

- Coverage Amounts: $50,000 to $1.5 million

- Term Lengths: 10 to 30 years

- Age Range: 18 to 60

- Application Process: Completely online, no medical exam required for most applicants

- Key Features: Fast approval, affordable rates, no hidden fees

Haven Life:

- Coverage Amounts: $25,000 to $3 million

- Term Lengths: 10 to 30 years

- Age Range: 18 to 64

- Application Process: Mostly online, medical exam may be required for some applicants

- Key Features: Backed by MassMutual, competitive rates, Haven Life Plus rider (offers discounts on health and wellness products)

Ladder:

- Coverage Amounts: $100,000 to $3 million

- Term Lengths: 10 to 30 years

- Age Range: 20 to 60

- Application Process: Completely online, no medical exam required for most applicants

- Key Features: Flexible coverage (can increase or decrease coverage amount as needed), competitive rates, user-friendly website

Pricing Details for Sample Policies: A Cost Analysis

To give you a better idea of the cost of life insurance, let's look at some sample pricing for a 35-year-old male non-smoker in excellent health seeking a $500,000 term life policy with a 20-year term.

- Bestow: Approximately $25 per month

- Haven Life: Approximately $27 per month

- Ladder: Approximately $29 per month

Please note that these are just estimates and your actual rates may vary based on your individual circumstances.

Use Cases for Different Life Insurance Policies: Tailoring Coverage to Your Needs

Let's explore some specific use cases for different types of life insurance policies:

- Young Family with a Mortgage: A 30-year term life policy can provide affordable coverage to protect your family if you were to die before the mortgage is paid off and your children are grown.

- Business Owner: Key person insurance can protect your business if a key employee dies.

- Retiree: Final expense insurance can cover funeral costs and other end-of-life expenses.

- High-Net-Worth Individual: Permanent life insurance can be used for estate planning purposes.

Saving Money on Life Insurance: Expert Tips and Strategies

Here are some additional expert tips and strategies for saving money on life insurance:

- Shop Around: Get quotes from multiple insurers to compare rates and coverage options.

- Consider Term Life Insurance: Term life insurance is generally more affordable than permanent life insurance.

- Maintain a Healthy Lifestyle: Your health plays a significant role in determining your premiums.

- Avoid Riders You Don't Need: Riders can add to the cost of your policy.

- Pay Annually: Paying your premiums annually can save you money on administrative fees.

- Review Your Policy Regularly: Your needs may change over time. Review your policy annually to ensure that you have adequate coverage.

This comprehensive guide provides you with the knowledge and tools you need to save money on life insurance. By comparing quotes, understanding different policy types, and maintaining a healthy lifestyle, you can find the best coverage at the most affordable price. Remember to consult with a qualified financial advisor to determine the best life insurance strategy for your specific needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)