Life Insurance and Key Employee Retention

Understanding the Vital Link Between Life Insurance and Key Employee Retention

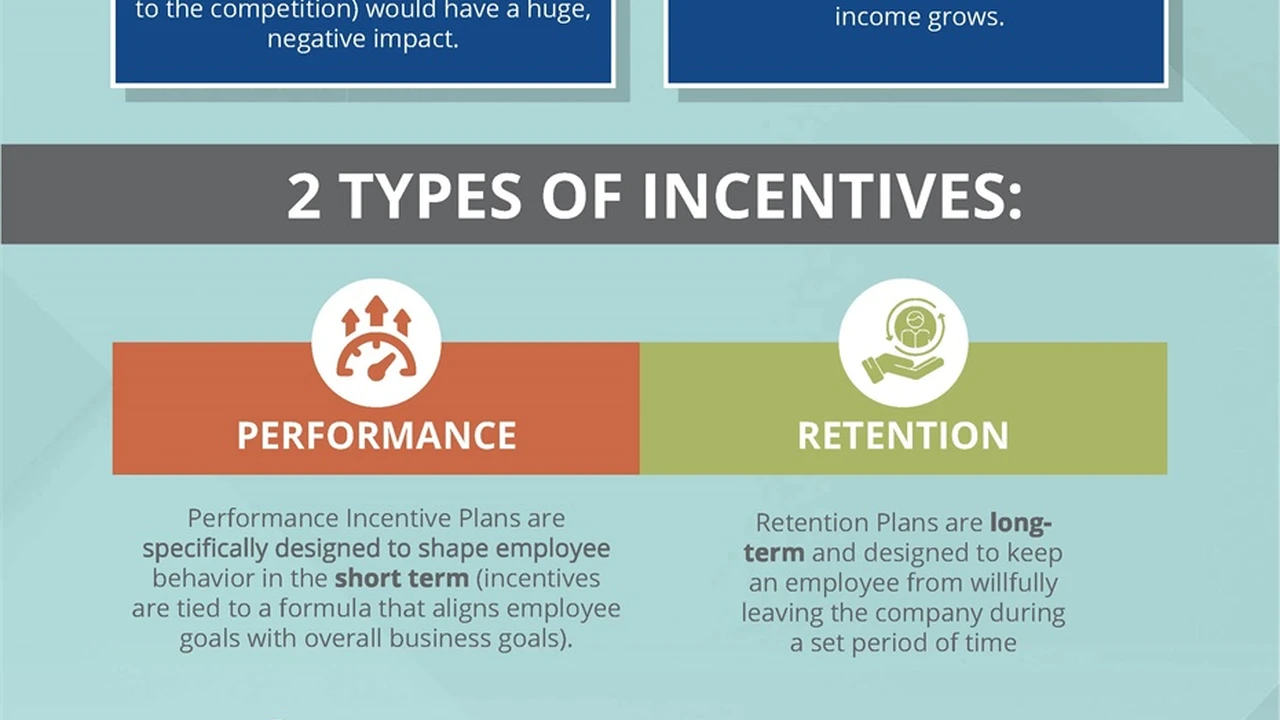

In today's competitive business landscape, retaining top talent is crucial for sustained success. Losing a key employee can disrupt operations, decrease productivity, and negatively impact morale. While competitive salaries and benefits packages are essential, innovative strategies like incorporating life insurance can provide an added layer of security and incentivization, fostering loyalty and commitment among your most valuable assets.

The Strategic Use of Life Insurance as a Retention Tool

Life insurance, often perceived as a tool for personal financial planning, can be strategically leveraged to enhance employee retention. By offering life insurance benefits tailored to key employees, companies can demonstrate their commitment to their well-being and future, strengthening the employer-employee bond.

Key Person Insurance: Protecting Your Business's Most Valuable Assets

Key person insurance is a type of life insurance policy that a company takes out on the life of a key employee. The company is the beneficiary and pays the premiums. This insurance provides a financial safety net in the event of the key employee's death or disability, allowing the company to cover the costs associated with replacing the employee, such as recruitment, training, and lost productivity.

Determining Who Qualifies as a Key Employee for Insurance Purposes

Identifying key employees is paramount. These are individuals whose contributions are vital to the company's success. They typically possess specialized skills, knowledge, or relationships that are difficult to replace. Consider factors such as their impact on revenue, their role in strategic decision-making, and the potential disruption caused by their absence.

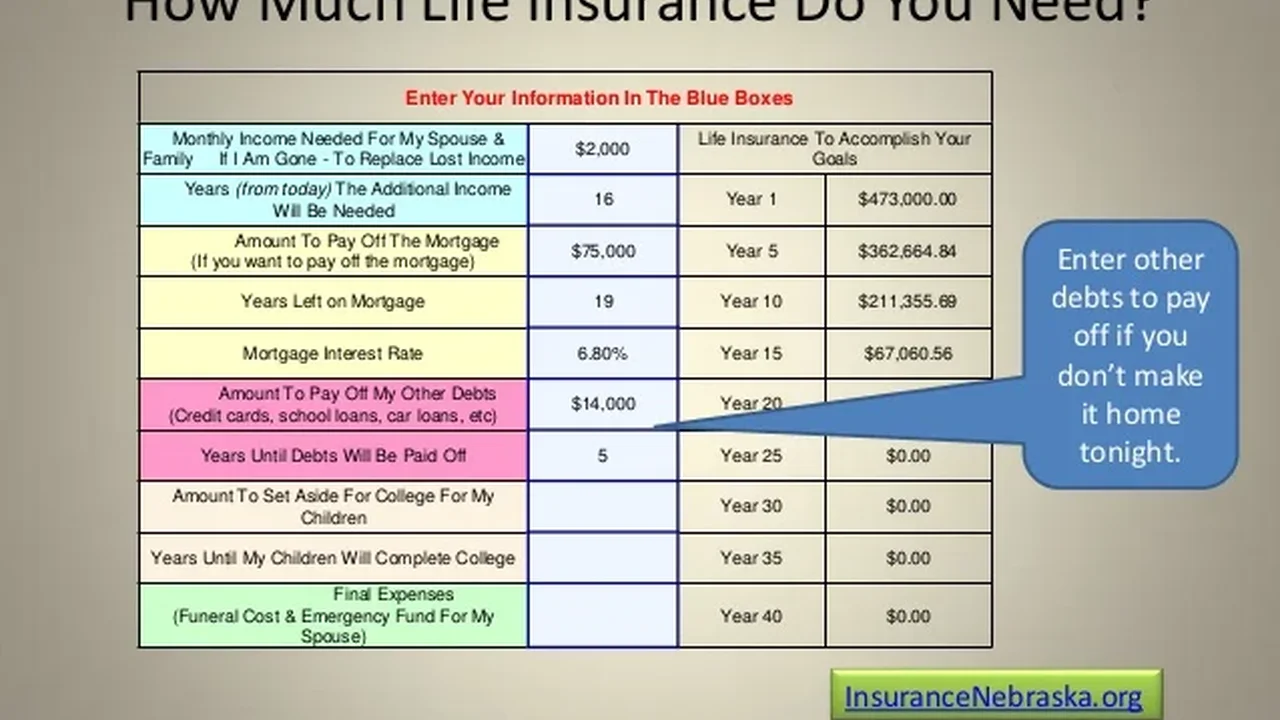

Calculating the Appropriate Coverage Amount for Key Person Insurance

Determining the appropriate coverage amount requires careful consideration of various factors. These include the key employee's salary, their contributions to revenue, the cost of replacing them, and the potential impact on profits. A common rule of thumb is to multiply the key employee's salary by a factor of 5 to 10, but a more thorough analysis is recommended.

The Tax Implications of Key Person Insurance for Businesses

Understanding the tax implications of key person insurance is crucial for maximizing its benefits. Generally, premiums paid for key person insurance are not tax-deductible, but the death benefit received is typically tax-free. Consult with a tax advisor to ensure compliance and optimize your tax strategy.

Executive Bonus Life Insurance: Rewarding and Retaining Top Performers

Executive bonus life insurance is a strategy where the company pays a bonus to the executive, which the executive then uses to purchase a life insurance policy. The executive owns the policy and can choose the beneficiary. This provides the executive with valuable life insurance coverage while also offering a tax-advantaged way to save for retirement.

How Executive Bonus Plans Work: A Step-by-Step Guide

Executive bonus plans are relatively straightforward to implement. The company establishes a plan, selects the executives to participate, and determines the bonus amount. The executive then uses the bonus to purchase a life insurance policy that meets their needs. The company reports the bonus as taxable income to the executive.

The Advantages of Executive Bonus Life Insurance for Employers and Employees

Executive bonus life insurance offers several advantages for both employers and employees. For employers, it provides a cost-effective way to attract and retain top talent. For employees, it provides valuable life insurance coverage and a tax-advantaged way to save for retirement. It also offers flexibility, as the executive owns the policy and can choose the beneficiary.

Comparing Executive Bonus Life Insurance to Other Executive Compensation Strategies

Executive bonus life insurance can be compared to other executive compensation strategies, such as stock options and deferred compensation. While stock options can provide significant upside potential, they also carry risk. Deferred compensation can provide tax benefits, but it may not be as flexible as executive bonus life insurance. Each strategy has its own advantages and disadvantages, and the best choice will depend on the specific circumstances.

Split-Dollar Life Insurance: Sharing the Costs and Benefits

Split-dollar life insurance is an arrangement where the employer and employee share the costs and benefits of a life insurance policy. There are several types of split-dollar arrangements, each with its own tax and legal implications. This strategy can be particularly attractive for companies looking to provide significant life insurance benefits to key employees without incurring the full cost.

Understanding the Different Types of Split-Dollar Arrangements

There are two main types of split-dollar arrangements: endorsement split-dollar and collateral assignment split-dollar. In an endorsement split-dollar arrangement, the employer owns the policy and endorses certain rights to the employee. In a collateral assignment split-dollar arrangement, the employee owns the policy and assigns certain rights to the employer as collateral for the employer's premium payments.

The Tax Implications of Split-Dollar Life Insurance for Employers and Employees

The tax implications of split-dollar life insurance can be complex and depend on the specific arrangement. Generally, the employee is taxed on the economic benefit of the life insurance coverage provided by the employer. The employer may be able to deduct the premiums paid, depending on the arrangement and applicable tax laws. Consulting with a tax advisor is crucial to ensure compliance.

When Split-Dollar Life Insurance Makes Sense: Use Cases and Examples

Split-dollar life insurance can be a valuable tool in various situations. For example, it can be used to provide key employees with substantial life insurance coverage while minimizing the cost to the company. It can also be used to fund buy-sell agreements or estate planning strategies. Consider a scenario where a company wants to provide a retiring executive with life insurance benefits. A split-dollar arrangement can allow the company to pay a portion of the premiums, providing the executive with valuable coverage while minimizing the tax burden.

Life Insurance Trusts: Protecting Assets and Providing for Loved Ones

Life insurance trusts can be used in conjunction with life insurance to provide additional estate planning benefits. A life insurance trust is an irrevocable trust that owns the life insurance policy. This can help to avoid estate taxes and ensure that the death benefit is used according to the insured's wishes.

The Benefits of Using Life Insurance Trusts for Estate Planning

Life insurance trusts offer several benefits for estate planning. They can help to avoid estate taxes, protect assets from creditors, and provide for loved ones in a tax-efficient manner. By transferring ownership of the life insurance policy to the trust, the death benefit is not included in the insured's estate, potentially reducing estate tax liability.

Setting Up a Life Insurance Trust: A Step-by-Step Guide

Setting up a life insurance trust requires careful planning and legal expertise. The first step is to establish the trust document, which outlines the terms of the trust, including the beneficiaries, trustees, and how the death benefit will be distributed. The next step is to transfer ownership of the life insurance policy to the trust. This requires notifying the insurance company and completing the necessary paperwork. Finally, it's important to fund the trust with sufficient assets to cover the ongoing expenses, such as trustee fees.

Choosing the Right Trustee for Your Life Insurance Trust

Choosing the right trustee is crucial for the success of a life insurance trust. The trustee is responsible for managing the trust assets and distributing the death benefit according to the terms of the trust. The trustee should be someone you trust implicitly and who is capable of handling the responsibilities of the role. Consider factors such as their financial acumen, their understanding of your wishes, and their willingness to act in the best interests of the beneficiaries.

Whole Life Insurance: Guaranteed Coverage and Cash Value Accumulation

Whole life insurance is a type of permanent life insurance that provides guaranteed coverage for the insured's entire life. It also includes a cash value component that grows over time on a tax-deferred basis. This cash value can be borrowed against or withdrawn, providing a source of liquidity.

Understanding the Features and Benefits of Whole Life Insurance

Whole life insurance offers several key features and benefits. It provides guaranteed death benefit protection for the insured's entire life. It also includes a cash value component that grows over time on a tax-deferred basis. The premiums are typically level, meaning they remain the same throughout the life of the policy. This provides predictability and peace of mind.

How Whole Life Insurance Can Be Used for Key Employee Retention

Whole life insurance can be used for key employee retention by offering it as part of an executive compensation package. The company can pay the premiums on a whole life policy for a key employee, and the employee can accumulate cash value over time. This provides the employee with a valuable benefit that can help to retain them.

Comparing Whole Life Insurance to Other Types of Life Insurance

Whole life insurance can be compared to other types of life insurance, such as term life insurance and universal life insurance. Term life insurance provides coverage for a specific period of time, while universal life insurance offers more flexibility in terms of premiums and death benefit. Whole life insurance provides guaranteed coverage and cash value accumulation, making it a suitable option for long-term financial planning.

Product Recommendation: New York Life Whole Life Insurance

New York Life offers a comprehensive whole life insurance product with competitive rates and strong financial stability. Their whole life policies offer guaranteed death benefit protection, level premiums, and tax-deferred cash value accumulation. They also offer various riders that can be added to the policy to customize coverage.

New York Life Whole Life Insurance: Pricing and Details

The pricing of New York Life's whole life insurance policies depends on several factors, including the insured's age, health, and the amount of coverage desired. Generally, premiums are higher for older individuals and those with health conditions. The cash value growth rate is guaranteed and can vary depending on the specific policy. Contact a New York Life agent for a personalized quote.

Universal Life Insurance: Flexible Coverage and Investment Options

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life insurance. It allows the policyholder to adjust the premiums and death benefit within certain limits. It also offers a cash value component that grows based on the performance of underlying investment options.

Exploring the Flexibility and Investment Potential of Universal Life Insurance

Universal life insurance offers significant flexibility. The policyholder can adjust the premiums and death benefit to meet their changing needs. The cash value grows based on the performance of underlying investment options, such as stocks, bonds, and money market accounts. This provides the potential for higher returns compared to whole life insurance, but also carries more risk.

Using Universal Life Insurance to Supplement Retirement Savings

Universal life insurance can be used to supplement retirement savings. The cash value can grow tax-deferred, providing a source of income in retirement. It can also be used to fund long-term care expenses or other financial needs.

Comparing Universal Life Insurance to Variable Life Insurance

Universal life insurance can be compared to variable life insurance. Variable life insurance also offers investment options, but the cash value is directly linked to the performance of the underlying investments. This provides the potential for higher returns, but also carries more risk. Universal life insurance offers more guarantees and flexibility compared to variable life insurance.

Product Recommendation: Transamerica Financial Foundation IUL

Transamerica's Financial Foundation IUL is a solid Indexed Universal Life product. It offers a death benefit, and the potential for cash value growth linked to an index like the S&P 500, but with downside protection.

Transamerica Financial Foundation IUL: Pricing and Details

Transamerica IUL policy costs vary based on age, health, coverage amount, and the chosen index crediting strategy. It's important to compare quotes and fully understand the potential fees and charges associated with the policy. Contact a Transamerica agent for a personalized quote and policy details.

Term Life Insurance: Affordable Coverage for a Specific Period

Term life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years. It is the most affordable type of life insurance, making it a popular choice for individuals who need coverage for a specific purpose, such as paying off a mortgage or raising children.

The Simplicity and Affordability of Term Life Insurance

Term life insurance is simple and affordable. It provides coverage for a specific period of time, and the premiums are typically lower than those for permanent life insurance. This makes it a suitable option for individuals who need coverage for a specific period and want to minimize their costs.

Using Term Life Insurance to Protect Your Family's Financial Future

Term life insurance can be used to protect your family's financial future. If you die during the term of the policy, the death benefit will be paid to your beneficiaries, providing them with financial security. This can help to cover expenses such as mortgage payments, education costs, and living expenses.

Comparing Term Life Insurance to Permanent Life Insurance

Term life insurance can be compared to permanent life insurance. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the insured's entire life. Term life insurance is typically more affordable, but it does not offer cash value accumulation. Permanent life insurance is more expensive, but it offers guaranteed coverage and cash value accumulation.

Product Recommendation: SelectQuote Term Life Insurance Comparison

SelectQuote is a broker that allows you to compare term life insurance quotes from multiple companies. This allows you to find the best rates and coverage for your needs. They work with many highly rated companies like Protective, Prudential, and Transamerica.

SelectQuote Term Life Insurance Comparison: Pricing and Details

Term life insurance costs through SelectQuote will vary greatly based on age, health, coverage amount, and the term length. Get a free quote through their website or by calling one of their agents to find the best policy for you.

Group Life Insurance: Employer-Sponsored Coverage for Employees

Group life insurance is a type of life insurance that is offered by employers to their employees as part of a benefits package. It typically provides a death benefit equal to one or two times the employee's salary. Group life insurance can be a valuable benefit for employees, but it may not provide sufficient coverage for all needs.

The Benefits and Limitations of Employer-Sponsored Group Life Insurance

Group life insurance offers several benefits for employees. It provides affordable coverage, often without requiring a medical exam. It can also be a valuable benefit for attracting and retaining employees. However, group life insurance typically provides a limited death benefit, and the coverage may not be portable if the employee leaves the company.

Using Group Life Insurance in Conjunction with Individual Life Insurance

Group life insurance can be used in conjunction with individual life insurance. Employees can supplement their group life insurance coverage with individual life insurance to ensure they have sufficient coverage to meet their needs. This can provide additional peace of mind and financial security for their families.

The Role of Group Life Insurance in Employee Benefits Packages

Group life insurance plays an important role in employee benefits packages. It is a valuable benefit for attracting and retaining employees, and it can provide them with financial security. Employers should carefully consider the benefits and limitations of group life insurance when designing their employee benefits packages.

The Importance of Regular Policy Review and Adjustments

Life insurance needs can change over time due to factors such as changes in income, family size, and financial goals. It is important to regularly review your life insurance policies and make adjustments as needed to ensure that you have adequate coverage.

Factors to Consider When Reviewing Your Life Insurance Coverage

When reviewing your life insurance coverage, consider factors such as your income, debts, assets, and family size. Also, consider your financial goals, such as providing for your children's education or ensuring your spouse's financial security in retirement. Based on these factors, you can determine whether you have adequate coverage to meet your needs.

Making Adjustments to Your Life Insurance Policies to Meet Changing Needs

If your life insurance needs have changed, you may need to make adjustments to your policies. This could involve increasing or decreasing the death benefit, changing the beneficiaries, or adding riders to the policy. Consult with a financial advisor to determine the best course of action.

Seeking Professional Guidance for Life Insurance Planning

Life insurance planning can be complex, and it is important to seek professional guidance from a qualified financial advisor. A financial advisor can help you assess your needs, compare different types of life insurance policies, and develop a comprehensive financial plan that includes life insurance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

-A-Powerful-Tool.webp)