How to Find a Lost Life Insurance Policy

Understanding the Importance of Life Insurance Policy Management

Life insurance is a cornerstone of financial planning, providing a safety net for loved ones in the event of an untimely passing. But what happens when the policy gets lost or misplaced? This is a more common scenario than you might think. The good news is, finding a lost life insurance policy is often achievable with a systematic approach. This article will guide you through the steps, resources, and even some product recommendations to ensure your family's future is secure.

Why Life Insurance Policies Go Missing

Before diving into the "how-to," let's understand why life insurance policies disappear in the first place. Several factors contribute to this:

- Moving Residences: Families relocate frequently, and important documents can get lost in the shuffle.

- Poor Record-Keeping: Over time, paperwork accumulates, and critical documents like life insurance policies can become buried.

- Estate Planning Neglect: Sometimes, policy details aren't properly integrated into estate planning, leading to confusion after the policyholder's death.

- Policy Transfers and Mergers: Insurance companies merge or are acquired, and notification of these changes might not reach the policyholder or beneficiaries.

- Simply Forgetting: Years can pass, and the policyholder might forget the details of a policy they purchased long ago.

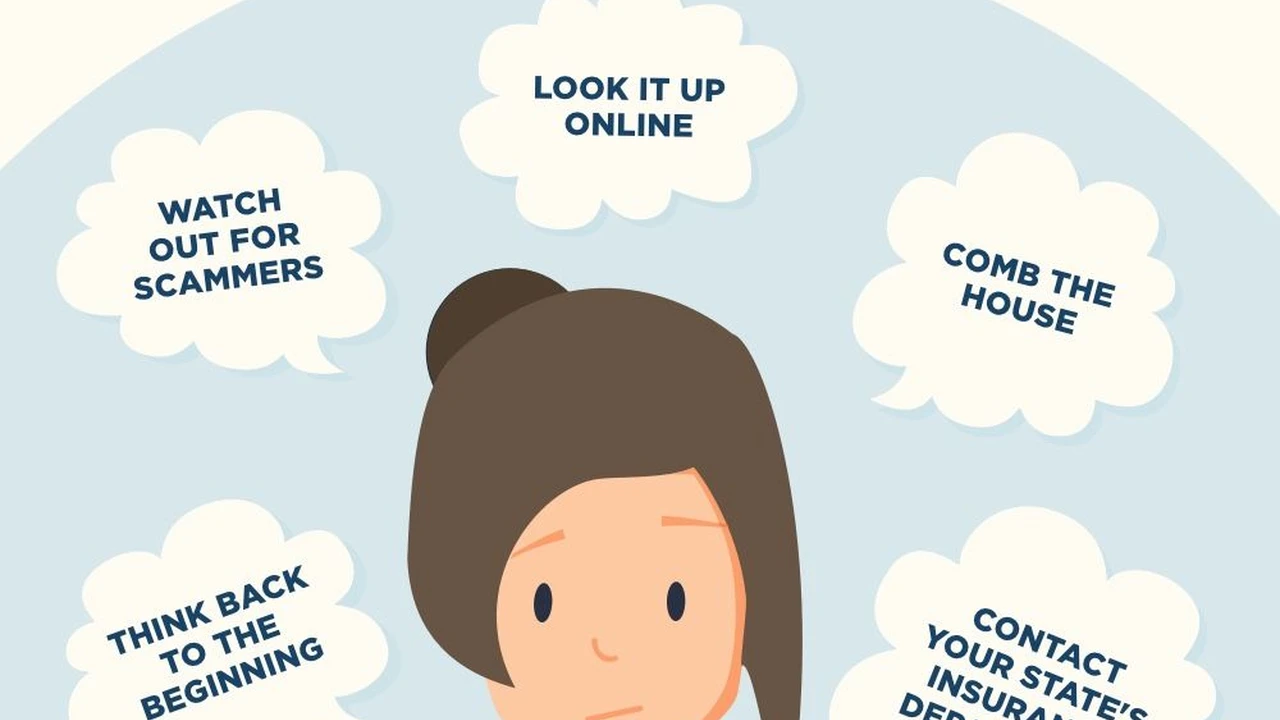

Initial Steps in Locating a Lost Life Insurance Policy

Don't panic! The first steps involve some basic detective work:

- Check Personal Records: Thoroughly search your own files, including bank statements, tax returns, and old correspondence. Look for premium payments made to an insurance company.

- Contact the Policyholder's Bank: Banks often have records of payments made to insurance companies.

- Review Employer Benefits: If the policyholder was employed, check with their former employer's HR department for information on group life insurance policies.

- Talk to Family Members: Family members might have knowledge of the policy or its location.

- Consult with the Policyholder's Attorney or Financial Advisor: They may have records of the policy or be able to provide guidance.

Leveraging the MIB Group for Life Insurance Policy Searches

The MIB Group (formerly the Medical Information Bureau) is a valuable resource for locating lost life insurance policies. It's a non-profit organization that maintains records of life insurance applications. Here's how to leverage it:

- MIB Policy Locator Service: The MIB Policy Locator Service can search its database to determine if the deceased individual applied for life insurance.

- How it Works: Authorized beneficiaries or legal representatives can submit a request to the MIB. The MIB then contacts its member insurance companies to see if they have a matching policy.

- Important Considerations: The MIB only tracks applications, not issued policies. Therefore, a positive match doesn't guarantee a policy exists, but it's a strong lead.

Contacting State Insurance Departments for Policy Information

Each state has an insurance department that regulates insurance companies operating within its borders. These departments can be helpful in locating lost policies:

- Unclaimed Property Divisions: Many state insurance departments have unclaimed property divisions that hold funds from unclaimed life insurance policies.

- How to Search: Visit the website of the state insurance department where the policyholder resided and search their unclaimed property database.

- Information Required: You'll typically need the policyholder's name, date of birth, and last known address.

Utilizing the National Association of Insurance Commissioners (NAIC)

The NAIC is an organization that coordinates state insurance regulators. While they don't directly locate policies, they offer resources that can be helpful:

- State Insurance Department Directory: The NAIC website provides a directory of state insurance departments, making it easy to find contact information.

- Consumer Information: The NAIC offers educational materials on life insurance and policy management.

Understanding the Life Insurance Policy Claim Process

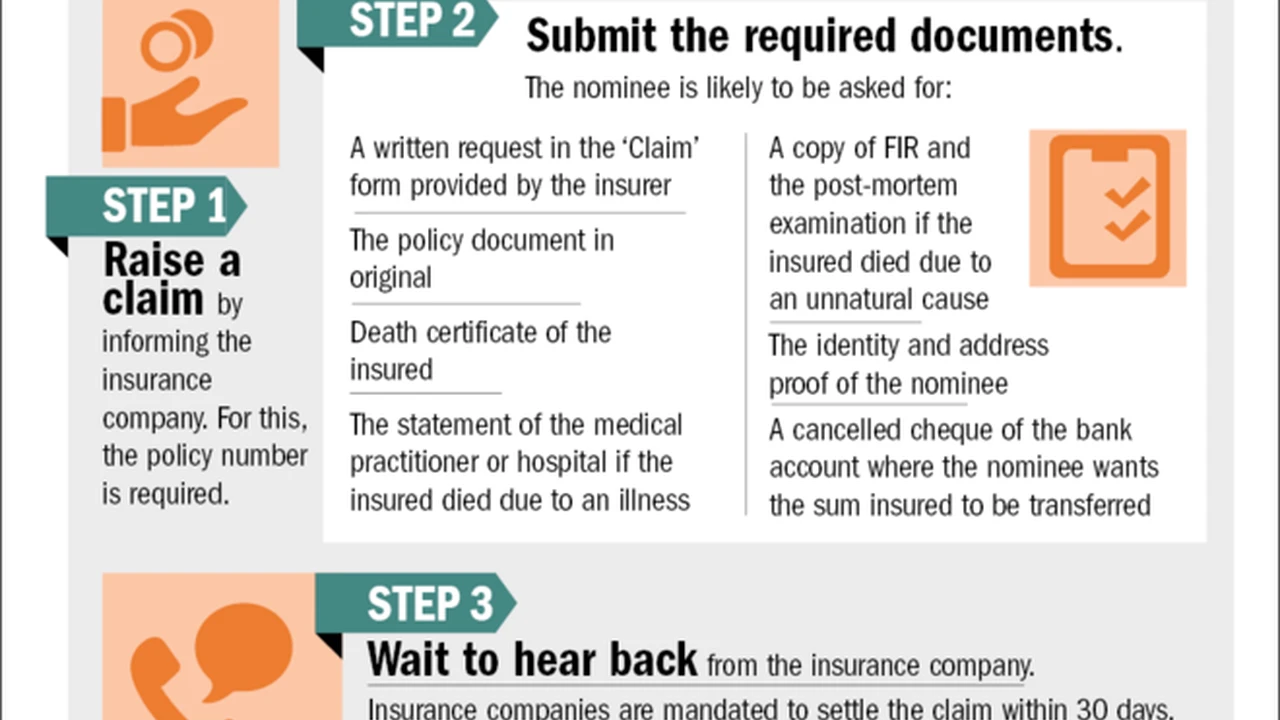

Once you've located the policy, understanding the claim process is crucial:

- Notification of Death: Notify the insurance company of the policyholder's death as soon as possible.

- Claim Forms: The insurance company will provide claim forms to be completed by the beneficiary.

- Required Documentation: You'll typically need a certified copy of the death certificate, the policy document, and proof of identification.

- Review and Processing: The insurance company will review the claim and process the payment if it's approved.

Common Reasons for Life Insurance Claim Denials and How to Avoid Them

Life insurance claims can be denied for various reasons. Understanding these reasons can help you avoid potential pitfalls:

- Misrepresentation or Fraud: Providing false information on the application can lead to claim denial.

- Lapse in Premium Payments: If premiums aren't paid on time, the policy can lapse, resulting in no coverage.

- Suicide Clause: Most policies have a suicide clause that excludes coverage if the policyholder dies by suicide within a certain period (usually two years) after the policy's inception.

- Contestability Period: The insurance company has a limited time (usually two years) to contest the policy based on misrepresentations in the application.

- Excluded Activities: Some policies exclude coverage for deaths resulting from certain activities, such as extreme sports.

Product Recommendations for Life Insurance Policy Management Software

Several software solutions can help individuals and families manage their life insurance policies effectively. Here are some recommendations:

Everplans

Everplans is a digital estate planning platform that allows you to store and organize all your important documents, including life insurance policies. It offers a secure and centralized location to keep track of policy details, beneficiary information, and other relevant information.

- Use Cases: Ideal for individuals and families who want to create a comprehensive estate plan and ensure their loved ones have access to critical information.

- Features: Document storage, task management, beneficiary designations, and secure sharing.

- Pricing: Offers various subscription plans based on features and storage capacity. Typically ranges from $75 to $300 per year.

- Detailed Information: Everplans provides a user-friendly interface and robust security features. It also offers educational resources on estate planning.

LifeSite

LifeSite is another digital vault that allows you to store and manage important documents, including life insurance policies. It offers a secure and organized way to keep track of your financial information.

- Use Cases: Suitable for individuals and families who want a secure and organized way to manage their financial documents.

- Features: Document storage, secure sharing, password management, and emergency access.

- Pricing: Offers various subscription plans based on storage capacity and features. Typically ranges from $50 to $200 per year.

- Detailed Information: LifeSite provides a secure and easy-to-use platform. It also offers features for managing other important documents, such as wills and trusts.

Trustworthy

Trustworthy is a family operating system that helps you organize and manage your family's important information, including life insurance policies. It offers a centralized location to keep track of policy details, beneficiary information, and other relevant information.

- Use Cases: Ideal for families who want a comprehensive solution for managing all their important information.

- Features: Document storage, task management, password management, and secure sharing.

- Pricing: Offers a subscription plan for families. Typically around $240 per year.

- Detailed Information: Trustworthy provides a user-friendly interface and robust security features. It also offers features for managing other aspects of family life, such as finances and healthcare.

Comparing Life Insurance Policy Management Software Options

Choosing the right policy management software depends on your individual needs and preferences. Here's a comparison of the features and pricing of the options mentioned above:

| Software | Document Storage | Task Management | Secure Sharing | Password Management | Pricing (Approximate) |

|---|---|---|---|---|---|

| Everplans | Yes | Yes | Yes | No | $75 - $300 per year |

| LifeSite | Yes | No | Yes | Yes | $50 - $200 per year |

| Trustworthy | Yes | Yes | Yes | Yes | $240 per year |

The Role of a Life Insurance Agent in Policy Management

A life insurance agent can play a crucial role in policy management, especially when dealing with complex situations or lost policies:

- Policy Review and Analysis: An agent can review your existing policies and help you understand their terms and conditions.

- Policy Locator Assistance: An agent can assist you in locating lost policies by contacting insurance companies and utilizing industry resources.

- Claim Assistance: An agent can guide you through the claim process and help you navigate any challenges that may arise.

- Ongoing Support: An agent can provide ongoing support and answer any questions you may have about your policies.

Specific Use Cases for Finding a Lost Life Insurance Policy

Let's consider some specific scenarios where finding a lost life insurance policy becomes critical:

Scenario 1: Elderly Parent Passes Away

An elderly parent passes away, and their children are tasked with settling their estate. They suspect their parent had a life insurance policy but can't find any documentation. In this case, the children should:

- Search the parent's personal records, bank statements, and tax returns.

- Contact the parent's bank, attorney, and financial advisor.

- Utilize the MIB Policy Locator Service.

- Check the state insurance department's unclaimed property database.

Scenario 2: Spouse Dies Unexpectedly

A spouse dies unexpectedly, and the surviving spouse needs to locate their life insurance policy to provide financial support for their family. In this situation, the surviving spouse should:

- Search their shared personal records and bank statements.

- Contact the deceased spouse's employer and former employers.

- Utilize the MIB Policy Locator Service.

- Consult with a life insurance agent for assistance.

Scenario 3: Updating Beneficiary Designations

An individual needs to update the beneficiary designations on their life insurance policy but can't find the policy document. In this case, the individual should:

- Contact the insurance company directly.

- Provide their policy number or other identifying information.

- Request a copy of the policy document and beneficiary designation form.

The Long-Term Benefits of Organized Policy Management

Implementing a system for organized policy management offers numerous long-term benefits:

- Peace of Mind: Knowing that your policies are organized and accessible provides peace of mind.

- Reduced Stress: Organized policy management reduces stress during difficult times, such as after a death or disability.

- Efficient Claims Processing: Having all the necessary information readily available streamlines the claims process.

- Financial Security: Organized policy management ensures that your loved ones receive the financial benefits they're entitled to.

- Estate Planning Efficiency: Organized policy information facilitates estate planning and ensures that your wishes are carried out.

Advanced Search Techniques for Finding Lost Policies

If the initial steps haven't yielded results, consider these advanced search techniques:

- Contact Former Insurance Agents: The policyholder may have worked with an insurance agent in the past who may have records of the policy.

- Search Old Email Accounts: Old email accounts may contain correspondence related to the life insurance policy.

- Check Safe Deposit Boxes: Important documents, including life insurance policies, are sometimes stored in safe deposit boxes.

- Review Credit Card Statements: Credit card statements may show payments made to insurance companies.

- Consider Professional Search Services: There are professional search services that specialize in locating lost life insurance policies. These services typically charge a fee for their services.

Understanding the Legal Aspects of Life Insurance Policies

It's important to understand the legal aspects of life insurance policies, including:

- Insurable Interest: The policyholder must have an insurable interest in the insured individual. This means they must have a financial or emotional connection to the insured that would cause them to suffer a loss if the insured were to die.

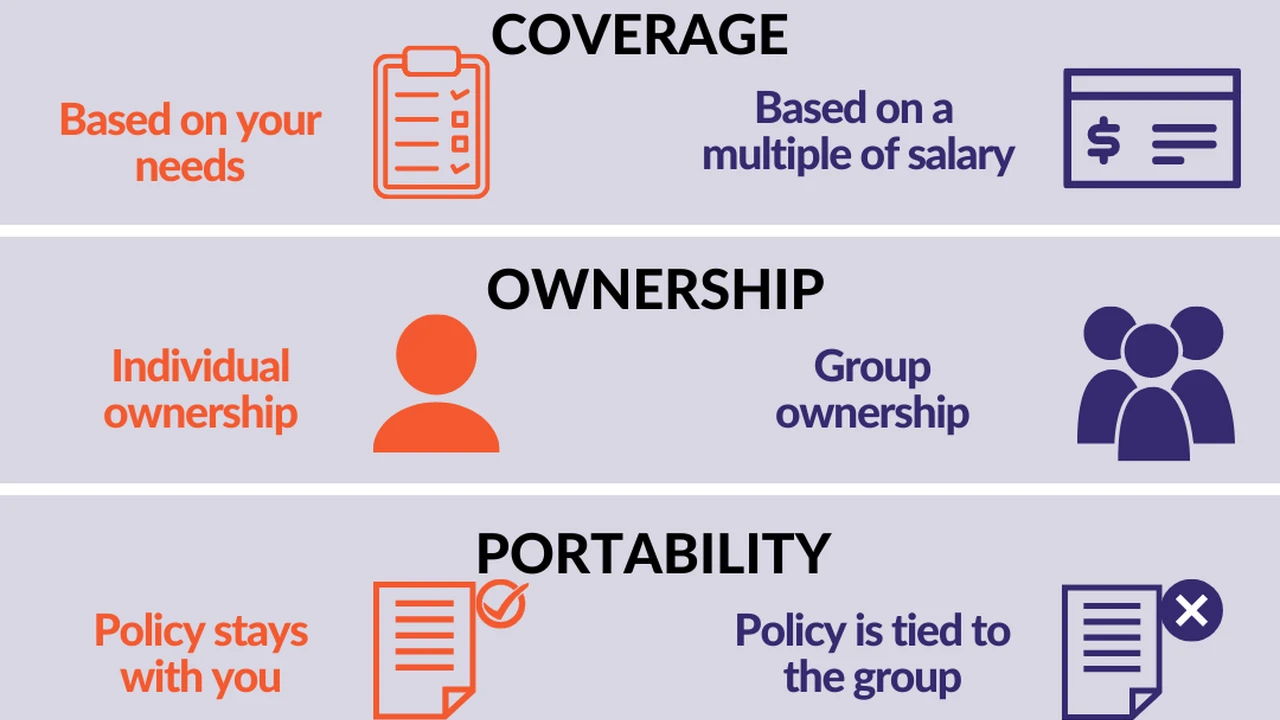

- Beneficiary Designations: Beneficiary designations determine who will receive the policy proceeds upon the insured's death.

- Policy Ownership: Policy ownership determines who has the right to make changes to the policy, such as changing beneficiary designations or surrendering the policy.

- Assignment of Policies: Life insurance policies can be assigned to another party, such as a creditor.

- Tax Implications: Life insurance proceeds are generally tax-free to the beneficiary, but there may be estate tax implications.

The Future of Life Insurance Policy Management

The future of life insurance policy management is likely to be increasingly digital and automated:

- Digital Policy Storage: More insurance companies are offering digital policy storage options, allowing policyholders to access their documents online.

- Automated Policy Tracking: Software solutions are emerging that automatically track policy details and provide alerts for important events, such as premium due dates.

- AI-Powered Policy Analysis: Artificial intelligence is being used to analyze policy terms and conditions and identify potential risks or opportunities.

- Blockchain Technology: Blockchain technology could be used to create a secure and transparent record of life insurance policies.

Choosing the Right Life Insurance Policy for Your Needs

While this article focuses on finding lost policies, it's also important to choose the right life insurance policy in the first place. Consider these factors:

- Coverage Amount: Determine how much coverage you need to protect your loved ones financially.

- Policy Type: Choose between term life insurance and permanent life insurance based on your needs and budget.

- Insurance Company: Select a reputable insurance company with a strong financial rating.

- Policy Riders: Consider adding riders to your policy to customize your coverage.

- Cost: Compare quotes from multiple insurance companies to find the best price.

Life Insurance Needs Analysis: Determining the Right Coverage Amount

A life insurance needs analysis helps you determine the appropriate amount of coverage based on your individual circumstances. Consider these factors:

- Outstanding Debts: Calculate your outstanding debts, including mortgages, loans, and credit card balances.

- Future Expenses: Estimate future expenses, such as college tuition and childcare costs.

- Income Replacement: Determine how much income your family will need to replace if you were to die.

- Final Expenses: Account for funeral costs and other final expenses.

Term Life Insurance vs Permanent Life Insurance

Understanding the difference between term and permanent life insurance is crucial for making the right choice:

- Term Life Insurance: Provides coverage for a specific period of time (the "term"). It's typically less expensive than permanent life insurance.

- Permanent Life Insurance: Provides coverage for your entire life. It includes a cash value component that grows over time.

Popular Life Insurance Companies and Their Offerings

Here are some popular life insurance companies and their offerings:

- New York Life: Offers a wide range of life insurance products, including term, whole life, and universal life.

- Northwestern Mutual: Specializes in permanent life insurance and financial planning services.

- State Farm: Offers a variety of insurance products, including term and whole life insurance.

- Prudential: Provides life insurance, annuities, and other financial services.

- Transamerica: Offers a range of life insurance products, including term, whole life, and indexed universal life.

The Importance of Regularly Reviewing Your Life Insurance Policy

It's important to review your life insurance policy periodically to ensure it still meets your needs. Consider these factors:

- Changes in Family Circumstances: Review your policy after major life events, such as marriage, divorce, or the birth of a child.

- Changes in Income: Review your policy if your income increases or decreases significantly.

- Changes in Debt: Review your policy if your debt levels change.

- Changes in Financial Goals: Review your policy if your financial goals change.

Seeking Professional Financial Advice for Life Insurance Planning

Consulting with a qualified financial advisor can help you make informed decisions about life insurance planning. A financial advisor can:

- Assess Your Needs: Help you determine how much coverage you need.

- Compare Policy Options: Compare policy options from different insurance companies.

- Develop a Financial Plan: Integrate life insurance into your overall financial plan.

- Provide Ongoing Support: Provide ongoing support and answer any questions you may have.

Key Takeaways for Finding and Managing Life Insurance Policies

Finding and managing life insurance policies requires a proactive and organized approach. Remember these key takeaways:

- Start with the Basics: Search personal records, bank statements, and tax returns.

- Utilize Available Resources: Leverage the MIB Group, state insurance departments, and the NAIC.

- Consider Policy Management Software: Explore software options like Everplans, LifeSite, and Trustworthy.

- Seek Professional Assistance: Consult with a life insurance agent or financial advisor.

- Stay Organized: Implement a system for organized policy management.

By following these steps, you can increase your chances of finding a lost life insurance policy and ensure that your loved ones are financially protected.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)