Life Insurance and Annuities_ A Combined Approach

Understanding the Synergy Life Insurance and Annuities

Let's dive into the fascinating world where life insurance and annuities meet. On the surface, they might seem like completely different financial instruments. Life insurance, you know, protects your loved ones in case something happens to you. Annuities, on the other hand, are all about creating a steady income stream, often in retirement. But what if I told you they could work together, hand in glove, to achieve a more comprehensive financial plan?

The core idea is that life insurance addresses the "what if" scenarios – the unexpected loss of income due to death. Annuities address the "what then" – ensuring you have a reliable income source during your golden years. By combining them, you're essentially hedging against both premature death and outliving your savings.

Life Insurance A Safety Net For Your Loved Ones

Before we explore the combined strategy, let's quickly recap what life insurance is all about. It's a contract between you and an insurance company. You pay premiums, and in exchange, the insurer promises to pay a death benefit to your beneficiaries upon your death. There are primarily two types of life insurance:

- Term Life Insurance: This provides coverage for a specific term, like 10, 20, or 30 years. It's generally more affordable than permanent life insurance, but it doesn't accumulate cash value. If you outlive the term, the coverage ends unless you renew it (usually at a higher premium).

- Permanent Life Insurance: This type provides lifelong coverage and also builds cash value over time. Popular types of permanent life insurance include whole life, universal life, and variable life. The cash value grows tax-deferred and can be borrowed against or withdrawn.

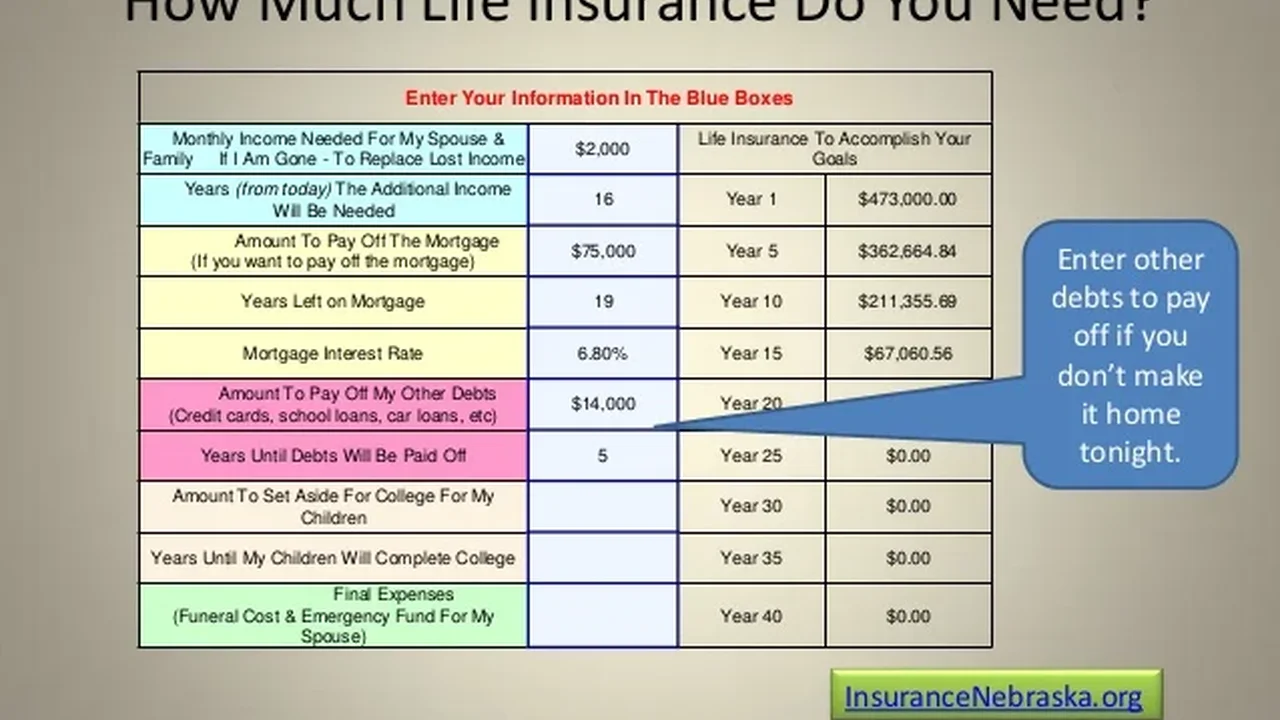

The death benefit from life insurance can be used to cover various expenses, such as:

- Funeral costs

- Outstanding debts (mortgage, loans, credit card bills)

- Living expenses for your family

- College tuition for your children

- Estate taxes

Annuities A Guaranteed Income Stream For Retirement

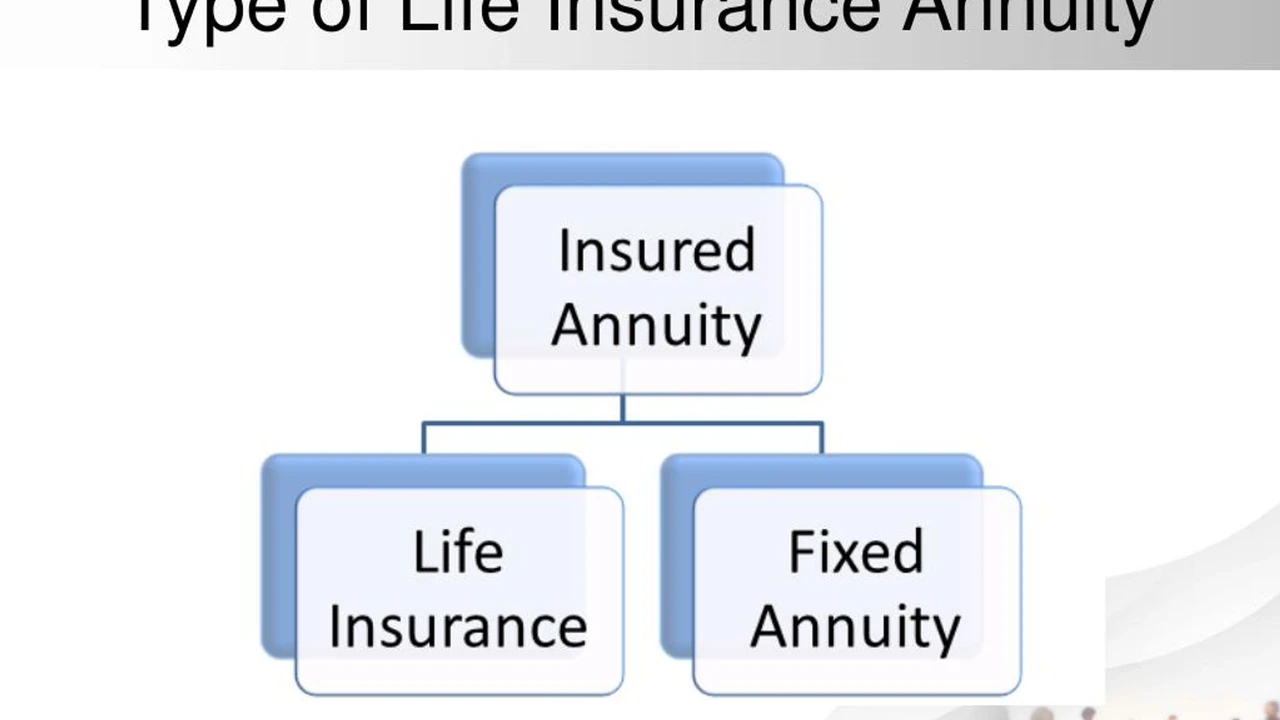

Now, let's turn our attention to annuities. An annuity is a contract between you and an insurance company where you make either a lump-sum payment or a series of payments, and in return, the insurer promises to pay you a stream of income, either immediately or in the future. There are two main types of annuities:

- Immediate Annuities: These start paying you income almost immediately after you purchase them. They're often used by retirees who want a guaranteed income stream for life.

- Deferred Annuities: These accumulate value over time and start paying you income at a later date, typically during retirement. They can be further categorized into fixed, variable, and indexed annuities.

Here's a quick breakdown of deferred annuity types:

- Fixed Annuities: These offer a guaranteed interest rate on your investment. They're the most conservative type of annuity.

- Variable Annuities: These allow you to invest your money in a variety of subaccounts, similar to mutual funds. Your returns will fluctuate based on the performance of these investments. They offer the potential for higher returns but also come with more risk.

- Indexed Annuities: These link your returns to the performance of a specific market index, such as the S&P 500. They offer a balance between fixed and variable annuities, providing some upside potential while also protecting you from downside risk.

Combining Life Insurance and Annuities Strategic Applications

So, how do we combine these two powerful tools? Here are a few strategic applications:

Funding Retirement With Life Insurance Cash Value and Annuities

One popular strategy involves using the cash value of a permanent life insurance policy to fund an annuity. Let's say you have a whole life policy that has accumulated a significant cash value. You could surrender the policy (or take a loan against it) and use the proceeds to purchase an immediate annuity. This provides you with a guaranteed income stream for life, while still having the peace of mind knowing that your loved ones are protected by the death benefit of the original life insurance policy (or a smaller policy purchased with remaining funds).

Example: John, age 65, has a whole life policy with a cash value of $200,000. He decides to surrender the policy and use the $200,000 to purchase an immediate annuity. Based on current annuity rates, he can expect to receive a monthly income of approximately $1,200 for the rest of his life. He also purchases a smaller term life policy for $100,000 to provide some continued coverage for his wife.

Using Annuities To Protect Against Longevity Risk And Life Insurance For Legacy Planning

Another strategy involves using an annuity to protect against longevity risk (the risk of outliving your savings) and life insurance for legacy planning. You could purchase an annuity to provide a guaranteed income stream for life, ensuring that you have enough money to cover your expenses, even if you live to be 100. Then, you could purchase a life insurance policy to leave a legacy for your heirs. This strategy allows you to enjoy your retirement without worrying about running out of money, while also ensuring that your loved ones are taken care of after you're gone.

Example: Mary, age 70, is concerned about outliving her savings. She purchases a deferred annuity that will start paying her income at age 80. She also purchases a life insurance policy to leave a legacy for her grandchildren. This strategy provides her with peace of mind knowing that she will have enough money to cover her expenses in retirement and that her grandchildren will receive a financial inheritance.

Bridging The Gap During Early Retirement Using Annuities And Life Insurance

A third strategy involves using annuities to bridge the gap during early retirement. Let's say you retire early, before you're eligible for Social Security or pension benefits. You could purchase an annuity to provide income during this period, supplementing your savings and allowing you to delay claiming Social Security, which can result in a higher benefit later on. You can then use a life insurance policy to protect your family in case of premature death during this transition period.

Example: Robert, age 62, retires early. He purchases an immediate annuity to provide income until he turns 66, when he will be eligible for Social Security. He also purchases a term life insurance policy to protect his wife in case he dies before age 66.

Specific Product Recommendations Integrating Life Insurance and Annuities

Now, let's get into some specific product recommendations that can help you implement this combined strategy. Keep in mind that these are just examples, and you should always consult with a qualified financial advisor to determine the best products for your individual circumstances.

For Cash Value Funding Of Annuities Consider Whole Life Insurance Policies

If you're looking to use the cash value of a life insurance policy to fund an annuity, consider a whole life policy from a reputable insurer like New York Life, Northwestern Mutual, or MassMutual. These companies have strong financial ratings and offer competitive dividend rates, which can help your cash value grow over time. Look for policies with guaranteed cash value growth and the option to take policy loans.

Product Example: New York Life Whole Life. This policy offers guaranteed cash value growth, a death benefit, and the option to take policy loans. It also pays dividends, which can further increase the cash value of the policy.

For Longevity Risk Protection Consider Fixed Annuities

To protect against longevity risk, consider a fixed annuity from a company like Athene, Global Atlantic, or Allianz. These companies offer competitive interest rates and a variety of payout options. Look for annuities with guaranteed lifetime income options and the ability to add a cost-of-living adjustment (COLA) to your payments.

Product Example: Athene MaxRate Fixed Annuity. This annuity offers a guaranteed interest rate for a specific period of time, such as 5 or 7 years. It also offers a variety of payout options, including a lifetime income option.

For Bridging The Gap To Retirement Consider Immediate Annuities

For bridging the gap during early retirement, consider an immediate annuity from a company like Principal, Lincoln Financial, or Transamerica. These companies offer competitive payout rates and a variety of payment options. Look for annuities with a guaranteed income stream for a specific period of time or for the rest of your life.

Product Example: Principal Income Choice Immediate Annuity. This annuity provides a guaranteed income stream for the rest of your life, starting immediately after you purchase it. You can choose from a variety of payout options, including a single life annuity, a joint and survivor annuity, and a period certain annuity.

Case Studies Real World Examples of Life Insurance and Annuity Combinations

Let's look at some real-world examples to illustrate how this combined strategy can work in practice.

Case Study 1 The Smith Family and Legacy Planning

The Smith family, John and Jane, are in their early 60s. They have a comfortable retirement nest egg but are concerned about leaving a legacy for their children and grandchildren. They decide to purchase a fixed annuity to provide a guaranteed income stream for life, ensuring that they won't run out of money. They also purchase a life insurance policy to leave a legacy for their heirs. The annuity provides them with peace of mind, while the life insurance policy ensures that their loved ones are taken care of after they're gone.

Case Study 2 Maria and Early Retirement

Maria, age 58, wants to retire early but isn't eligible for Social Security until age 62. She purchases an immediate annuity to provide income for the next four years, supplementing her savings and allowing her to delay claiming Social Security. She also purchases a term life insurance policy to protect her husband in case she dies before age 62.

Case Study 3 The Johnson's And Long Term Care Planning

The Johnsons are concerned about the potential cost of long-term care. They purchase a hybrid annuity that combines the features of an annuity and a long-term care insurance policy. The annuity provides a guaranteed income stream, and the long-term care insurance policy provides benefits to cover the cost of long-term care if they need it. They also have a small life insurance policy to cover final expenses.

Product Comparison Life Insurance vs Annuities

Let's compare life insurance and annuities side-by-side to highlight their key differences and similarities.

| Feature | Life Insurance | Annuities | |--------------------|---------------------------------------------------|------------------------------------------------| | Purpose | Protection against financial loss due to death | Income stream, often for retirement | | Beneficiary | Designated beneficiaries | Annuitant (and potentially beneficiaries) | | Risk | Risk of premature death | Longevity risk (outliving your savings) | | Tax Treatment | Death benefit generally tax-free | Income taxable, but growth is tax-deferred | | Cash Value (Perm) | Builds cash value over time (permanent policies) | Accumulates value over time (deferred annuities) | | Liquidity | Policy loans and withdrawals (permanent policies) | Limited liquidity, surrender charges may apply |Detailed Information Pricing and Fees Associated With Life Insurance and Annuities

It's important to understand the pricing and fees associated with both life insurance and annuities.

Life Insurance Pricing Factors

Life insurance premiums are based on a variety of factors, including:

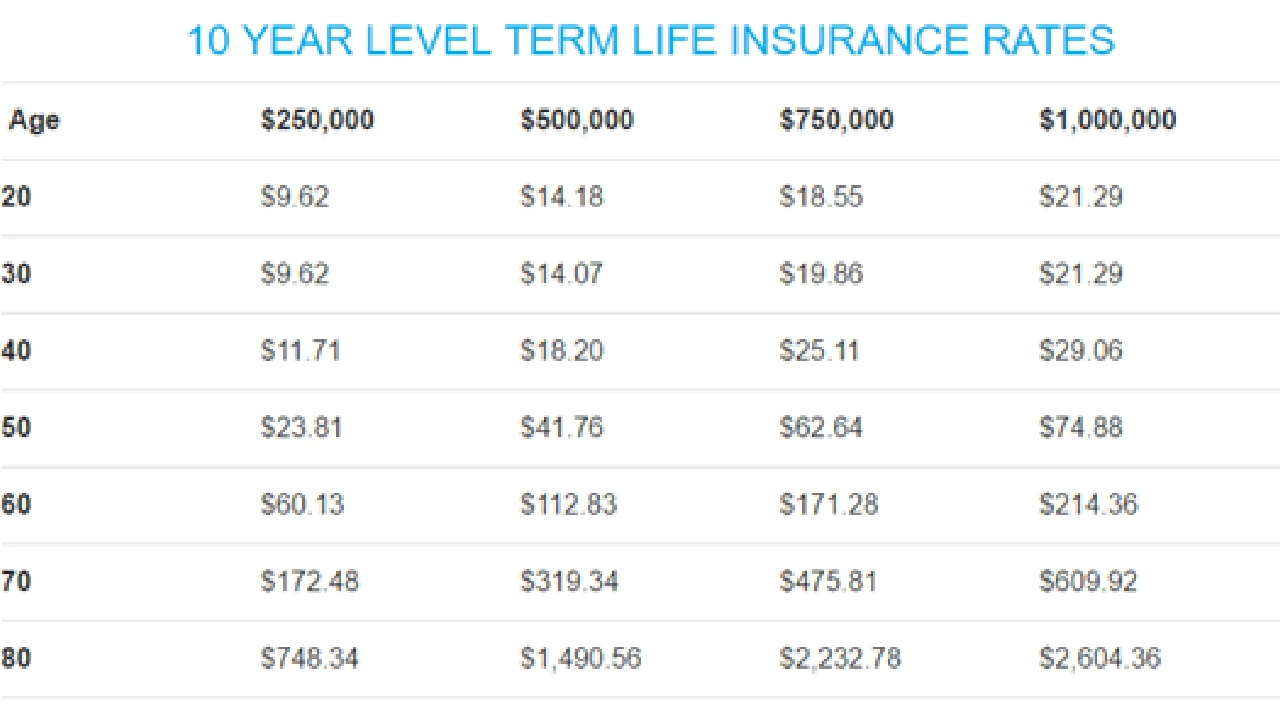

- Age: Older individuals typically pay higher premiums.

- Health: Individuals with health problems typically pay higher premiums or may be denied coverage.

- Gender: Women typically pay lower premiums than men because they have a longer life expectancy.

- Lifestyle: Smokers and individuals with risky hobbies typically pay higher premiums.

- Coverage Amount: The higher the death benefit, the higher the premium.

- Policy Type: Permanent life insurance policies typically have higher premiums than term life insurance policies.

Annuity Fees and Charges

Annuities can have a variety of fees and charges, including:

- Mortality and Expense (M&E) Fees: These fees cover the insurer's costs of providing the annuity.

- Administrative Fees: These fees cover the insurer's administrative costs.

- Surrender Charges: These charges apply if you withdraw money from the annuity before a certain period of time.

- Investment Management Fees: These fees apply to variable annuities and cover the cost of managing the subaccounts.

- Rider Fees: These fees apply to optional riders, such as guaranteed lifetime income riders.

It's crucial to carefully review the fees and charges associated with any life insurance or annuity policy before you purchase it.

Consulting A Financial Advisor For Personalized Life Insurance and Annuity Strategies

This information is for educational purposes only and should not be considered financial advice. The best approach is to consult with a qualified financial advisor who can assess your individual needs and goals and recommend the most appropriate life insurance and annuity strategies for you. They can help you navigate the complexities of these products and ensure that you're making informed decisions that are in your best interest.

The Future of Combined Life Insurance and Annuity Planning

As the financial landscape continues to evolve, the combined use of life insurance and annuities is likely to become even more prevalent. With increasing longevity and the uncertainty surrounding retirement planning, these tools offer a powerful way to protect against both premature death and outliving your savings. By understanding the synergy between life insurance and annuities, you can create a more comprehensive and secure financial future for yourself and your loved ones.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)