How to Find the Best Life Insurance Rates

Life Insurance Understanding the Basics

Life insurance. It's a topic many shy away from, often seen as complicated or morbid. But understanding life insurance is crucial for securing your financial future and protecting your loved ones. Let's break down the basics in a way that's easy to digest.

At its core, life insurance is a contract between you and an insurance company. You pay premiums, and in exchange, the insurance company promises to pay a death benefit to your beneficiaries upon your death. This death benefit can be used for a variety of purposes, such as:

- Replacing lost income

- Paying off debts, like mortgages or student loans

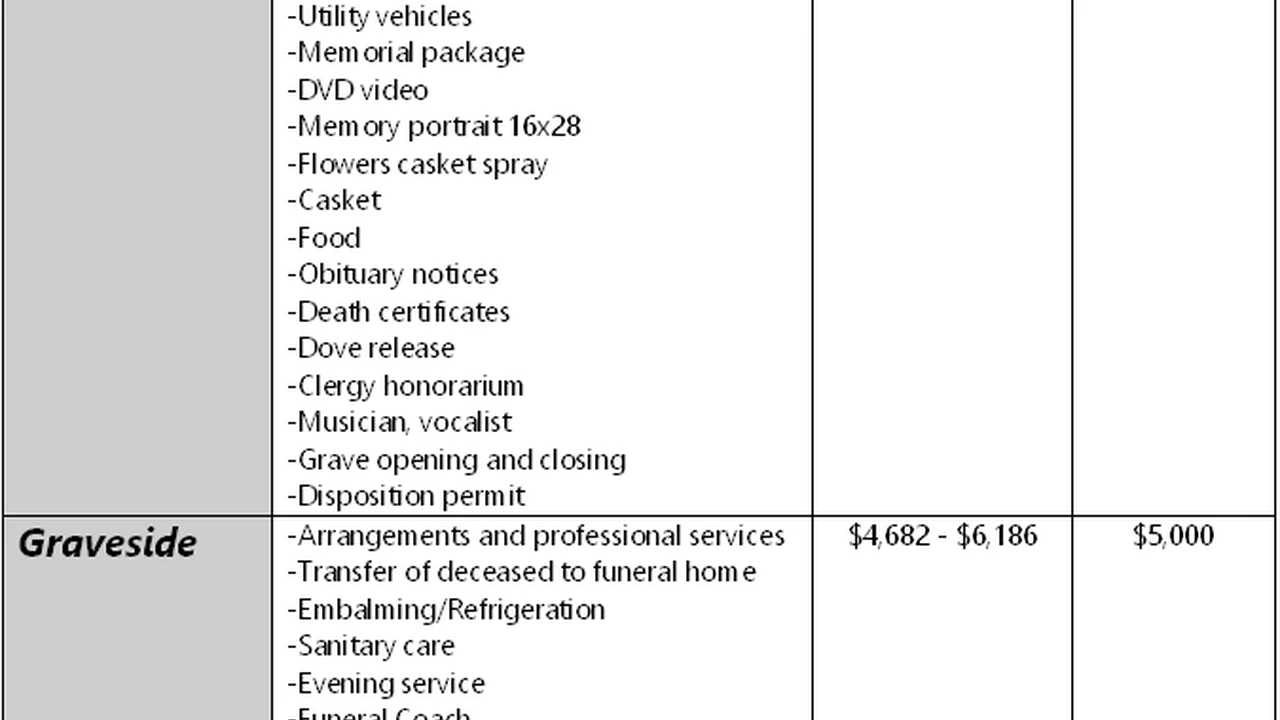

- Covering funeral expenses

- Funding education for children

- Leaving a legacy for future generations

Think of it as a financial safety net, providing peace of mind knowing that your family will be taken care of even after you're gone.

Different Types of Life Insurance Policies Explained

Now, let's delve into the different types of life insurance policies available. The two main categories are term life insurance and permanent life insurance.

Term Life Insurance Understanding Its Benefits

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If you die within the term, your beneficiaries receive the death benefit. If the term expires and you're still alive, the coverage ends. Term life insurance is generally more affordable than permanent life insurance, making it a popular choice for young families or those with specific financial obligations, such as a mortgage.

Pros of Term Life Insurance:

- Lower premiums compared to permanent life insurance

- Simple and straightforward to understand

- Ideal for covering specific financial obligations

Cons of Term Life Insurance:

- Coverage expires at the end of the term

- Premiums may increase upon renewal

- Does not build cash value

Permanent Life Insurance Exploring Its Options

Permanent life insurance, on the other hand, provides coverage for your entire life, as long as you continue to pay the premiums. It also includes a cash value component that grows over time, tax-deferred. This cash value can be borrowed against or withdrawn, providing a source of funds for future needs.

There are several types of permanent life insurance, including:

- Whole Life Insurance: Offers a guaranteed death benefit and a fixed premium. The cash value grows at a guaranteed rate.

- Universal Life Insurance: Offers more flexibility in terms of premiums and death benefit amounts. The cash value growth is tied to current interest rates.

- Variable Life Insurance: Allows you to invest the cash value in a variety of sub-accounts, offering the potential for higher returns but also higher risk.

- Indexed Universal Life Insurance (IUL): The cash value growth is linked to a market index, such as the S&P 500, offering a balance between growth potential and downside protection.

Pros of Permanent Life Insurance:

- Lifelong coverage

- Builds cash value

- Tax-deferred growth

Cons of Permanent Life Insurance:

- Higher premiums compared to term life insurance

- More complex than term life insurance

- Cash value growth may not be guaranteed

Determining How Much Life Insurance Coverage You Need

One of the most crucial steps in understanding life insurance is determining how much coverage you actually need. This isn't a one-size-fits-all answer; it depends on your individual circumstances and financial goals.

Here are some factors to consider:

- Income Replacement: How much income would your family need to replace if you were no longer around? A common rule of thumb is to multiply your annual income by 7-10 years.

- Outstanding Debts: Do you have a mortgage, student loans, or other debts that your family would be responsible for?

- Funeral Expenses: The average funeral costs between $7,000 and $10,000.

- Education Expenses: Do you want to provide for your children's education?

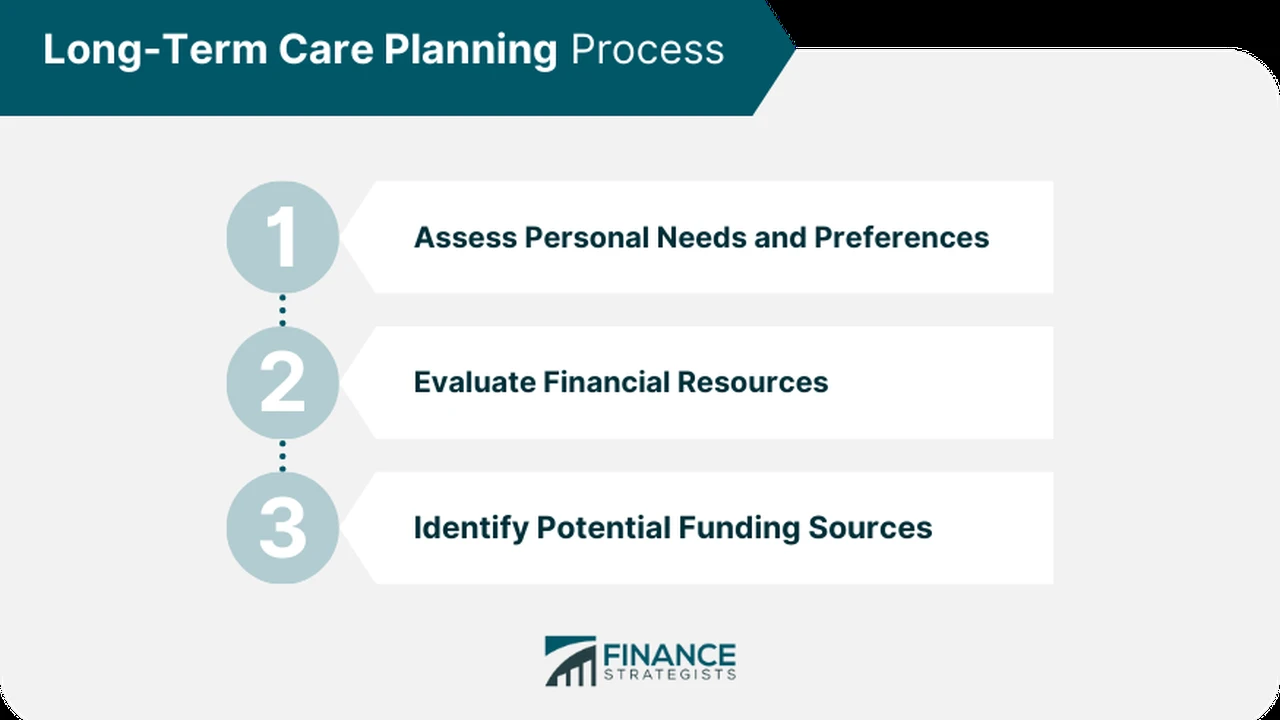

- Future Needs: Consider any future expenses, such as retirement planning or long-term care.

Several online calculators and tools can help you estimate your life insurance needs. Consulting with a financial advisor is also a good idea to get personalized recommendations.

Life Insurance Underwriting Health and Lifestyle Factors

The underwriting process is how insurance companies assess your risk and determine your premium. They'll consider factors such as your age, health, lifestyle, and occupation.

Health: You'll typically need to undergo a medical exam, which may include blood and urine tests. The insurance company will also review your medical history. Pre-existing conditions, such as diabetes or heart disease, can affect your premium.

Lifestyle: Smoking, excessive alcohol consumption, and risky hobbies can increase your risk profile and lead to higher premiums.

Occupation: Certain occupations, such as construction work or firefighting, are considered riskier than others and may result in higher premiums.

Being honest and transparent during the underwriting process is crucial. Hiding information can lead to the denial of your claim later on.

Choosing the Right Life Insurance Company Considerations

Not all life insurance companies are created equal. It's essential to choose a reputable and financially stable insurer that can meet its obligations.

Here are some factors to consider:

- Financial Strength Ratings: Look for companies with high ratings from independent rating agencies like A.M. Best, Standard & Poor's, and Moody's.

- Customer Service: Read online reviews and check the company's customer service record.

- Policy Options: Make sure the company offers a range of policy options to meet your specific needs.

- Claims Payment History: Research the company's claims payment history to ensure they have a good track record of paying out claims promptly and fairly.

Life Insurance Riders Enhancing Your Policy

Life insurance riders are optional add-ons that can enhance your policy and provide additional benefits.

Here are some common riders:

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit if you're diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premium payments if you become disabled and unable to work.

- Accidental Death Benefit Rider: Pays an additional death benefit if you die as a result of an accident.

- Child Term Rider: Provides term life insurance coverage for your children.

- Long-Term Care Rider: Allows you to use your death benefit to pay for long-term care expenses.

Consider whether these riders are appropriate for your needs and budget.

Life Insurance and Estate Planning Integrating Your Policy

Life insurance can play a crucial role in your estate plan. It can provide funds to pay estate taxes, cover debts, and ensure that your assets are distributed according to your wishes.

You can also use life insurance to create a trust, which can provide more control over how your assets are managed and distributed to your beneficiaries.

Consulting with an estate planning attorney can help you integrate your life insurance policy into your overall estate plan.

Understanding Life Insurance Premiums Factors Affecting Costs

Life insurance premiums are influenced by a variety of factors. Understanding these factors can help you find the most affordable coverage.

Key factors include:

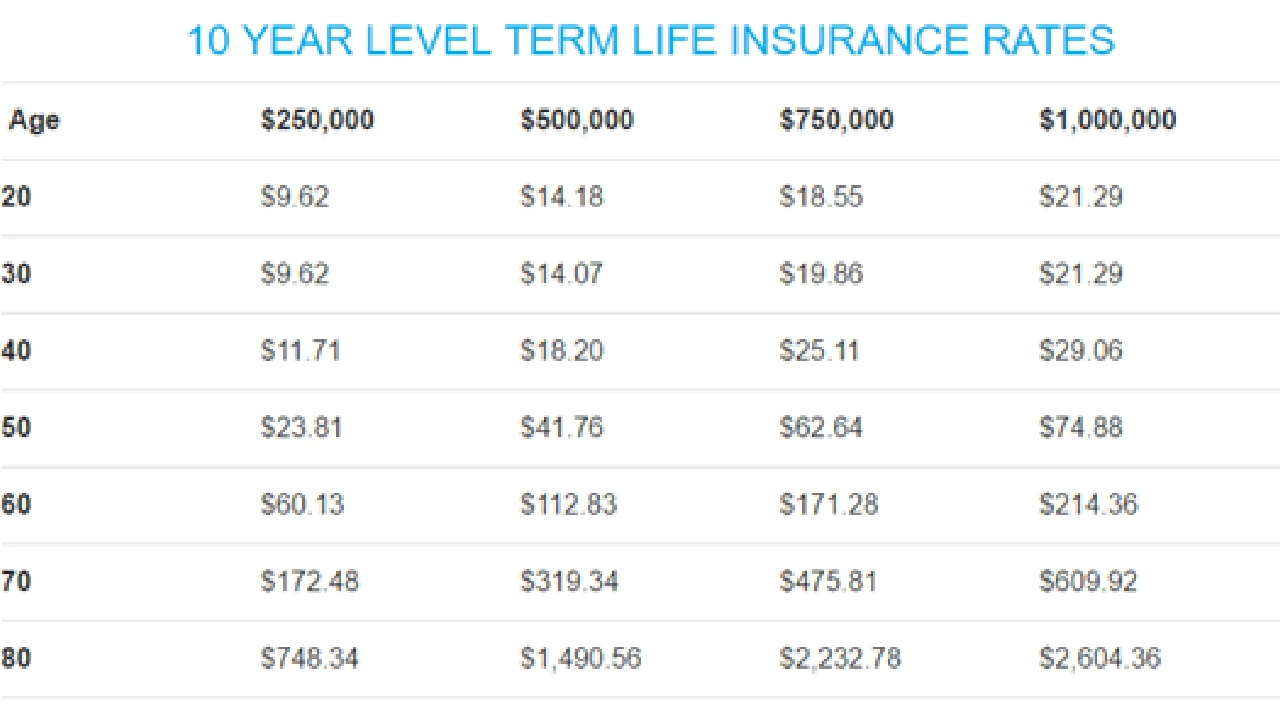

- Age: Younger individuals typically pay lower premiums.

- Health: Good health results in lower premiums.

- Gender: Women generally pay lower premiums than men due to longer life expectancy.

- Lifestyle: Healthy lifestyle choices lead to lower premiums.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Policy Type: Term life insurance is typically less expensive than permanent life insurance.

Shopping around and comparing quotes from multiple insurance companies is essential to finding the best rates.

Life Insurance as an Investment Exploring the Possibilities

While the primary purpose of life insurance is to provide financial protection, certain types of permanent life insurance can also be used as an investment vehicle.

The cash value component of permanent life insurance grows tax-deferred, which can be a significant advantage over taxable investment accounts.

However, it's important to understand that life insurance is not primarily an investment. The returns may not be as high as other investment options, and there are fees and expenses associated with the policy.

Consider your investment goals and risk tolerance before using life insurance as an investment vehicle.

Life Insurance Policy Reviews When and Why to Reassess

Your life insurance needs may change over time as your circumstances evolve. It's essential to review your policy periodically to ensure it still meets your needs.

Here are some events that may warrant a policy review:

- Marriage

- Birth or adoption of a child

- Purchase of a home

- Change in income

- Job change

- Divorce

- Retirement

Reviewing your policy regularly can help you identify any gaps in coverage and make necessary adjustments.

Life Insurance Product Recommendations and Use Cases

Now, let's look at some specific life insurance products and their ideal use cases. Remember, these are general recommendations, and it's essential to consult with a financial advisor for personalized advice.

Term Life Insurance Recommendation Protective Life Classic Choice Term

Product: Protective Life Classic Choice Term

Use Case: This is a great option for young families who need affordable coverage to protect their loved ones in case of unexpected death. It's also suitable for individuals with a mortgage or other significant debts.

Details: Protective Life is a well-regarded insurer with strong financial ratings. The Classic Choice Term policy offers competitive rates and a variety of term lengths, from 10 to 30 years. You can also convert the policy to permanent life insurance later on, if your needs change.

Pricing: A healthy 30-year-old male can expect to pay around $30-$50 per month for a $500,000, 20-year term policy. Prices vary based on age, health, and coverage amount.

Universal Life Insurance Recommendation Pacific Life Indexed Accumulator 6

Product: Pacific Life Indexed Accumulator 6

Use Case: This is a good option for individuals who are looking for lifelong coverage with the potential for cash value growth. It's suitable for those who want to supplement their retirement income or leave a legacy for their heirs.

Details: Pacific Life is a leading provider of indexed universal life insurance. The Indexed Accumulator 6 policy offers the potential for cash value growth linked to a market index, such as the S&P 500, with downside protection. It also provides flexibility in terms of premiums and death benefit amounts.

Pricing: Premiums for indexed universal life insurance are generally higher than term life insurance. A healthy 40-year-old male can expect to pay around $500-$1000 per month for a policy with a $500,000 death benefit. The actual premium will depend on the policy's features, funding level, and the chosen index strategy.

Whole Life Insurance Recommendation New York Life Whole Life

Product: New York Life Whole Life

Use Case: Ideal for individuals seeking guaranteed lifelong coverage and predictable cash value growth. Suitable for estate planning, wealth transfer, and providing a legacy for future generations.

Details: New York Life is a mutual company, meaning it's owned by its policyholders. Their Whole Life policy offers a guaranteed death benefit, fixed premiums, and a guaranteed cash value growth rate. It also pays dividends, which can further enhance the cash value growth.

Pricing: Whole life insurance is typically the most expensive type of life insurance. A healthy 40-year-old male can expect to pay around $800-$1500 per month for a policy with a $500,000 death benefit. The premium will vary based on age, health, and the policy's features.

Life Insurance Product Comparisons Detailed Information

Let's compare the key features of these three recommended products:

| Feature | Protective Life Classic Choice Term | Pacific Life Indexed Accumulator 6 | New York Life Whole Life |

|---|---|---|---|

| Coverage Duration | Specific Term (e.g., 10, 20, 30 years) | Lifelong | Lifelong |

| Cash Value | None | Yes, linked to a market index | Yes, guaranteed growth |

| Premium Flexibility | Fixed | Flexible | Fixed |

| Investment Component | None | Indexed to a market index | Guaranteed interest and dividends |

| Suitable For | Affordable coverage for a specific period | Lifelong coverage with growth potential | Guaranteed coverage and estate planning |

This table provides a quick overview of the key differences between these three types of life insurance policies. Remember to consider your individual needs and consult with a financial advisor before making a decision.

Detailed Information on Pricing Examples and Scenarios

To further illustrate the pricing differences, let's consider a hypothetical scenario:

Scenario: A healthy 35-year-old female looking for $1,000,000 in life insurance coverage.

- Protective Life Classic Choice Term (20-year term): Approximately $50-$80 per month.

- Pacific Life Indexed Accumulator 6: Approximately $800-$1500 per month.

- New York Life Whole Life: Approximately $1200-$2000 per month.

These are just estimates, and the actual premiums may vary depending on individual circumstances and policy features.

Important Considerations:

- Term Length: Longer term lengths will result in higher term life insurance premiums.

- Riders: Adding riders to your policy will increase the premium.

- Underwriting: Your health and lifestyle will significantly impact your premium.

Next Steps Consulting with a Financial Advisor

Understanding life insurance is a journey, not a destination. The information provided here is a starting point, but it's essential to consult with a qualified financial advisor to get personalized advice.

A financial advisor can help you:

- Assess your life insurance needs

- Compare policy options

- Choose the right policy for your situation

- Integrate your life insurance policy into your overall financial plan

Don't hesitate to seek professional guidance to ensure you're making informed decisions about your financial future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)