How Your Credit Score Affects Life Insurance Rates

Understanding the Landscape of Life Insurance Cost Factors

Life insurance, a cornerstone of financial planning, offers a safety net for your loved ones in the event of your passing. However, navigating the complexities of life insurance costs can be daunting. Many factors influence the premiums you'll pay, and understanding these elements is crucial for securing affordable and adequate coverage. While your age, health, and the coverage amount you choose are often top of mind, several other variables play a significant role in determining your life insurance rates.

This article delves into the advanced strategies for saving money on life insurance, going beyond the basics to uncover lesser-known tactics and insights that can help you optimize your coverage and minimize your expenses. We'll explore the impact of lifestyle choices, policy riders, and even the insurance company you select. Furthermore, we'll examine specific life insurance products and their suitability for different scenarios, providing detailed comparisons and pricing information to empower you to make informed decisions.

Lifestyle Choices and Their Impact on Life Insurance Premiums

Your lifestyle choices have a profound impact on your life insurance premiums. Insurers assess the risks associated with your daily habits and activities, and these risks directly translate into the cost of your policy.

Smoking and Tobacco Use A Major Premium Driver

Smoking is one of the most significant factors that drive up life insurance premiums. Smokers pose a higher risk of developing serious health conditions, such as lung cancer, heart disease, and respiratory illnesses. Consequently, life insurance companies charge smokers significantly higher rates than non-smokers. The difference in premiums can be substantial, often exceeding several hundred percent. Even occasional smoking or the use of tobacco products like chewing tobacco can impact your rates. If you're a smoker, quitting smoking is not only beneficial for your health but also for your wallet. After a certain period of being smoke-free (typically one to five years), you may qualify for non-smoker rates, resulting in significant savings.

Alcohol Consumption and Life Insurance Costs

Excessive alcohol consumption can also increase your life insurance premiums. While moderate drinking is generally not a concern, heavy or frequent alcohol use can lead to liver damage, heart problems, and other health issues, making you a higher risk in the eyes of the insurer. If you have a history of alcohol abuse or have been diagnosed with an alcohol-related medical condition, your premiums will likely be higher. Insurers may require a medical exam and blood tests to assess your alcohol consumption habits. Maintaining a healthy lifestyle and limiting alcohol intake can help you secure more favorable life insurance rates.

Risky Hobbies and Occupational Hazards

Engaging in risky hobbies or working in hazardous occupations can also elevate your life insurance premiums. Activities such as skydiving, scuba diving, rock climbing, and racing are considered high-risk because they increase the likelihood of accidents or injuries. Similarly, certain occupations, such as construction work, logging, and firefighting, involve inherent dangers that can impact your life expectancy. Insurers will assess the specific risks associated with your hobbies or occupation and adjust your premiums accordingly. If you participate in high-risk activities, you may need to provide additional information about your safety precautions and experience level. In some cases, insurers may exclude coverage for deaths resulting from these activities.

Leveraging Policy Riders to Customize Your Life Insurance Coverage

Policy riders are optional add-ons to your life insurance policy that provide additional benefits or coverage. While some riders may increase your premiums, others can actually save you money by tailoring your policy to your specific needs and circumstances.

Accelerated Death Benefit Rider For Terminal Illness

An accelerated death benefit rider, also known as a living benefit rider, allows you to access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness. This rider can provide financial assistance to cover medical expenses, living costs, or other needs during a difficult time. The amount you can withdraw is typically limited to a percentage of the death benefit, and the remaining balance will be paid to your beneficiaries upon your death. While the accelerated death benefit rider may slightly increase your premiums, it can provide valuable peace of mind and financial security in the event of a serious illness.

Waiver of Premium Rider Protection During Disability

A waiver of premium rider waives your premium payments if you become disabled and unable to work. This rider ensures that your life insurance coverage remains in force even if you're facing financial hardship due to a disability. The waiver of premium rider typically has a waiting period, usually three to six months, before the waiver takes effect. After the waiting period, the insurer will begin paying your premiums on your behalf. This rider can be particularly beneficial for individuals who are self-employed or who don't have access to disability insurance through their employer.

Return of Premium Rider Getting Your Money Back

A return of premium rider refunds the premiums you've paid if you outlive the term of your term life insurance policy. This rider essentially turns your term life insurance into a savings plan. At the end of the term, you'll receive a lump-sum payment equal to the premiums you've paid, minus any fees or charges. While the return of premium rider can be appealing, it's important to note that it significantly increases your premiums. In many cases, you may be better off investing the difference in premiums in a separate savings or investment account. However, the return of premium rider can be a good option for individuals who want a guaranteed return on their investment and who prefer the simplicity of a single financial product.

Choosing the Right Life Insurance Company For Better Rates

The life insurance company you choose can have a significant impact on your premiums. Different insurers have different underwriting standards and risk assessments, which can lead to variations in pricing. It's essential to shop around and compare quotes from multiple insurers to find the best rates for your specific circumstances.

Comparing Insurers with Strong Financial Ratings

When comparing life insurance companies, it's crucial to consider their financial strength and stability. Choose insurers with high ratings from independent rating agencies such as A.M. Best, Standard & Poor's, and Moody's. These ratings indicate the insurer's ability to meet its financial obligations and pay out claims. A financially strong insurer is more likely to be around when you need them most. You can find these ratings on the insurer's website or through the rating agency's websites.

Exploring Mutual vs Stock Life Insurance Companies

Life insurance companies can be either mutual or stock companies. Mutual companies are owned by their policyholders, while stock companies are owned by shareholders. Mutual companies may offer participating policies, which pay dividends to policyholders. These dividends can reduce your premiums or increase the cash value of your policy. Stock companies, on the other hand, may focus on maximizing profits for their shareholders, which could potentially lead to higher premiums or lower policy values. However, both mutual and stock companies are subject to regulatory oversight and must maintain adequate reserves to meet their obligations.

Leveraging Independent Insurance Agents For Comparison Shopping

An independent insurance agent can be a valuable resource when shopping for life insurance. Independent agents represent multiple insurers and can provide you with quotes from different companies. They can also help you understand the different policy options and riders available and guide you in choosing the best coverage for your needs. Independent agents are typically paid a commission by the insurer, so their services are usually free to you. Be sure to work with an agent who is knowledgeable, experienced, and trustworthy.

Specific Life Insurance Products and Their Use Cases

Life insurance comes in various forms, each designed to meet different needs and financial goals. Understanding the different types of life insurance policies is crucial for selecting the right coverage for your specific circumstances.

Term Life Insurance Affordable Protection For A Specific Period

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If you die during the term, your beneficiaries receive a death benefit. If you outlive the term, the coverage expires, and you'll need to renew the policy or purchase a new one. Term life insurance is generally the most affordable type of life insurance, making it a good option for individuals who need coverage for a specific period, such as while they're raising children or paying off a mortgage. Term life insurance is often used to replace lost income, pay off debts, or fund future expenses like college tuition.

Use Case: A young couple with two children has a mortgage and wants to ensure their family is financially protected if one of them dies prematurely. They purchase a 20-year term life insurance policy with a death benefit sufficient to cover the mortgage, replace lost income, and fund their children's education.

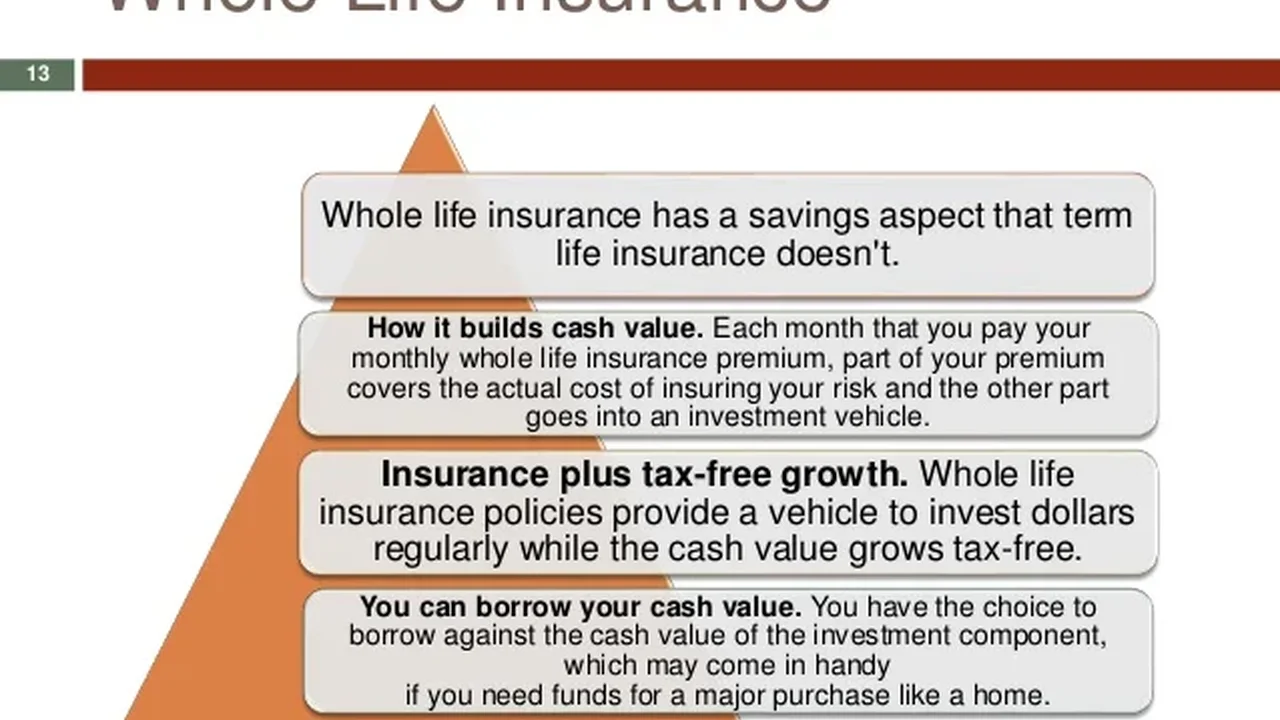

Whole Life Insurance Permanent Coverage With Cash Value

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life. It also includes a cash value component that grows over time on a tax-deferred basis. The cash value can be accessed through policy loans or withdrawals. Whole life insurance premiums are typically higher than term life insurance premiums, but the policy provides lifelong coverage and a savings component. Whole life insurance is often used for estate planning, wealth accumulation, and long-term financial security.

Use Case: An individual wants to provide a financial legacy for their children and grandchildren. They purchase a whole life insurance policy with a death benefit that will be used to fund a trust for their heirs. The cash value of the policy grows over time, providing an additional source of wealth for their family.

Universal Life Insurance Flexible Premiums and Death Benefits

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life insurance. With universal life insurance, you can adjust your premium payments and death benefit within certain limits. The cash value of the policy grows based on current interest rates. Universal life insurance can be a good option for individuals who want more control over their policy and who need the flexibility to adjust their premiums and death benefit as their financial circumstances change.

Use Case: A self-employed individual with fluctuating income wants life insurance coverage but needs the flexibility to adjust their premium payments based on their monthly earnings. They purchase a universal life insurance policy that allows them to increase or decrease their premium payments as needed.

Variable Life Insurance Investment Opportunities Within Your Policy

Variable life insurance is a type of permanent life insurance that allows you to invest the cash value of your policy in a variety of investment options, such as stocks, bonds, and mutual funds. The cash value of the policy can fluctuate based on the performance of the investments. Variable life insurance offers the potential for higher returns than other types of life insurance, but it also carries more risk. Variable life insurance is suitable for individuals who are comfortable with investment risk and who want the potential for higher returns.

Use Case: An experienced investor wants life insurance coverage and also wants to take advantage of the tax-deferred growth potential of a variable life insurance policy. They purchase a variable life insurance policy and allocate the cash value to a diversified portfolio of stocks and bonds.

Detailed Product Comparisons and Pricing Information

To help you make an informed decision about which life insurance product is right for you, let's compare some specific products and their pricing information.

Term Life Insurance Comparison: PolicyGenius vs LadderLife

PolicyGenius: PolicyGenius is an online insurance marketplace that allows you to compare quotes from multiple insurers. They offer term life insurance policies from a variety of companies, with terms ranging from 10 to 30 years. PolicyGenius provides a user-friendly interface and helpful tools to help you find the best rates for your needs.

LadderLife: LadderLife is a direct-to-consumer term life insurance provider that offers flexible and affordable coverage. LadderLife allows you to "ladder" your coverage, meaning you can adjust your death benefit as your needs change over time. LadderLife also offers a streamlined application process and instant approval in many cases.

Pricing Comparison: For a 35-year-old non-smoker seeking a $500,000 20-year term life insurance policy, PolicyGenius may offer rates ranging from $25 to $35 per month, depending on the insurer. LadderLife may offer rates in a similar range, but the exact price will depend on your individual circumstances and the specific policy features you choose.

Whole Life Insurance Comparison: New York Life vs MassMutual

New York Life: New York Life is a mutual life insurance company that has been in business for over 175 years. They offer a variety of whole life insurance policies with guaranteed death benefits and cash value growth. New York Life is known for its financial strength and stability.

MassMutual: MassMutual is another mutual life insurance company with a long history of providing financial security to its policyholders. They offer a range of whole life insurance policies with competitive dividend rates and flexible policy options.

Pricing Comparison: For a 45-year-old non-smoker seeking a $100,000 whole life insurance policy, New York Life and MassMutual may offer premiums ranging from $800 to $1,200 per month, depending on the specific policy features and dividend rates. The actual premium will depend on your age, health, and other factors.

Universal Life Insurance Comparison: Transamerica vs Prudential

Transamerica: Transamerica is a leading provider of universal life insurance policies with a variety of features and benefits. They offer flexible premium payments, adjustable death benefits, and a range of investment options.

Prudential: Prudential is a well-known insurance company that offers a variety of universal life insurance policies with competitive interest rates and flexible policy options. They provide tools and resources to help you manage your policy and make informed decisions.

Pricing Comparison: For a 40-year-old non-smoker seeking a $250,000 universal life insurance policy, Transamerica and Prudential may offer premiums ranging from $300 to $500 per month, depending on the specific policy features, interest rates, and investment options. The actual premium will depend on your individual circumstances and the choices you make.

Understanding Key Life Insurance Terminology

Navigating the world of life insurance requires familiarity with specific terminology. Here's a breakdown of some key terms you'll encounter:

Death Benefit The Payout To Your Beneficiaries

The death benefit is the amount of money that your beneficiaries will receive upon your death. This is the primary purpose of life insurance – to provide financial support to your loved ones after you're gone. The death benefit is typically tax-free to your beneficiaries.

Premium The Cost Of Your Life Insurance Policy

The premium is the amount you pay regularly (monthly, quarterly, or annually) to keep your life insurance policy in force. The premium is determined by various factors, including your age, health, coverage amount, and policy type.

Cash Value The Savings Component Of Permanent Life Insurance

The cash value is the savings component of permanent life insurance policies, such as whole life and universal life. The cash value grows over time on a tax-deferred basis and can be accessed through policy loans or withdrawals.

Beneficiary The Person Or Entity Receiving The Death Benefit

The beneficiary is the person or entity you designate to receive the death benefit from your life insurance policy. You can name multiple beneficiaries and specify the percentage of the death benefit each beneficiary will receive.

Underwriting The Insurance Company's Risk Assessment Process

Underwriting is the process by which the insurance company assesses your risk factors and determines your eligibility for coverage and your premium rate. The underwriting process typically involves a medical exam, a review of your medical history, and an assessment of your lifestyle and habits.

Advanced Strategies For Minimizing Life Insurance Costs

Beyond the factors discussed above, several advanced strategies can help you minimize your life insurance costs.

Shopping Around and Comparing Quotes From Multiple Insurers

As mentioned earlier, shopping around and comparing quotes from multiple insurers is crucial for finding the best rates. Don't settle for the first quote you receive. Get quotes from several different companies and compare their prices, policy features, and financial strength ratings.

Improving Your Health and Lifestyle To Lower Premiums

Improving your health and lifestyle can significantly lower your life insurance premiums. Quitting smoking, maintaining a healthy weight, and exercising regularly can all reduce your risk factors and make you a more attractive candidate for coverage. Consider making lifestyle changes before applying for life insurance to potentially save money on your premiums.

Considering a Shorter Term Length For Lower Premiums

If you only need life insurance coverage for a specific period, consider purchasing a shorter term length. Shorter term lengths typically have lower premiums than longer term lengths. For example, a 10-year term life insurance policy will generally be less expensive than a 30-year term life insurance policy.

Reviewing Your Coverage Regularly and Adjusting As Needed

Your life insurance needs may change over time as your financial circumstances and family situation evolve. Review your coverage regularly and adjust it as needed. If you no longer need as much coverage, you can reduce your death benefit to lower your premiums. Conversely, if your needs have increased, you may need to purchase additional coverage.

Exploring Group Life Insurance Through Your Employer

Many employers offer group life insurance as a benefit to their employees. Group life insurance is typically less expensive than individual life insurance because the risk is spread across a larger group of people. If your employer offers group life insurance, consider taking advantage of this benefit to supplement your individual coverage.

Conclusion: Securing Affordable Life Insurance Requires Diligence and Research

Securing affordable life insurance requires diligence, research, and a proactive approach. By understanding the factors that influence life insurance costs, leveraging policy riders, choosing the right insurer, and exploring different product options, you can optimize your coverage and minimize your expenses. Remember to shop around, compare quotes, and review your coverage regularly to ensure you have the right life insurance policy for your needs and budget. Don't hesitate to consult with an independent insurance agent for personalized advice and guidance.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)

-Insurance-What-It-Covers.webp)