Lapsed Life Insurance Policy_ Can You Reinstate It_

Understanding Life Insurance Lapses A Comprehensive Overview

Let's face it life throws curveballs and sometimes keeping up with everything especially financial obligations like life insurance premiums can be a challenge. A lapsed life insurance policy is essentially a policy that has been terminated because the premium payments weren't made within the grace period. This grace period usually lasts for 30 to 31 days after the due date of the premium. If the premium isn't paid during this time the policy lapses meaning the coverage is no longer in effect.

Why does this happen? Well there are several reasons. Perhaps you simply forgot to pay the premium. Maybe you experienced a temporary financial setback. Or perhaps you were unaware of the grace period and thought you had more time to make the payment. Whatever the reason a lapsed policy can leave you and your loved ones vulnerable.

It's crucial to understand the implications of a lapse. The primary consequence is the loss of coverage. If something were to happen to you during the lapse period your beneficiaries wouldn't receive the death benefit. This can create significant financial hardship for your family especially if they rely on your income.

Furthermore reinstating a lapsed policy isn't always guaranteed. Insurance companies typically have specific requirements and timelines for reinstatement. You might need to provide proof of insurability which could involve a medical exam and answering health-related questions. And even if you meet the requirements the reinstatement process can be time-consuming and potentially more expensive than keeping the policy active in the first place.

The Reinstatement Process Navigating the Steps to Restore Your Coverage

Okay so your policy has lapsed. What now? Don't panic. Reinstatement might be an option. The reinstatement process generally involves several steps. First you'll need to contact your insurance company and inquire about their reinstatement policy. They'll provide you with the necessary forms and instructions.

Next you'll likely need to complete an application for reinstatement. This application will typically ask for updated information about your health lifestyle and financial situation. You'll also need to pay all overdue premiums plus any applicable interest.

The insurance company will then review your application and may require a medical exam to assess your current health. They'll evaluate your risk profile to determine whether they're willing to reinstate the policy. This evaluation is crucial because the insurance company needs to be confident that you're still insurable.

If your application is approved the policy will be reinstated and coverage will resume. However keep in mind that there might be a waiting period before certain benefits become available again. For example the suicide clause which typically excludes coverage for suicide within the first two years of the policy might be reset upon reinstatement.

It's important to note that insurance companies aren't obligated to reinstate a lapsed policy. They have the right to deny your application if they believe you pose too high of a risk. This could be due to a significant change in your health a history of missed payments or other factors.

Reinstatement Eligibility Factors That Influence Your Chances

Several factors can influence your eligibility for reinstatement. Your health is a primary consideration. If you've developed a serious medical condition since the policy lapsed the insurance company might be hesitant to reinstate it. They'll want to ensure that you're not at a significantly higher risk of death than when the policy was originally issued.

Your lifestyle also plays a role. If you've started engaging in risky behaviors such as smoking or skydiving the insurance company might view you as a higher risk. They'll want to assess whether these behaviors could increase your likelihood of filing a claim.

Your payment history is another important factor. If you have a history of missed payments or frequent lapses the insurance company might be less inclined to reinstate your policy. They'll want to be confident that you'll be able to keep up with the premium payments in the future.

The time elapsed since the policy lapsed is also a consideration. Most insurance companies have a deadline for reinstatement typically within a few years of the lapse. If too much time has passed they might consider the policy permanently terminated.

Finally the type of policy you have can also affect your eligibility. Some policies such as term life insurance might be more difficult to reinstate than others such as whole life insurance. This is because term life insurance is typically more expensive to reinstate due to the increasing cost of insurance as you age.

Alternatives to Reinstatement Exploring Other Coverage Options

What if you're unable to reinstate your lapsed policy? Don't worry you still have options. One alternative is to purchase a new life insurance policy. This might be a good option if your health has improved since the policy lapsed or if you're looking for a different type of coverage.

When shopping for a new policy be sure to compare quotes from multiple insurance companies. Consider factors such as the death benefit premium cost and policy features. You might also want to work with an independent insurance agent who can help you find the best policy for your needs.

Another alternative is to explore group life insurance through your employer. Many employers offer group life insurance as a benefit to their employees. This type of coverage is typically less expensive than individual life insurance and doesn't require a medical exam.

However keep in mind that group life insurance is usually tied to your employment. If you leave your job you'll likely lose your coverage. You might be able to convert your group policy to an individual policy but this can be expensive.

A third alternative is to consider other types of insurance such as accidental death and dismemberment insurance. This type of insurance provides coverage in the event of death or dismemberment due to an accident. While it doesn't offer the same comprehensive coverage as life insurance it can provide some financial protection for your loved ones.

Preventing Lapses Proactive Strategies for Maintaining Your Coverage

The best way to avoid the hassle and uncertainty of reinstating a lapsed policy is to prevent the lapse from happening in the first place. Here are some proactive strategies to help you maintain your coverage.

First set up automatic premium payments. This is the easiest way to ensure that your premiums are paid on time. Most insurance companies offer automatic payment options through your bank account or credit card.

Second review your policy regularly. Make sure you understand the terms and conditions of your policy including the grace period and reinstatement provisions. Keep your contact information up to date with the insurance company so they can reach you if there's a problem with your payments.

Third create a budget and stick to it. Make sure you allocate enough money each month to cover your life insurance premiums. If you're struggling to afford your premiums consider reducing your coverage or switching to a less expensive policy.

Fourth consider purchasing a policy with a cash value component. Policies like whole life insurance accumulate cash value over time. You can borrow against this cash value to pay your premiums if you're facing a temporary financial setback.

Finally communicate with your insurance company. If you're having trouble making your payments don't hesitate to contact them. They might be able to offer you a payment plan or other options to help you keep your policy in force.

Product Recommendations Top Life Insurance Policies for Comprehensive Coverage

Choosing the right life insurance policy can be overwhelming. Here are some top recommendations for policies that offer comprehensive coverage and flexibility:

* **Term Life Insurance:** For those seeking affordable coverage for a specific period, consider **SelectQuote**. They offer competitive rates and a streamlined application process. Use Case: Provides financial security for your family during critical years like raising children or paying off a mortgage. * **Whole Life Insurance:** For lifelong coverage and cash value accumulation, **New York Life** is a reputable option. They've been around for over 175 years and offer a variety of whole life policies. Use Case: Estate planning, long-term financial security, and potential for tax-deferred growth. * **Universal Life Insurance:** For flexible premiums and death benefits, **Transamerica** offers a range of universal life policies. You can adjust your premiums and death benefit as your needs change. Use Case: Flexible financial planning, adapting to changing income and expenses. * **Variable Life Insurance:** For those seeking potential investment growth within their life insurance policy, **Prudential** offers variable life policies. These policies allow you to invest your cash value in a variety of investment options. Use Case: Long-term growth potential, supplementing retirement income.Real-World Use Cases How Life Insurance Protects Your Loved Ones

Life insurance isn't just a financial product; it's a safety net that protects your loved ones from financial hardship in the event of your death. Here are some real-world use cases that demonstrate the importance of life insurance:

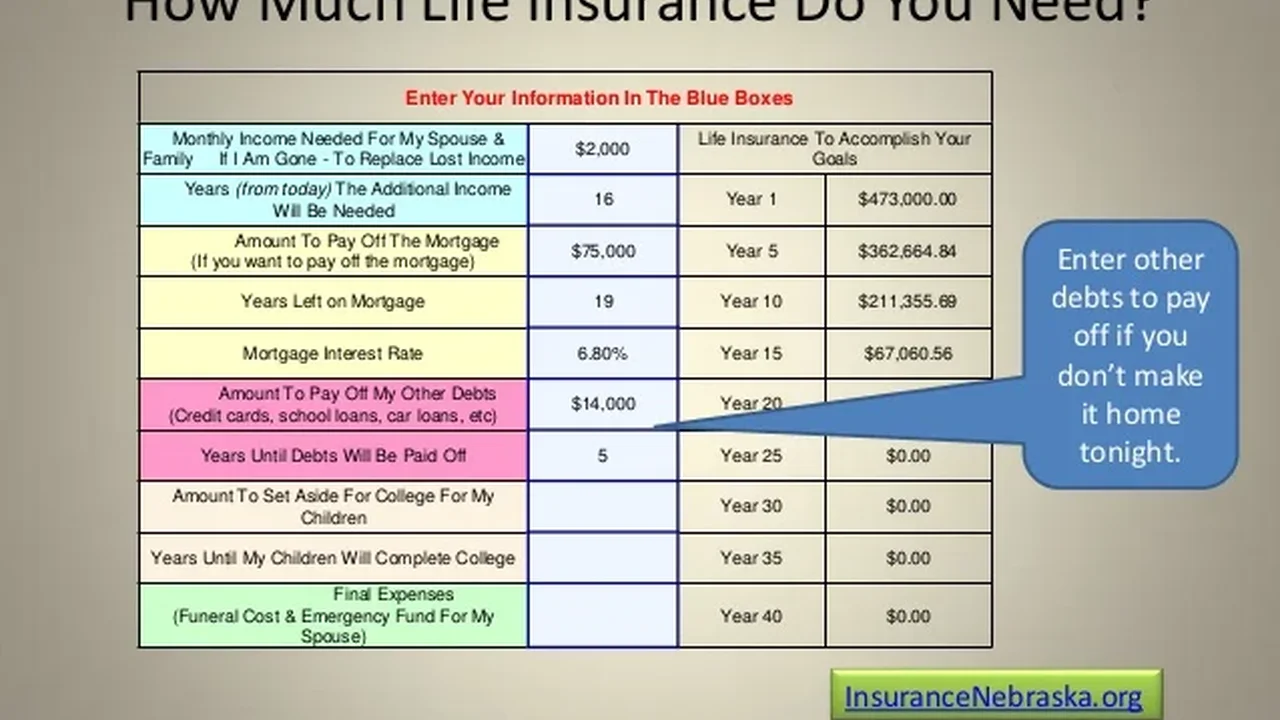

* **Replacing Lost Income:** Imagine a scenario where a parent dies unexpectedly. Life insurance can replace the lost income, allowing the surviving spouse to maintain their standard of living and provide for their children. * **Paying Off Debt:** Life insurance can be used to pay off outstanding debts such as mortgages, student loans, and credit card debt. This can prevent your loved ones from being burdened with these debts after your death. * **Funding Education:** Life insurance can be used to fund your children's education. A death benefit can provide the financial resources necessary to cover tuition, fees, and other educational expenses. * **Covering Funeral Expenses:** Funeral expenses can be surprisingly high. Life insurance can be used to cover these expenses relieving your loved ones of this financial burden during a difficult time. * **Estate Planning:** Life insurance can be a valuable tool for estate planning. It can be used to pay estate taxes and provide liquidity to your heirs.Detailed Product Comparison Choosing the Right Policy for Your Needs

With so many life insurance options available it can be difficult to choose the right policy for your needs. Here's a detailed comparison of some popular policy types:

* **Term Life Insurance vs. Whole Life Insurance:** Term life insurance provides coverage for a specific period while whole life insurance provides lifelong coverage. Term life insurance is typically less expensive than whole life insurance but it doesn't accumulate cash value. Whole life insurance accumulates cash value which can be borrowed against or withdrawn. * **Universal Life Insurance vs. Variable Life Insurance:** Universal life insurance offers flexible premiums and death benefits while variable life insurance allows you to invest your cash value in a variety of investment options. Universal life insurance is typically less risky than variable life insurance but it also offers less potential for growth. * **Simplified Issue Life Insurance vs. Guaranteed Issue Life Insurance:** Simplified issue life insurance requires some health questions but doesn't typically require a medical exam. Guaranteed issue life insurance doesn't require any health questions or a medical exam but it's typically more expensive and offers lower coverage amounts.Pricing and Detailed Information Understanding the Costs and Benefits

The cost of life insurance varies depending on several factors including your age health coverage amount and policy type. Here's a general overview of pricing and detailed information:

* **Term Life Insurance Pricing:** Term life insurance premiums are typically lower than whole life insurance premiums. A healthy 30-year-old male can expect to pay around $30 per month for a $500000 20-year term life insurance policy. * **Whole Life Insurance Pricing:** Whole life insurance premiums are typically higher than term life insurance premiums. A healthy 30-year-old male can expect to pay around $500 per month for a $500000 whole life insurance policy. * **Universal Life Insurance Pricing:** Universal life insurance premiums can vary depending on the policy's features and the insurance company's pricing model. * **Variable Life Insurance Pricing:** Variable life insurance premiums can also vary depending on the policy's features and the investment options you choose.It's important to get quotes from multiple insurance companies to compare prices and find the best policy for your needs. You should also carefully review the policy's terms and conditions to understand the coverage benefits and limitations.

Navigating Complex Policy Details Seeking Professional Guidance

Life insurance policies can be complex and difficult to understand. It's always a good idea to seek professional guidance from a qualified insurance agent or financial advisor.

An insurance agent can help you assess your needs and recommend the right type of policy for your situation. They can also explain the policy's terms and conditions and answer any questions you may have.

A financial advisor can help you integrate life insurance into your overall financial plan. They can help you determine how much coverage you need and how to use life insurance to achieve your financial goals.

Don't hesitate to seek professional guidance when making decisions about life insurance. It's a complex product and it's important to make sure you're making the right choices for your needs and your family's future.

Key Takeaways and Proactive Steps Securing Your Family's Future

Life insurance is a crucial part of financial planning providing financial security for your loved ones in the event of your death. Understanding the nuances of lapsed policies reinstatement options and alternative coverage solutions is essential for making informed decisions.

Take proactive steps to prevent lapses by setting up automatic payments reviewing your policy regularly and communicating with your insurance company. Explore different policy types compare pricing and seek professional guidance to find the best coverage for your needs.

By taking these steps you can ensure that your family is protected and that your financial legacy is secure. Life insurance is an investment in your family's future a gift of peace of mind that will last a lifetime.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)