Accidental Death and Dismemberment (AD&D) Insurance_ What It Covers

-Insurance-What-It-Covers.webp)

Understanding the Landscape of Insurance Policies A Comprehensive Guide

Navigating the world of insurance policies can feel like traversing a complex maze. With countless options available, each promising financial security and peace of mind, it's easy to feel overwhelmed. But fear not! This guide is designed to illuminate the path, providing you with a comprehensive understanding of various insurance policies and empowering you to make informed decisions that align with your unique needs and circumstances.

Before diving into specific policy types, let's establish a foundational understanding of what insurance is and why it's crucial. At its core, insurance is a risk management tool that transfers the potential financial burden of unforeseen events from you to an insurance company. In exchange for regular premium payments, the insurance company agrees to cover specific losses or damages outlined in the policy contract. This arrangement provides a safety net, protecting you from potentially devastating financial consequences arising from accidents, illnesses, natural disasters, or other covered events.

Now, let's embark on a journey through the diverse landscape of insurance policies, exploring the key features, benefits, and considerations of each type.

Life Insurance Protecting Your Loved Ones' Future

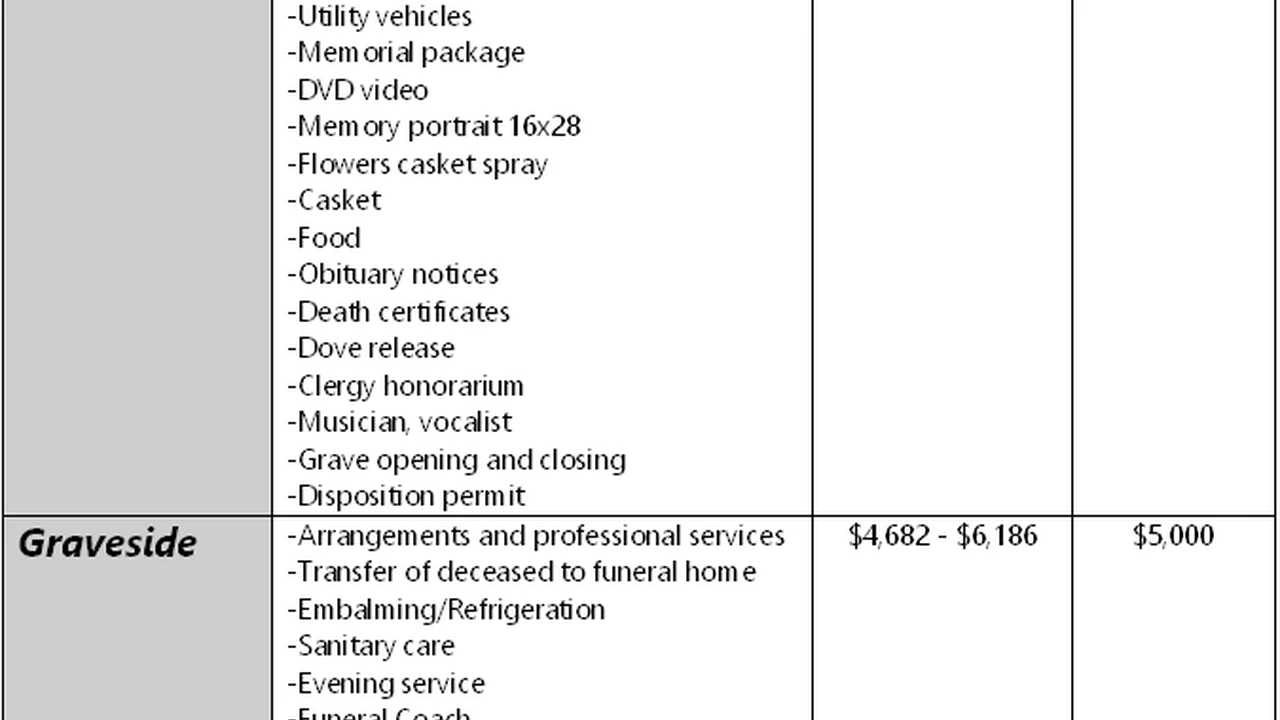

Life insurance is arguably one of the most important types of insurance, providing financial security for your loved ones in the event of your untimely death. It offers a death benefit, a lump-sum payment to your beneficiaries, which can be used to cover funeral expenses, outstanding debts, living expenses, and future educational costs.

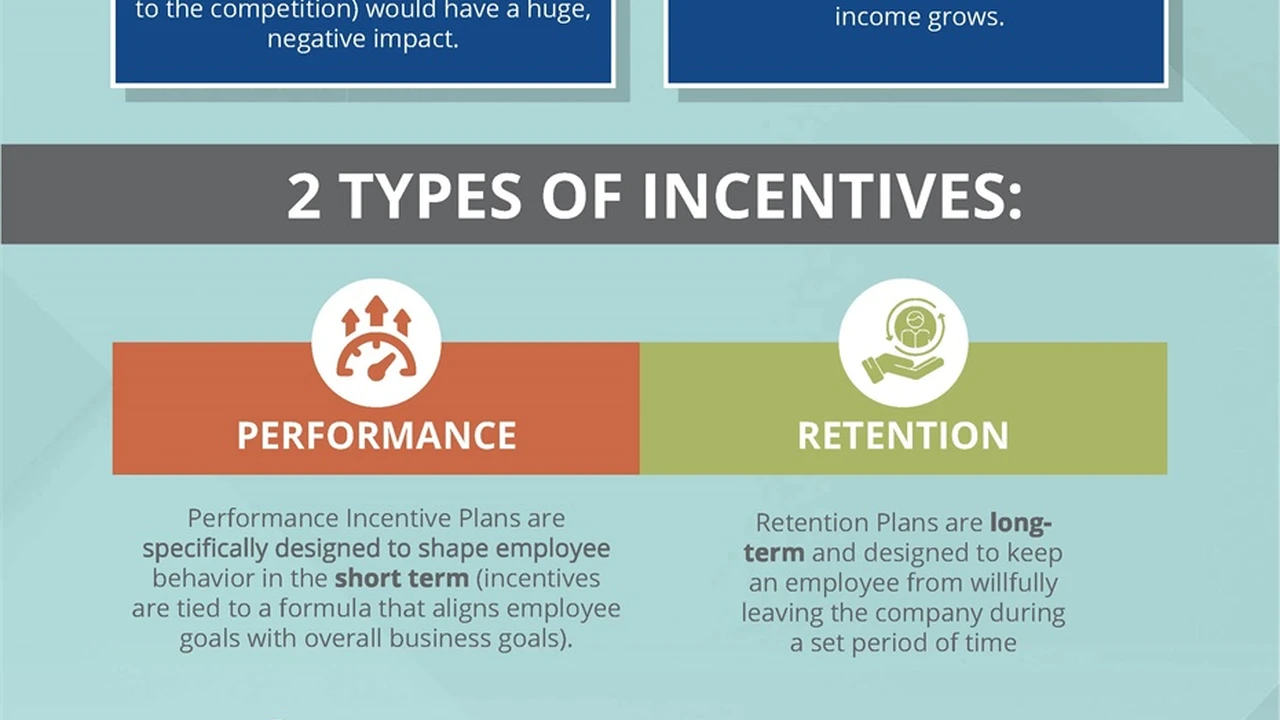

There are primarily two main types of life insurance: term life insurance and permanent life insurance.

Term Life Insurance Affordable Protection for a Specific Period

Term life insurance provides coverage for a specific term, typically ranging from 10 to 30 years. If you die within the term, your beneficiaries receive the death benefit. If the term expires and you still need coverage, you can typically renew the policy, although premiums will likely be higher due to your increased age. Term life insurance is generally more affordable than permanent life insurance, making it a suitable option for individuals with budget constraints or those seeking coverage for a specific period, such as while raising children or paying off a mortgage.

Example Use Case: A young couple with two young children takes out a 20-year term life insurance policy to ensure their children's financial security in case of either parent's death. The death benefit would cover expenses like childcare, education, and mortgage payments.

Permanent Life Insurance Lifelong Coverage and Cash Value Accumulation

Permanent life insurance, on the other hand, provides lifelong coverage as long as you continue to pay premiums. In addition to the death benefit, permanent life insurance policies also accumulate cash value over time, which you can borrow against or withdraw from during your lifetime. This cash value component makes permanent life insurance a more versatile financial tool, offering both protection and potential investment opportunities.

There are several types of permanent life insurance, including whole life insurance, universal life insurance, and variable life insurance. Each type offers different features and benefits, catering to varying financial goals and risk tolerances.

Whole Life Insurance: Offers guaranteed death benefit and cash value growth, providing stability and predictability.

Universal Life Insurance: Offers flexible premiums and death benefit options, allowing you to adjust your coverage as your needs change.

Variable Life Insurance: Allows you to invest the cash value in a variety of investment options, potentially generating higher returns but also exposing you to market risk.

Example Use Case: A business owner purchases a whole life insurance policy to provide a death benefit for their family and also to use the cash value component to fund future business ventures.

Product Recommendation: Northwestern Mutual Whole Life

Northwestern Mutual consistently ranks high in customer satisfaction and financial strength. Their whole life policies offer competitive dividend rates and a strong track record of performance. While premiums are typically higher than term life, the guaranteed cash value growth and lifelong coverage make it a compelling option for those seeking long-term financial security.

Product Recommendation: Transamerica Trendsetter Super Series (Term Life)

For those seeking affordable term life insurance, Transamerica's Trendsetter Super Series is a popular choice. It offers competitive rates and a variety of term lengths to suit different needs. It's a great option for young families or individuals looking to protect their loved ones without breaking the bank.

Health Insurance Protecting Your Well-being and Finances

Health insurance is essential for safeguarding your health and finances from the potentially crippling costs of medical care. It helps cover expenses related to doctor visits, hospital stays, prescription drugs, and other healthcare services.

There are various types of health insurance plans available, each with its own set of benefits, limitations, and costs. The most common types include:

Health Maintenance Organization (HMO) Managed Care with a Primary Care Physician

HMOs typically require you to choose a primary care physician (PCP) who coordinates your healthcare and refers you to specialists when necessary. HMOs generally offer lower premiums and out-of-pocket costs, but they may have limited provider networks and require referrals for specialist visits.

Preferred Provider Organization (PPO) Greater Flexibility and Choice

PPOs offer greater flexibility than HMOs, allowing you to see any doctor or specialist without a referral. However, you'll typically pay higher premiums and out-of-pocket costs for this added flexibility. PPOs also have a network of preferred providers, and you'll generally pay less when you see a provider within the network.

Exclusive Provider Organization (EPO) Similar to PPO but with a Stricter Network

EPOs are similar to PPOs in that they don't require referrals for specialist visits. However, EPOs typically have a more limited network of providers, and you may not be covered if you see a provider outside the network, except in emergencies.

Point of Service (POS) A Hybrid of HMO and PPO

POS plans combine features of both HMOs and PPOs. You typically choose a PCP who coordinates your care, but you can also see out-of-network providers, although you'll likely pay higher out-of-pocket costs. POS plans offer a balance between cost and flexibility.

High-Deductible Health Plan (HDHP) Lower Premiums with Higher Out-of-Pocket Costs

HDHPs have lower monthly premiums but higher deductibles, the amount you pay out-of-pocket before your insurance coverage kicks in. HDHPs are often paired with a Health Savings Account (HSA), a tax-advantaged account that you can use to pay for qualified medical expenses. HDHPs can be a good option for healthy individuals who don't anticipate needing frequent medical care.

Example Use Case: A self-employed individual chooses an HDHP with an HSA to save on monthly premiums and take advantage of the tax benefits of the HSA. They contribute regularly to the HSA to cover potential medical expenses.

Product Recommendation: Kaiser Permanente (HMO)

Kaiser Permanente is a well-regarded HMO known for its integrated healthcare system and focus on preventative care. They offer comprehensive coverage and a wide range of services, making them a popular choice for individuals seeking affordable and convenient healthcare.

Product Recommendation: Blue Cross Blue Shield (PPO)

Blue Cross Blue Shield is a national network of independent health insurance companies offering a variety of PPO plans. They are known for their extensive provider network and flexible coverage options, making them a good choice for individuals who value choice and access to a wide range of healthcare providers.

Homeowners Insurance Protecting Your Investment

Homeowners insurance provides financial protection against damage or loss to your home and personal belongings due to covered events, such as fire, theft, vandalism, and natural disasters. It also provides liability coverage, protecting you if someone is injured on your property.

A standard homeowners insurance policy typically covers the following:

Dwelling Coverage Protecting the Structure of Your Home

Dwelling coverage protects the physical structure of your home, including the walls, roof, and foundation. It covers the cost to repair or rebuild your home if it's damaged by a covered event.

Personal Property Coverage Protecting Your Belongings

Personal property coverage protects your personal belongings, such as furniture, clothing, and electronics, against damage or loss due to covered events. It typically covers the actual cash value of your belongings, which is the replacement cost minus depreciation.

Liability Coverage Protecting You from Lawsuits

Liability coverage protects you if someone is injured on your property and sues you for damages. It covers your legal defense costs and any settlements or judgments you're required to pay.

Additional Living Expenses (ALE) Coverage Covering Temporary Housing

ALE coverage covers the cost of temporary housing and other living expenses if your home is uninhabitable due to a covered event. This can include hotel bills, restaurant meals, and other necessary expenses.

Example Use Case: A homeowner experiences a fire in their kitchen. Homeowners insurance covers the cost to repair the kitchen, replace damaged appliances, and provide temporary housing while the repairs are being made.

Product Recommendation: State Farm Homeowners Insurance

State Farm is a well-established insurance company known for its strong financial stability and excellent customer service. Their homeowners insurance policies offer comprehensive coverage options and competitive rates.

Product Recommendation: Allstate Homeowners Insurance

Allstate is another leading insurance provider offering a variety of homeowners insurance policies with customizable coverage options. They are known for their innovative features and digital tools, making it easy to manage your policy online.

Auto Insurance Protecting You on the Road

Auto insurance provides financial protection against damage or loss to your vehicle and injuries to yourself or others in the event of an accident. It's typically required by law in most states.

There are several types of auto insurance coverage, including:

Liability Coverage Covering Damages to Others

Liability coverage protects you if you're at fault in an accident and cause injury or damage to another person or their property. It covers their medical expenses, vehicle repairs, and other damages.

Collision Coverage Covering Damage to Your Vehicle

Collision coverage covers damage to your vehicle if you're involved in an accident, regardless of who is at fault. It typically covers the cost to repair or replace your vehicle, minus your deductible.

Comprehensive Coverage Covering Non-Collision Damage

Comprehensive coverage covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, hail, and flood. It typically covers the cost to repair or replace your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage Covering Accidents with Uninsured Drivers

Uninsured/Underinsured Motorist coverage protects you if you're involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and other damages.

Example Use Case: A driver is involved in an accident and is at fault. Auto insurance liability coverage covers the other driver's medical expenses and vehicle repairs.

Product Recommendation: GEICO Auto Insurance

GEICO is a well-known auto insurance company known for its competitive rates and user-friendly online tools. They offer a variety of coverage options and discounts to help you save money on your auto insurance.

Product Recommendation: Progressive Auto Insurance

Progressive is another leading auto insurance provider offering a range of coverage options and discounts. They are known for their "Name Your Price" tool, which allows you to customize your coverage and find a policy that fits your budget.

Disability Insurance Protecting Your Income

Disability insurance protects your income if you become disabled and are unable to work. It provides a monthly benefit to help cover your living expenses while you're unable to earn a paycheck.

There are two main types of disability insurance: short-term disability insurance and long-term disability insurance.

Short-Term Disability Insurance Covering Temporary Disabilities

Short-term disability insurance provides coverage for a short period, typically ranging from a few weeks to a few months. It's designed to cover temporary disabilities, such as those resulting from an illness or injury.

Long-Term Disability Insurance Covering Long-Lasting Disabilities

Long-term disability insurance provides coverage for a longer period, typically ranging from a few years to your retirement age. It's designed to cover more serious and long-lasting disabilities.

Example Use Case: An individual suffers a back injury and is unable to work for several months. Disability insurance provides a monthly benefit to help cover their living expenses while they recover.

Product Recommendation: Principal Disability Insurance

Principal is a leading provider of disability insurance, known for its comprehensive coverage options and strong financial stability. Their policies offer a variety of features and benefits to meet your individual needs.

Product Recommendation: The Standard Disability Insurance

The Standard is another reputable disability insurance provider offering a range of policies with customizable coverage options. They are known for their excellent customer service and claims handling.

Umbrella Insurance Providing Extra Liability Protection

Umbrella insurance provides extra liability protection above and beyond the limits of your other insurance policies, such as homeowners insurance and auto insurance. It can help protect your assets if you're sued for a large amount of money.

Umbrella insurance typically covers:

Bodily Injury Liability Protecting You from Lawsuits for Injuries

Bodily injury liability protects you if you're sued for causing injury to another person.

Property Damage Liability Protecting You from Lawsuits for Property Damage

Property damage liability protects you if you're sued for causing damage to another person's property.

Personal Injury Liability Protecting You from Lawsuits for Defamation

Personal injury liability protects you if you're sued for defamation, libel, or slander.

Example Use Case: A homeowner is sued for a large amount of money after someone is seriously injured on their property. Umbrella insurance provides extra liability coverage to protect their assets.

Product Recommendation: Chubb Umbrella Insurance

Chubb is a high-end insurance provider known for its superior coverage and exceptional customer service. Their umbrella insurance policies offer comprehensive protection and high liability limits.

Product Recommendation: Travelers Umbrella Insurance

Travelers is another reputable insurance provider offering umbrella insurance policies with customizable coverage options. They are known for their strong financial stability and reliable claims handling.

Renters Insurance Protecting Your Belongings in a Rented Property

Renters insurance protects your personal belongings in a rented apartment or house. It covers damage or loss due to covered events, such as fire, theft, and vandalism. It also provides liability coverage, protecting you if someone is injured in your rented property.

Renters insurance typically covers:

Personal Property Coverage Protecting Your Belongings

Personal property coverage protects your personal belongings, such as furniture, clothing, and electronics, against damage or loss due to covered events.

Liability Coverage Protecting You from Lawsuits

Liability coverage protects you if someone is injured in your rented property and sues you for damages.

Additional Living Expenses (ALE) Coverage Covering Temporary Housing

ALE coverage covers the cost of temporary housing and other living expenses if your rented property is uninhabitable due to a covered event.

Example Use Case: A renter experiences a fire in their apartment. Renters insurance covers the cost to replace their damaged belongings and provide temporary housing while the apartment is being repaired.

Product Recommendation: Lemonade Renters Insurance

Lemonade is a tech-driven insurance company known for its user-friendly online platform and affordable renters insurance policies. They offer a quick and easy way to get a quote and purchase coverage.

Product Recommendation: State Farm Renters Insurance

State Farm also offers renters insurance policies with comprehensive coverage options and competitive rates. They are a well-established insurance company with a strong reputation for customer service.

Pet Insurance Protecting Your Furry Friends

Pet insurance helps cover the cost of veterinary care for your pets. It can help you afford unexpected vet bills due to illness or injury.

Pet insurance typically covers:

Accidents Covering Unexpected Injuries

Covers costs associated with accidents like broken bones, cuts, and swallowed objects.

Illnesses Covering Unexpected Illnesses

Covers costs associated with illnesses like infections, allergies, and cancer.

Wellness Care Covering Routine Checkups

Some policies offer coverage for routine checkups, vaccinations, and preventative care.

Example Use Case: A pet owner's dog requires emergency surgery after being hit by a car. Pet insurance helps cover the cost of the surgery and follow-up care.

Product Recommendation: Trupanion Pet Insurance

Trupanion is a popular pet insurance provider known for its comprehensive coverage and direct payment to veterinarians. They offer a simple and straightforward policy with no payout limits.

Product Recommendation: Embrace Pet Insurance

Embrace is another leading pet insurance provider offering a variety of coverage options and discounts. They are known for their customizable policies and excellent customer service.

Travel Insurance Protecting Your Trips

Travel insurance protects you from financial losses due to unforeseen events that may occur before or during your trip. It can cover trip cancellations, medical emergencies, lost luggage, and other unexpected expenses.

Travel insurance typically covers:

Trip Cancellation Coverage Covering Canceled Trips

Covers non-refundable trip costs if you have to cancel your trip due to a covered reason, such as illness, injury, or a family emergency.

Trip Interruption Coverage Covering Interrupted Trips

Covers expenses related to interrupting your trip due to a covered reason, such as a medical emergency or a natural disaster.

Medical Coverage Covering Medical Emergencies

Covers medical expenses if you become ill or injured while traveling.

Lost Luggage Coverage Covering Lost Luggage

Covers the cost of replacing lost or stolen luggage and personal belongings.

Example Use Case: A traveler has to cancel their trip due to a sudden illness. Travel insurance covers the non-refundable costs of their flights and hotel reservations.

Product Recommendation: Allianz Travel Insurance

Allianz is a leading travel insurance provider known for its comprehensive coverage options and excellent customer service. They offer a variety of policies to suit different travel needs and budgets.

Product Recommendation: World Nomads Travel Insurance

World Nomads is a popular travel insurance provider for adventurous travelers. They offer flexible policies that can be purchased or extended while you're already traveling.

Choosing the Right Policy A Personalized Approach

Selecting the right insurance policy is a personal decision that depends on your individual needs, circumstances, and risk tolerance. It's essential to carefully consider your options and compare different policies before making a decision.

Here are some key factors to consider when choosing an insurance policy:

Coverage Needs Assessing Your Risk

Assess your coverage needs based on your assets, liabilities, and lifestyle. Consider the potential financial impact of various risks and choose a policy that provides adequate coverage.

Premium Costs Balancing Affordability and Coverage

Compare premium costs from different insurance companies and choose a policy that fits your budget. Keep in mind that lower premiums may come with higher deductibles or lower coverage limits.

Deductibles Understanding Your Out-of-Pocket Costs

Understand the deductibles associated with each policy and choose a deductible that you're comfortable paying out-of-pocket.

Coverage Limits Knowing Your Maximum Payout

Review the coverage limits of each policy and ensure that they are sufficient to cover your potential losses.

Policy Exclusions Understanding What's Not Covered

Carefully review the policy exclusions to understand what events or situations are not covered by the policy.

Insurance Company Reputation Considering Financial Stability

Choose an insurance company with a strong financial reputation and a history of paying claims promptly and fairly. Check the company's ratings from independent rating agencies, such as A.M. Best and Standard & Poor's.

Customer Service Evaluating the Insurance Company's Support

Read customer reviews and ratings to get an idea of the insurance company's customer service and claims handling. Look for a company that is responsive, helpful, and easy to work with.

By carefully considering these factors and taking the time to research your options, you can choose the right insurance policies to protect your financial well-being and provide peace of mind.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)