10 Ways to Lower Your Life Insurance Premiums

Understanding Life Insurance Premiums The Basics

Life insurance premiums can feel like a significant expense, especially when you're juggling multiple financial obligations. But understanding what drives these costs is the first step towards finding ways to lower them. Essentially, your premium is the price you pay to keep your life insurance policy active. It's calculated based on a variety of factors, all aimed at assessing the risk the insurance company takes on by insuring you.

Think of it like this: the higher the perceived risk, the higher the premium. Factors like your age, health, lifestyle, and the type of policy you choose all play a role in determining that risk. Let's delve deeper into some of these key factors.

Age Matters How Age Impacts Life Insurance Costs

Age is a primary factor in determining life insurance premiums. Simply put, younger individuals are generally healthier and have a longer life expectancy, making them less risky to insure. As you age, the likelihood of health issues increases, and the potential payout timeframe shortens, which translates to higher premiums. This is why it's often recommended to purchase life insurance when you're younger and healthier, as you'll likely secure a lower rate that will remain consistent throughout the policy's term.

Consider this example: a healthy 30-year-old might pay significantly less for a term life insurance policy than a healthy 50-year-old with the same coverage amount. The difference can be substantial, potentially saving you thousands of dollars over the life of the policy.

Health is Wealth Your Health and Life Insurance

Your health is another crucial factor influencing your life insurance premiums. Insurance companies will typically require you to undergo a medical exam and answer detailed questions about your medical history. This information helps them assess your overall health and identify any pre-existing conditions that could increase the risk of a payout. Conditions like heart disease, diabetes, high blood pressure, and obesity can all lead to higher premiums. Even seemingly minor health issues, like elevated cholesterol levels, can impact your rates.

Maintaining a healthy lifestyle through regular exercise, a balanced diet, and avoiding smoking can significantly improve your health profile and potentially lower your life insurance premiums. It's also important to be honest and transparent with the insurance company about your medical history, as withholding information can lead to policy cancellation or denial of benefits.

Lifestyle Choices How Lifestyle Affects Insurance Rates

Your lifestyle choices also play a significant role in determining your life insurance premiums. Certain habits and activities can increase your risk profile and lead to higher rates. Smoking, for example, is a major red flag for insurance companies, as it's linked to numerous health problems and a shorter life expectancy. Smokers typically pay significantly higher premiums than non-smokers.

Other lifestyle factors that can impact your premiums include excessive alcohol consumption, dangerous hobbies (such as skydiving or race car driving), and a history of substance abuse. Engaging in these activities increases the risk of accidents, injuries, and health complications, making you a higher risk to insure. Adopting a healthier lifestyle and avoiding risky behaviors can help you lower your life insurance premiums.

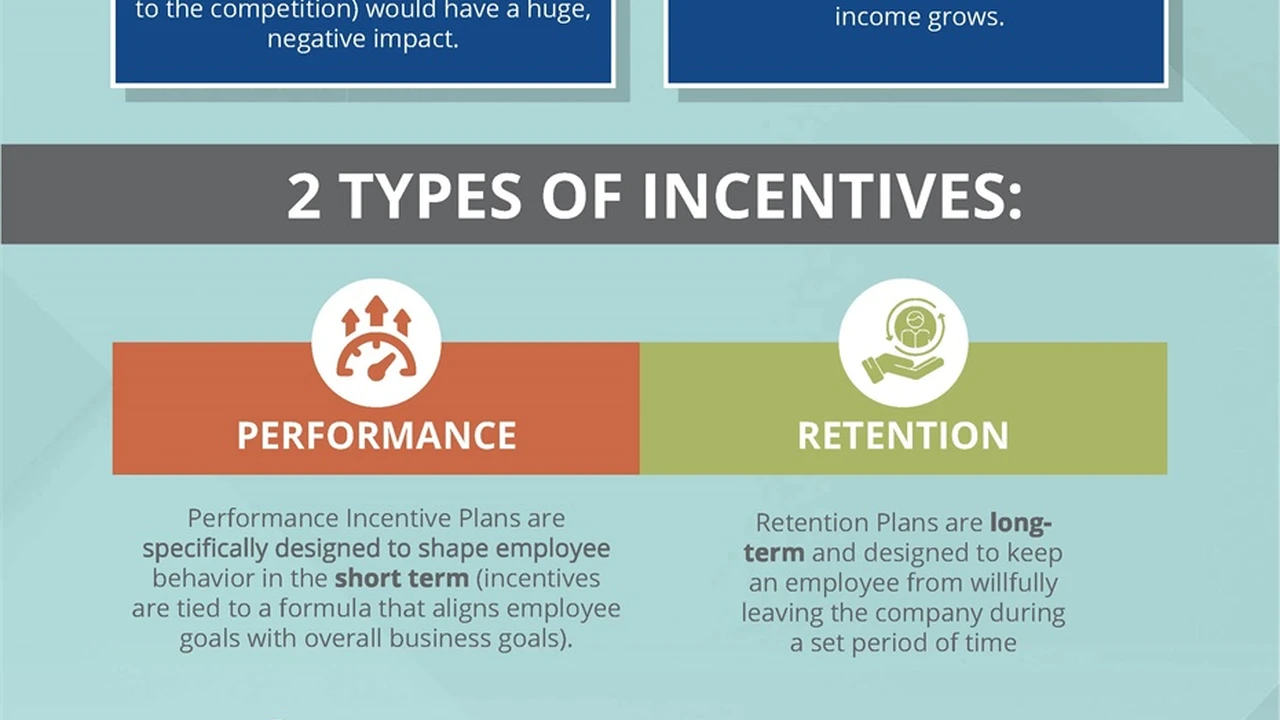

Type of Policy Choosing the Right Life Insurance

The type of life insurance policy you choose also significantly impacts your premiums. There are two main types of life insurance: term life and permanent life. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It's generally more affordable than permanent life insurance, as it only pays out if you die within the term. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that grows over time. Because of these added benefits, permanent life insurance policies typically have much higher premiums.

Within permanent life insurance, there are several sub-types, including whole life, universal life, and variable life. Each type offers different features and benefits, and the premiums can vary significantly. Understanding the different types of policies and their associated costs is crucial for choosing the right coverage for your needs and budget.

10 Proven Ways to Reduce Life Insurance Costs

Now that you understand the factors that influence life insurance premiums, let's explore ten practical ways to lower your costs.

1 Shop Around Compare Life Insurance Quotes

This is perhaps the most important step in securing the best life insurance rate. Don't settle for the first quote you receive. Instead, compare quotes from multiple insurance companies. Each company has its own underwriting guidelines and risk assessment criteria, which can lead to significant differences in premiums. Online quote comparison tools can help you quickly and easily compare rates from various insurers.

Consider using websites like Policygenius, SelectQuote, or Quotacy to compare quotes. These platforms allow you to enter your information once and receive multiple quotes from different companies, saving you time and effort. Remember to compare policies with similar coverage amounts and terms to ensure an accurate comparison.

2 Buy Early Lock in Lower Rates

As mentioned earlier, age is a significant factor in determining life insurance premiums. The younger you are when you purchase a policy, the lower your rates will likely be. This is because younger individuals are generally healthier and have a longer life expectancy. By buying life insurance early, you can lock in a lower rate that will remain consistent throughout the policy's term.

Even if you don't think you need life insurance right now, consider purchasing a policy while you're young and healthy. You can always increase your coverage later if your needs change. Starting early can save you a significant amount of money over the life of the policy.

3 Improve Your Health Get Healthy Save Money

Your health plays a crucial role in determining your life insurance premiums. If you're currently in poor health, taking steps to improve your health can significantly lower your rates. This includes losing weight, quitting smoking, exercising regularly, and managing any existing health conditions.

Before applying for life insurance, consider making lifestyle changes to improve your health profile. For example, if you're overweight, try to lose weight through diet and exercise. If you smoke, consider quitting. Even small improvements in your health can make a difference in your premiums. You might even consider delaying your application for a few months while you work on improving your health.

4 Choose Term Life Insurance Over Permanent Life

Term life insurance is generally much more affordable than permanent life insurance. If your primary goal is to provide financial protection for your family in the event of your death, term life insurance may be the best option. It provides coverage for a specific period, typically 10, 20, or 30 years, and the premiums are significantly lower than those of permanent life insurance.

Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that grows over time. While this can be beneficial, it also comes at a higher cost. If you don't need the lifelong coverage or the cash value component, term life insurance can be a more cost-effective option.

Consider your specific needs and financial goals when choosing between term life and permanent life insurance. If you're primarily concerned with providing financial protection for your family during a specific period, term life insurance may be the best choice. If you're looking for lifelong coverage and a cash value component, permanent life insurance may be a better fit.

5 Opt for a Shorter Term Length Save on Premiums

If you choose term life insurance, the length of the term will also impact your premiums. A shorter term length will typically result in lower premiums than a longer term length. This is because the insurance company is taking on less risk with a shorter term.

Consider how long you actually need life insurance coverage. If you only need coverage until your children are grown or your mortgage is paid off, a shorter term length may be sufficient. Choosing a shorter term length can save you a significant amount of money on premiums.

6 Increase Your Deductible Reduce Costs

While life insurance doesn't have a deductible in the traditional sense (like health or car insurance), you can think of the coverage amount as a kind of "deductible." Lowering the coverage amount will lower your premiums. This isn't directly a deductible, but it functions similarly by reducing the insurer's financial risk.

Carefully assess how much coverage you truly need. Avoid purchasing more coverage than you can realistically afford. While it's important to have adequate coverage, over-insuring yourself can lead to unnecessarily high premiums. Calculate your coverage needs based on your debts, income, and financial obligations.

7 Bundle Your Insurance Policies Get Discounts

Many insurance companies offer discounts to customers who bundle their insurance policies. This means purchasing multiple types of insurance from the same company, such as life insurance, auto insurance, and home insurance. Bundling your policies can save you a significant amount of money on your overall insurance costs.

Check with your current insurance providers to see if they offer bundling discounts. You may be surprised at how much you can save by consolidating your insurance policies with one company. This is a simple and effective way to lower your life insurance premiums without sacrificing coverage.

8 Pay Annually Instead of Monthly Save Money

Many insurance companies offer a discount for paying your premiums annually instead of monthly. This is because it reduces their administrative costs and simplifies their billing process. Paying annually can save you a small but noticeable amount of money on your life insurance premiums.

If you have the financial means to pay your premiums annually, it's worth considering. This can save you a few dollars each month, which can add up over the life of the policy. Just be sure to factor this expense into your annual budget.

9 Review Your Policy Regularly Update Information

Your life insurance needs may change over time. As your income increases, your debts decrease, or your family situation changes, you may need to adjust your coverage amount. Reviewing your policy regularly can help you ensure that you have the right amount of coverage for your current needs.

It's also important to update your beneficiary information regularly. Make sure your beneficiaries are still the people you want to receive the death benefit. Keeping your policy up-to-date can prevent potential issues and ensure that your loved ones are properly protected.

10 Consider a No-Medical-Exam Policy Weigh the Pros and Cons

While most life insurance policies require a medical exam, some companies offer no-medical-exam policies. These policies typically have higher premiums than traditional policies, but they can be a good option for individuals who have difficulty qualifying for traditional coverage due to health issues.

If you're considering a no-medical-exam policy, be sure to compare quotes from multiple companies. These policies can vary significantly in price and coverage. Also, be aware that some no-medical-exam policies may have limitations or exclusions.

Product Recommendations and Comparisons for Life Insurance

Navigating the world of life insurance can be overwhelming. Here are a few recommended products and comparisons to help you make an informed decision.

Term Life Insurance Recommendations

- Haven Life: Haven Life is a popular online provider offering term life insurance policies with competitive rates and a streamlined application process. They are backed by MassMutual, a well-established insurance company.

- Ladder: Ladder offers flexible term life insurance policies that allow you to increase or decrease your coverage amount as your needs change. They also have a fully online application process.

- Bestow: Bestow provides instant term life insurance quotes and coverage with no medical exam required for eligible applicants. They offer a convenient and hassle-free application experience.

Permanent Life Insurance Recommendations

- New York Life: New York Life is a mutual insurance company with a long history of providing reliable permanent life insurance policies. They offer a wide range of whole life and universal life options.

- Northwestern Mutual: Northwestern Mutual is another well-respected mutual insurance company offering a variety of permanent life insurance products, including whole life, universal life, and variable life.

- MassMutual: MassMutual offers a comprehensive selection of permanent life insurance policies, including whole life, universal life, and variable life, with competitive rates and flexible options.

Life Insurance Comparison Table

Here's a comparison table highlighting key features of different life insurance providers:

| Provider | Policy Type | Medical Exam Required | Online Application | Key Features |

|---|---|---|---|---|

| Haven Life | Term Life | Yes (for some applicants) | Yes | Competitive rates, streamlined application |

| Ladder | Term Life | Yes (for some applicants) | Yes | Flexible coverage, adjustable coverage amounts |

| Bestow | Term Life | No (for eligible applicants) | Yes | Instant quotes, no medical exam required |

| New York Life | Permanent Life | Yes | No (Agent Required) | Wide range of whole and universal life options, strong financial stability |

| Northwestern Mutual | Permanent Life | Yes | No (Agent Required) | Variety of permanent life insurance products, including whole life, universal life, and variable life. |

| MassMutual | Permanent Life | Yes | No (Agent Required) | Comprehensive selection of permanent life insurance policies, including whole life, universal life, and variable life, with competitive rates and flexible options. |

Detailed Information Pricing and Examples

Understanding pricing for life insurance is crucial. Here's a breakdown with examples:

Term Life Insurance Pricing Examples

The following are example monthly premiums for a $500,000 term life insurance policy for a healthy non-smoker:

- 30-year-old: $25 - $35 (20-year term)

- 40-year-old: $40 - $55 (20-year term)

- 50-year-old: $75 - $100 (20-year term)

These are just estimates, and actual premiums may vary based on individual factors.

Permanent Life Insurance Pricing Examples

Permanent life insurance is significantly more expensive than term life insurance due to the lifelong coverage and cash value component. Examples for a $500,000 whole life insurance policy for a healthy non-smoker:

- 30-year-old: $400 - $600 per month

- 40-year-old: $600 - $800 per month

- 50-year-old: $800 - $1200 per month

These are approximate figures and can vary widely depending on the specific policy features and the insurance company.

Factors Affecting Pricing

Remember that these are just examples, and your actual premiums will depend on a variety of factors, including:

- Age: As mentioned earlier, younger individuals typically pay lower premiums.

- Health: Your health history and current health status will significantly impact your rates.

- Lifestyle: Smoking, excessive alcohol consumption, and dangerous hobbies can increase your premiums.

- Coverage Amount: The higher the coverage amount, the higher the premiums.

- Policy Type: Term life insurance is generally more affordable than permanent life insurance.

- Term Length: Shorter term lengths typically result in lower premiums.

Use Cases and Scenarios for Life Insurance

Life insurance isn't a one-size-fits-all product. Here are some common use cases and scenarios to help you determine your needs:

Protecting Your Family's Financial Future

This is the most common use case for life insurance. If you have dependents who rely on your income, life insurance can provide financial support to help them cover expenses such as housing, food, education, and healthcare in the event of your death.

Paying Off Debts

Life insurance can be used to pay off outstanding debts, such as mortgages, car loans, and credit card debt. This can prevent your loved ones from being burdened with these debts after your death.

Funding Education

Life insurance can be used to fund your children's education. You can designate a portion of the death benefit to be used for college tuition, room and board, and other educational expenses.

Covering Funeral Expenses

Funeral expenses can be significant. Life insurance can be used to cover these costs, relieving your loved ones of this financial burden during a difficult time.

Estate Planning

Life insurance can be used as part of a comprehensive estate plan. It can provide liquidity to pay estate taxes and other expenses, ensuring that your assets are distributed according to your wishes.

Business Succession Planning

Life insurance can be used to fund buy-sell agreements in business succession planning. This allows surviving business partners to purchase the deceased partner's share of the business, ensuring a smooth transition of ownership.

By carefully considering your individual circumstances and financial goals, you can determine the right amount and type of life insurance coverage for your needs. Remember to shop around, compare quotes, and work with a qualified insurance professional to make an informed decision. Saving money on life insurance doesn't mean sacrificing coverage; it means finding the most cost-effective way to protect your loved ones and secure your financial future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)